WASHINGTON, DC–The multifamily housing market has been exhibiting nothing but prolific growth over the past decade. Now as 2017 comes to a close it is becoming apparent that this growth is starting to slow, according to a report from the Joint Center for Housing Studies of Harvard University. As the dust settles from this era, it is also apparent that the rental housing market has changed considerably and perhaps permanently, the report concluded.

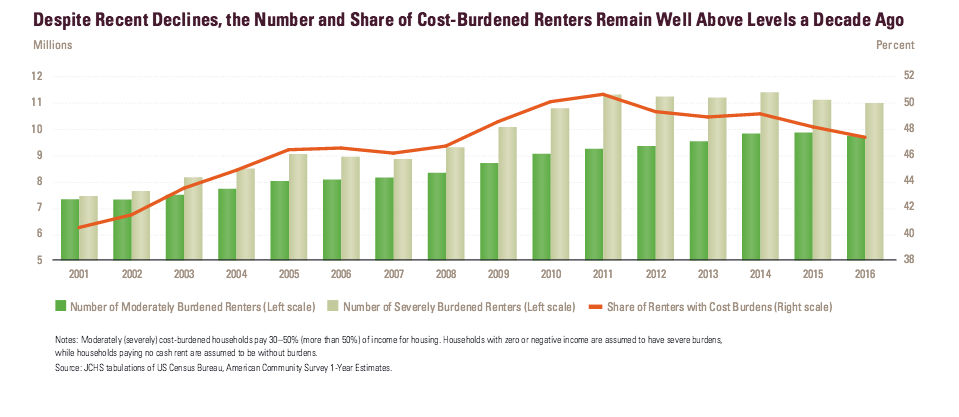

In short, the apartment market is settling into a “new normal” in which nearly 21 million households pay more than 30% of their income for rent.

A Slowing Pace

The halcyon days for the sector were good indeed, as the report noted, with rental construction rebounding nearly four-fold from the market trough in 2009 to 400,000 units in 2015 — the highest annual level since the late 1980s.

However, this year it is clear that construction is falling after little change in 2016. The pace of multifamily starts has dropped 9% through October 2017, with the slowdown most evident in metros where multifamily construction had been strongest.

Not that growth is stopping; renters are still likely to account for slightly more than a third of household growth. According to Joint Center projections, the number of renter households will increase by nearly 500,000 annually over the ten years from 2015 to 2025, “a still robust pace by historical standards,” it said. In fact the demand drivers that emerged over the last several years are likely to remain in place — namely renting's greater appeal for households that could afford to buy homes if they wanted to.

The report noted that:

In 2006, 12 percent of households earning $100,000 or more were renters. In 2016, that share exceeded 18 percent, a cumulative increase of 2.9 million renters in this top income category. Indeed, these high-income households drove nearly 30% of the growth in renters over the decade.

That said, renting remains the primary housing option for those with lower means. A majority, or 53%, of households earning less than $35,000 rent their housing, including over 60% of households earning less than $15,000.

Bifurcated Renter Demographics And Supply

Affordable rentals for this latter group will be harder to find as the supply slows. Much of this new housing is targeted to higher-income households and located primarily in high-rise buildings in downtown neighborhoods. As the Joint Center writes:

Given that construction and land costs are particularly high in these locations, the median asking rent for new apartments increased by 27% between 2011 and 2016 in real terms, to $1,480. Using the 30-percent-of-income standard for affordability, households would need an income of at least $59,000 to afford these new units, well above the median renter income of $37,300. At the same time, the supply of moderate- and lower-cost units has increased only modestly.

Due to these high development costs, most of the demand for low-priced rentals must be met by older units, the report concluded — only a fifth of existing units rented for under $650 a month in 2016, and nearly half of these units were built before 1970.

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.