WASHINGTON, DC–Vornado Realty Trust will not close on its spin off and subsequent launch of JBG Smith Properties this quarter as it previously planned, according to a regulatory filing.

July is the new date for the spin off (to be precise, the transaction is a spin off of Vornado's local assets and this new company will then be merged with JBG Cos.)

Read Crystal City, Land Bank Will Provide JBG SMITH “Tremendous Value Creation”

As recently as May 1, the REIT still appeared to be on track for a Q2 launch. During the earnings call CEO Steve Roth said that, (per Fair Disclosure)

We are still targeting the end of the second quarter for the launch of our Washington JBG spinoff. Our current schedule is that in June, we will file an investor deck describing JBG Smith's assets, balance sheet, business plan and prospects. Afterwards, Matt Kelly and the management team will be arranging group and one-on-one investor meetings.

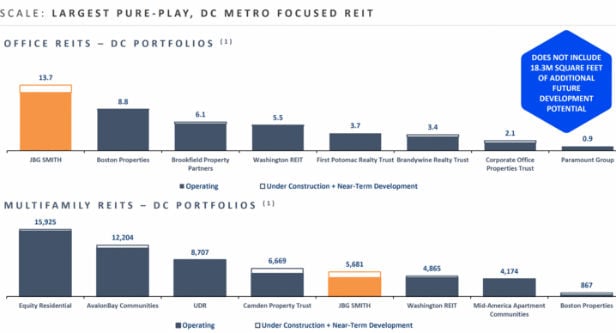

The delay notwithstanding, Roth also noted during the call that “JBG Smith…will be the largest and best-in-class publicly traded pure-play real estate company focused on the Washington, D.C. market.” One of the charts in the newly-filed investor presentation made a similar point.

The investor presentation goes into some detail about the portfolio and its footprint within the DC area.

A Strong Quarter

Meanwhile, Vornado's local assets posted a positive quarter. Adjusted first quarter EBITDA was $70.6 million, $1.4 million ahead of the first quarter of 2016. Same-store EBITDA was positive 70 basis points GAAP and 30 basis points cash — the third consecutive quarter of positive same-store results, according to Roth.

In addition, the REIT leased 545,000 square feet in the first quarter in the Washington DC area. “And that's a lot of leasing with a positive mark-to-market of 5.7% GAAP and negative 6.6% cash,” Roth said.

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.