SAN DIEGO—Both pre-1980s- and 1980s-built apartment product in San Diego have appreciated and continue to appreciate the fastest of all the year-built types in this market, having increased 55% and 51%, respectively, above their 2007 highs, ABI Multifamily's director of research Tom Brophy tells GlobeSt.com. The firm recently published an article on the record-breaking apartment pricing in the western part of the country, so we followed up with a chat with Brophy on trends in the multifamily sector in San Diego.

GlobeSt.com: What are the main trends you're noticing in multifamily unit pricing in San Diego?

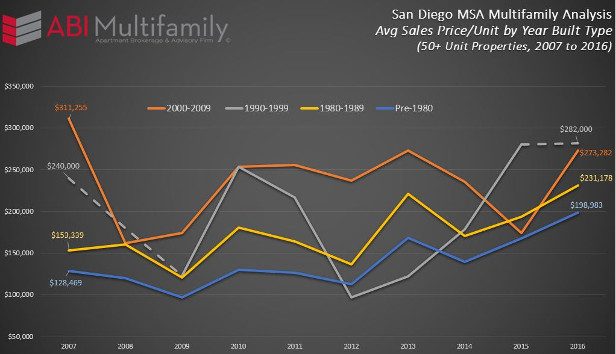

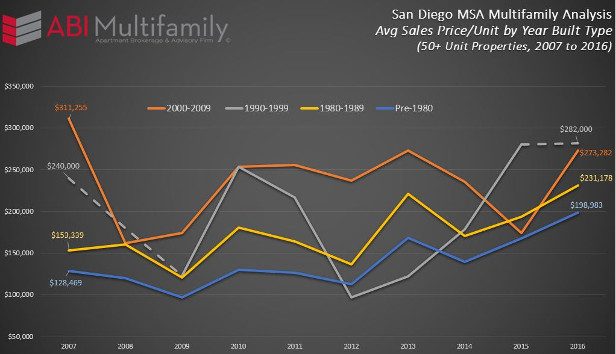

Brophy: As can be referenced on the chart below, both pre-1980s and 1980s-built product have appreciated, and continue to appreciate, the fastest of all the year-built types, having increased 55% and 51%, respectively, above their 2007 highs. It stands to reason that older-built product has seen the most appreciation because 1) older-built product is typically in more coastal settings, which naturally increases its pricing points, and 2) we have seen a tremendous surge of fix-and-flip activity by multifamily investors; this is particularly true for properties 20 units in size and smaller.

Investor sentiment seems to have shifted toward a more cautious approach to underwriting new acquisitions. Rental-rate growth, which has been tremendous over the last five to seven years, seems to be slowing a bit. Five percent-plus annual rent growth was the norm during this period and allowed for buyers of multifamily property to “grow” out of low cap-rate purchases. With cap rates compressed to historic lows—below the cost of debt, in many cases–this rent growth was critical. In addition, future interest-rate increases are becoming more likely. A rise in the pricing of debt will eventually lead to a move in cap rates, particularly if rent growth is perceived to be slowing or stalled-out in some regions.

GlobeSt.com: How do you see pricing changing in this market over the next year or two?

Brophy: Prices of apartment properties will continue to rise, but at a much slower pace. Rent growth appears to be slowing down and, therefore, will put a ceiling on aggressive pricing. The wild card is interest rates. If they shoot up, which I don't think will happen, then I would expect sales velocity to drop and put downward pressure on pricing expectations.

Nonetheless, in regards to how pricing changes might impact investor interest, personally, for 50-plus-unit properties, I see institutional investors getting more aggressive with late-1990s and early-2000s-built product, much like we've seen in Phoenix and Las Vegas. For example, these investors will target properties that require much smaller renovation plans and are in locations that can compete with newly built apartments, but their lease rates are below that of their newer-constructed counterparts. Additionally, you'll most likely see an uptick in sales activity on the periphery of the MSA, such as in East County, which has, as of year-end 2016, witnessed a dramatic 67% increase in overall sales volume. Lastly, the more coastal areas should see continued investor interest due to high demand for units and a general lack in new-construction development, such as the North County Coastal submarket.

GlobeSt.com: Which factors here are influencing the high per-unit prices?

Brophy: In general, with the lack of land for additional multifamily development in the region and moderate population and job growth, I predict a continuation of investor interest in repositioning of older product. With few candidate properties available to meet this demand, the march toward higher prices will continue in San Diego County.

