WASHINGTON, DC–Every year since 1992 the Association of Foreign Investors in Real Estate, or AFIRE, has surveyed its membership about where they thought they might investment in the US and around the world for the coming year. And every year, without fail, Washington DC has been among the top five US cities cited by foreign investors. Until this year.

This year, for the first time since the survey began, the nation's Capitol dropped from the list of investors' top five US cities.

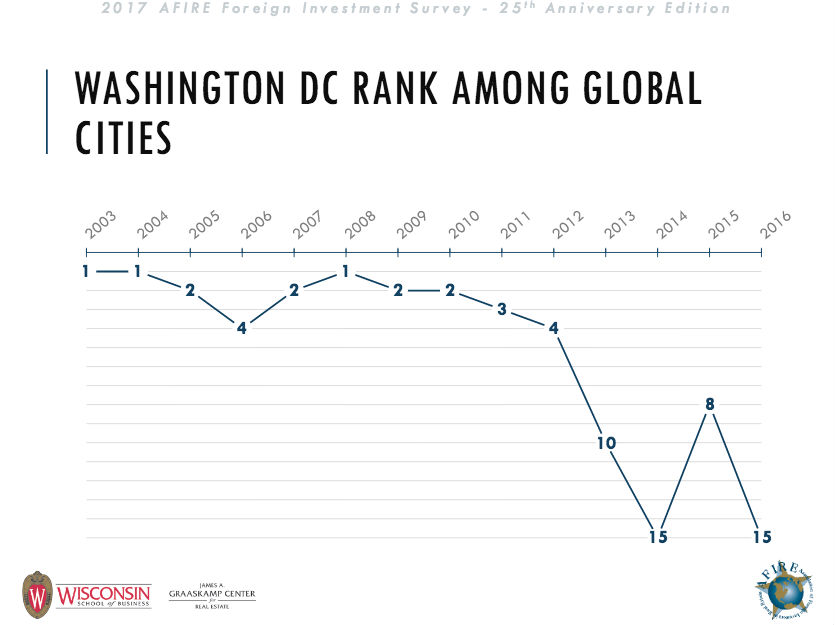

It is now No. 6 on the list of top US cities for foreign commercial real estate investors and No. 15 on the list of global cities.

The survey was conducted in the fourth quarter of 2016 by the James A. Graaskamp Center for Real Estate, Wisconsin School of Business. The top five US cities for 2017 were New York, Los Angeles, Boston, Seattle and San Francisco.

A Downward Trend

To be sure, the District's trend in this survey has been a downward one in recent years, save for a one-off blip up. [See Chart No. 1 below].

Last year in the ranking of US cities, it was at No. 4. having moved up from No. 5 in 2015. In 2014, it lost its perch among the top five global cities, dropping to an inauspicious No. 9. In 2015, it slipped even further on the global rankings, dropping to No. 15.

But Why?

Clearly, the District has been struggling in recent years with office absorption and the federal government's pullback in commercial real estate space — but it still is posting robust investment sales. JLL, for example, predicts that the Washington DC area's office investment sales will be slightly higher than the region's average for 2016 at $6.7 billion, compared to a more typical $6.3 billion.

More to the point, foreign commercial real estate investors have traditionally gravitated to the District for investment after they fulfilled their investment mandates in New York City. “We are scratching our heads over this one, I have to admit,” AFIRE CEO James A. Fetgatter tells GlobeSt.com. “When we talk to foreign investors Washington DC is always on their radar screens.”

Foreign Investors Have Been Steady Buyers

Now here would be a good place to point out the obvious: foreign investors have been steady acquirers of District assets, with Japanese firm Unizo likely to have been the most prolific for 2016 at close to $1 billion in acquisitions.

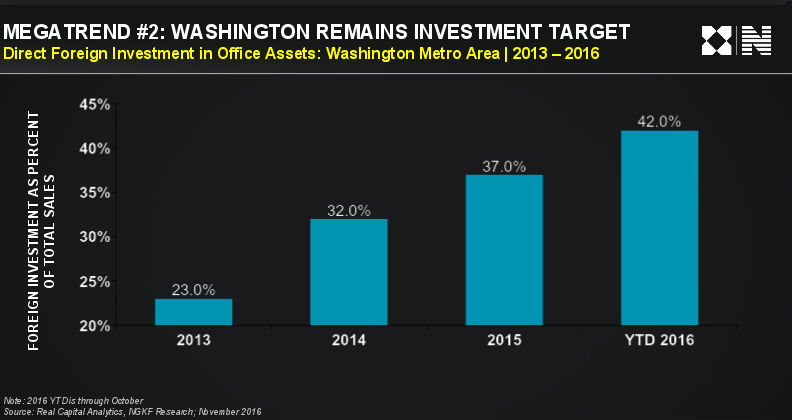

Also, it should be noted that even as DC drops in favor in the AFIRE surveys, foreign investors are still buying up assets in ever increasing amounts. Indeed, according to Newmark Grubb Knight Frank's Benchmark report for the Washington DC area foreign investment as a percentage of total office sales in the area has been steadily growing for the last few years and from January to October 2016 it had reached 42%. [See Chart No. 2 below]

