—David M. Blitzer, Fannie Mae

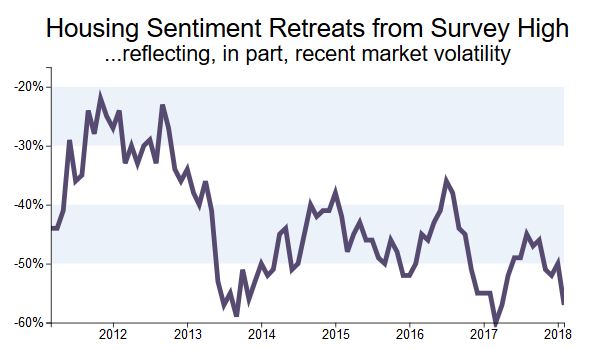

—David M. Blitzer, Fannie Mae WASHINGTON, DC—As interest rates are poised to rise and housing prices continue to climb, consumers are becoming a bit glum about the housing market. The latest indicator of consumer sentiment comes from Fannie Mae's Home Purchase Sentiment Index (HPSI), which fell 3.7 points in February to reach 85.8, reversing last month's increase. It is also down 2.5 points compared with the same time last year.

- There are six components to the HPSI and five showed decreases in sentiment.

- The net share of respondents who said now is a good time to buy a home decreased 5 percentage points compared to January.

- The net share who reported that now is a good time to sell a home decreased 2 percentage points.

- The net share who said home prices will go up in the next 12 months decreased 7 percentage points in February, while the net share of consumers who said mortgage rates will go down over the next 12 months also decreased 7 percentage points.

Interestingly, the HPSI also captured a sense of unease among Americans about job security, with the net share who say they are not concerned about losing their job decreasing 2 percentage points. On the other hand, the net share reporting that their income is significantly higher than it was 12 months ago increased 1 percentage point. The share who say their household income is significantly lower than it was 12 months ago fell 2 percentage points to 9%, matching a survey low last seen in February 2017.

“Volatility in consumer housing sentiment continued into February, with the new tax law beginning to impact respondents' take-home pay and the stock market creating negative headlines due to early-month turbulence,” says Doug Duncan, senior vice president and chief economist at Fannie Mae. “Additionally, consumers' expectations for higher mortgage rates suggest that consumers expect the Fed to hike rates a few more times in 2018.

Rising Prices That May Level Off

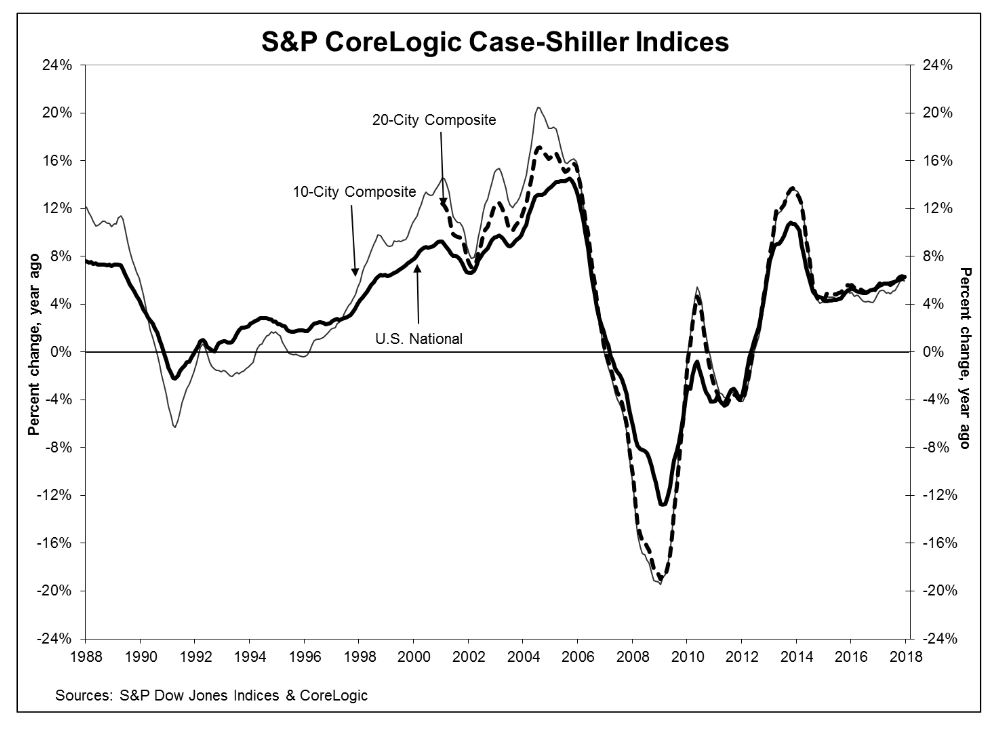

Separately, another index that came out last month—the S&P Case-Shiller national index—captured the rising level of home prices as well as a bit of consumer angst about where prices are heading.

The data released for December 2017 shows that home prices continued their rise across the country over the last 12 months, with a 6.3% annual gain that month, up from 6.1% in the previous month.

“The rise in home prices should be causing the same nervous wonder aimed at the stock market after its recent bout of volatility,” says David M. Blitzer, managing director and chairman of the Index Committee at S&P Dow Jones Indices. The National Index's average annual real gain from 1976 to 2017 was 1.3%, he points out. “Even considering the recovery from the financial crisis, we are experiencing a boom in home prices.”

That said, “within the past few months, there are beginning to be some signs that gains in housing may be leveling off.”

According to Blitzer, sales of existing homes fell in December and January after seasonal adjustment and are now as low as any month in 2017. Further, pending sales of existing homes are roughly flat over the past several months, and new home sales appear to be following a similar trend. “While the price increases do not suggest any weakening of demand, mortgage rates rose from 4% to 4.4% since the start of the year,” he notes. “It's too early to tell if the housing recovery is slowing. If it is, some moderation in price gains could be seen later this year.”

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.