ANAHEIM, CA—In the case of long-term master leases, developers should be satisfied with the current income situation of the property before any redevelopment if the lease term is not ending any time soon, Voit Real Estate Services' Seth Davenport tells GlobeSt.com. Davenport and Mitch Zehner, both EVPs in the company's Anaheim office, have recently completed the $14.6-million sale of an 8.5-acre land site in Anaheim on behalf of buyer Pacific Industrial.

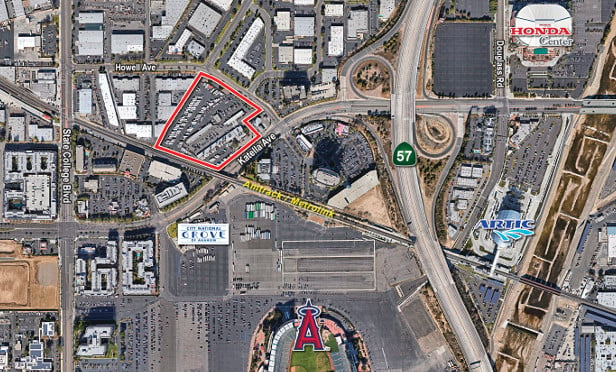

The property, located at 2222 East Howell Ave. within the boundaries of Anaheim's Platinum Triangle, had been encumbered by a 50-year master lease since 1973, which prevented any sale of the property until it expired or was otherwise terminated. Pacific Industrial executed a series of complex negotiations, coupled with impeccable timing, to ensure the deal closed. Given its location near the geographic center of Orange County, with immediate access to five major freeways, the site could be considered perfect for a last-mile distribution center.

We spoke with Davenport about the issues that come up for owners and developers with regard to long-term master leases and where the opportunities lie in these transactions.

GlobeSt.com: What are some of the issues that come up regarding long-term master leases and real estate transactions?

Davenport: In this case, Pacific Industrial is an industrial developer that has developed all types of product, but at the end of the day, it is traditionally known as a group that buys land and ultimately redevelops it. The fact that there are leases in place—four different tenants, each with different term—was of consideration but not necessarily a concern. Pacific Industrial's stance is that the site is probably the best land site in all of the county that's left because it sits down effectively between five major freeways. The firm is thinking that there may be leases in place, but depending upon who comes to the table in the next couple of years, that will affect how it develops the site, whether it's retail, mixed-use, last-mile distribution, etc. There are a lot of different ways the site could go. It took time to get city approval, and while it was a nuance, it didn't really affect the value or development opportunities associated with this site.

GlobeSt.com: How can real estate professionals find development opportunities in expiring master leases?

Davenport: Most developers are going to have a level of concern because they ultimately want to build buildings. So, when considering a site, if it has a long-term lease in place, it's not necessarily a good thing. Here, while there were positives like cash flow for developers, they also had termination rights. They could collect cash long term from the tenants, but if they decided to develop, they could execute termination rights with those tenants. In the future, it would be challenging to sell a site like this with a long-term lease in place because there's no finite period where they would actually be able to develop on it. Most of these developers come in, buy and immediately want to start development so that they're minimizing their risk from a market cycle perspective. But, if it's a great site with a tenant on it, if another tenant comes along that requires development, they could consider it at that point in time.

GlobeSt.com: What are some of the pitfalls to avoid in this process?

Davenport: Without any termination rights, it's about what the cash flow on the property is. The biggest risk would be if the site was not providing attractive returns as it sat. Pacific Industrial's case is different: if they did nothing, they still had an acceptable return. If they develop, it could be a home run, but if not, they're still sitting on a pretty attractive return. One pitfall to avoid would be buying a site encumbered by a long-term lease that's not providing an attractive return. Then, you're stuck in site that you won't be able to develop.

GlobeSt.com: What else should our readers know about your recent Platinum Triangle land transaction?

Davenport: This is a unique site. There are thousands of homes being developed around it. The transaction itself was very fast—it was a 30-day deal. Pacific Industrial moved very quickly through the process.

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.