Theories About the Disconnect

There are some theories why foreign investors' sentiment about Washington DC don't line up with their actions. Fetgatter posits that foreign investors are becoming more comfortable, or at least intrigued, with cities outside of the traditional gateway metro areas, especially as some are seen as more dynamic. There is a growing sentiment among foreign investors that smaller urban cities, such as Nashville, Portland, Charlotte, San Antonio, Madison, and Pittsburgh, offer good investment potential as well — and compared to high-cost Washington DC, perhaps better returns. Inevitably, however, foreign investors include the District in their portfolios for all the traditional reasons they like the city.

JLL Research Director Scott Homa also has an interesting theory that could affect sales this year: DC is running out of trophy office assets to sell, at least at this point in the cycle.

“Foreign investors are drawn to the historically 'safe haven' nature of DC real estate, but they prefer core product and that type of buying opportunity has been elusive,” he tells GlobeSt.com.

CHART NO. 1

WASHINGTON, DC–Every year since 1992 the Association of Foreign Investors in Real Estate, or AFIRE, has surveyed its membership about where they thought they might investment in the US and around the world for the coming year. And every year, without fail, Washington DC has been among the top five US cities cited by foreign investors. Until this year.

This year, for the first time since the survey began, the nation's Capitol dropped from the list of investors' top five US cities.

It is now No. 6 on the list of top US cities for foreign commercial real estate investors and No. 15 on the list of global cities.

The survey was conducted in the fourth quarter of 2016 by the James A. Graaskamp Center for Real Estate, Wisconsin School of Business. The top five US cities for 2017 were

A Downward Trend

To be sure, the District's trend in this survey has been a downward one in recent years, save for a one-off blip up. [See Chart No. 1 below].

Last year in the ranking of US cities, it was at No. 4. having moved up from No. 5 in 2015. In 2014, it lost its perch among the top five global cities, dropping to an inauspicious No. 9. In 2015, it slipped even further on the global rankings, dropping to No. 15.

But Why?

Clearly, the District has been struggling in recent years with office absorption and the federal government's pullback in commercial real estate space — but it still is posting robust investment sales. JLL, for example, predicts that the Washington DC area's office investment sales will be slightly higher than the region's average for 2016 at $6.7 billion, compared to a more typical $6.3 billion.

More to the point, foreign commercial real estate investors have traditionally gravitated to the District for investment after they fulfilled their investment mandates in

Foreign Investors Have Been Steady Buyers

Now here would be a good place to point out the obvious: foreign investors have been steady acquirers of District assets, with Japanese firm Unizo likely to have been the most prolific for 2016 at close to $1 billion in acquisitions.

Also, it should be noted that even as DC drops in favor in the AFIRE surveys, foreign investors are still buying up assets in ever increasing amounts. Indeed, according to Newmark Grubb Knight Frank's Benchmark report for the Washington DC area foreign investment as a percentage of total office sales in the area has been steadily growing for the last few years and from January to October 2016 it had reached 42%. [See Chart No. 2 below]

Theories About the Disconnect

There are some theories why foreign investors' sentiment about Washington DC don't line up with their actions. Fetgatter posits that foreign investors are becoming more comfortable, or at least intrigued, with cities outside of the traditional gateway metro areas, especially as some are seen as more dynamic. There is a growing sentiment among foreign investors that smaller urban cities, such as Nashville, Portland, Charlotte, San Antonio, Madison, and Pittsburgh, offer good investment potential as well — and compared to high-cost Washington DC, perhaps better returns. Inevitably, however, foreign investors include the District in their portfolios for all the traditional reasons they like the city.

JLL Research Director Scott Homa also has an interesting theory that could affect sales this year: DC is running out of trophy office assets to sell, at least at this point in the cycle.

“Foreign investors are drawn to the historically 'safe haven' nature of DC real estate, but they prefer core product and that type of buying opportunity has been elusive,” he tells GlobeSt.com.

CHART NO. 1

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.