Other factors include: 1) although it's priced relatively high compared to other non-California/coastal markets, in actual percentage terms, the overall market is only 8% above 2007's peak price-per-unit amount—well below Los Angeles, San Francisco, Portland and Seattle, all of whom are, on average, 20% or more above 2007's peak; 2) employers up and down the Western coast and those who want to stay in the coastal area are looking to San Diego as a more affordable alternative, relatively speaking, for either expansion and/or relocation plans; 3) unlike other markets, San Diego does have one of the best climates in the country and will continue to see people flocking to the area for an abundance of sunshine and generally temperate weather.

GlobeSt.com: What else should our readers take away from your research on this market?

Brophy: San Diego, in terms of both occupancy and average rental rates, has proven quite resilient even in the tough economic environment of the 2008/9 recession. As such, many investors view San Diego as a safer bet and good location in which to preserve and grow 1031 profits from other areas of the country.

SAN DIEGO—Both pre-1980s- and 1980s-built apartment product in San Diego have appreciated and continue to appreciate the fastest of all the year-built types in this market, having increased 55% and 51%, respectively, above their 2007 highs, ABI Multifamily's director of research Tom Brophy tells GlobeSt.com. The firm recently published an article on the record-breaking apartment pricing in the western part of the country, so we followed up with a chat with Brophy on trends in the multifamily sector in San Diego.

GlobeSt.com: What are the main trends you're noticing in multifamily unit pricing in San Diego?

Brophy: As can be referenced on the chart below, both pre-1980s and 1980s-built product have appreciated, and continue to appreciate, the fastest of all the year-built types, having increased 55% and 51%, respectively, above their 2007 highs. It stands to reason that older-built product has seen the most appreciation because 1) older-built product is typically in more coastal settings, which naturally increases its pricing points, and 2) we have seen a tremendous surge of fix-and-flip activity by multifamily investors; this is particularly true for properties 20 units in size and smaller.

Investor sentiment seems to have shifted toward a more cautious approach to underwriting new acquisitions. Rental-rate growth, which has been tremendous over the last five to seven years, seems to be slowing a bit. Five percent-plus annual rent growth was the norm during this period and allowed for buyers of multifamily property to “grow” out of low cap-rate purchases. With cap rates compressed to historic lows—below the cost of debt, in many cases–this rent growth was critical. In addition, future interest-rate increases are becoming more likely. A rise in the pricing of debt will eventually lead to a move in cap rates, particularly if rent growth is perceived to be slowing or stalled-out in some regions.

GlobeSt.com: How do you see pricing changing in this market over the next year or two?

Brophy: Prices of apartment properties will continue to rise, but at a much slower pace. Rent growth appears to be slowing down and, therefore, will put a ceiling on aggressive pricing. The wild card is interest rates. If they shoot up, which I don't think will happen, then I would expect sales velocity to drop and put downward pressure on pricing expectations.

Nonetheless, in regards to how pricing changes might impact investor interest, personally, for 50-plus-unit properties, I see institutional investors getting more aggressive with late-1990s and early-2000s-built product, much like we've seen in Phoenix and Las Vegas. For example, these investors will target properties that require much smaller renovation plans and are in locations that can compete with newly built apartments, but their lease rates are below that of their newer-constructed counterparts. Additionally, you'll most likely see an uptick in sales activity on the periphery of the MSA, such as in East County, which has, as of year-end 2016, witnessed a dramatic 67% increase in overall sales volume. Lastly, the more coastal areas should see continued investor interest due to high demand for units and a general lack in new-construction development, such as the North County Coastal submarket.

GlobeSt.com: Which factors here are influencing the high per-unit prices?

Brophy: In general, with the lack of land for additional multifamily development in the region and moderate population and job growth, I predict a continuation of investor interest in repositioning of older product. With few candidate properties available to meet this demand, the march toward higher prices will continue in San Diego County.

Other factors include: 1) although it's priced relatively high compared to other non-California/coastal markets, in actual percentage terms, the overall market is only 8% above 2007's peak price-per-unit amount—well below Los Angeles, San Francisco, Portland and Seattle, all of whom are, on average, 20% or more above 2007's peak; 2) employers up and down the Western coast and those who want to stay in the coastal area are looking to San Diego as a more affordable alternative, relatively speaking, for either expansion and/or relocation plans; 3) unlike other markets, San Diego does have one of the best climates in the country and will continue to see people flocking to the area for an abundance of sunshine and generally temperate weather.

GlobeSt.com: What else should our readers take away from your research on this market?

Brophy: San Diego, in terms of both occupancy and average rental rates, has proven quite resilient even in the tough economic environment of the 2008/9 recession. As such, many investors view San Diego as a safer bet and good location in which to preserve and grow 1031 profits from other areas of the country.

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.