WASHINGTON, DC–The commercial real estate market, long awaiting the gradual-but-steady increases in the federal funds rate, has had plenty of time to think about how high will be too high for a rate increase. According to Seyfarth Shaw's newly-released 3rd annual Real Estate Market Sentiment Survey, that threshold is a 51 to 150 basis point increase — and then there will be a material adverse impact on the commercial real estate market. That was according to 36% of the respondents. Another 27% had a higher pain tolerance and settled on a basis point increase of up to 150, Ron Gart, a partner in the firm's Washington, DC office, tells GlobeSt.com. “It is no more than 150 basis points,” he said, and then most of the respondents agree that the pain will set in.

The release of the survey is a timely one following the address by the new Fed chair Jerome Powell to Congress on Tuesday. He provided the Fed's outlook for monetary policy and economic growth and when asked about rate hikes in 2018, he indicated that the Central Bank would consider more than three increases if necessary. If it does, it will be due to a confluence of factors. Powell told Congress that:

We've seen continuing strength in the labor market. We've seen some data that in my case will add some confidence to my view that inflation is moving up to target. We've also seen continued strength around the globe. And we've seen fiscal policy become more stimulative.

The last time the Fed raised the federal funds rate was in December 2017 and it increased it to a range of between 1.25% and 1.5%. It is widely expected that the Fed will increase the rate again at its March meeting.

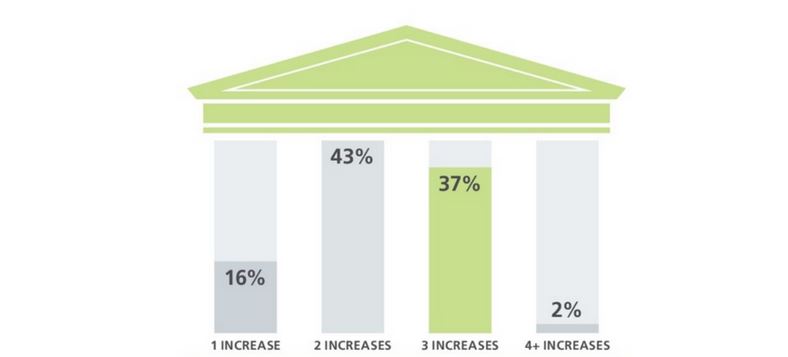

The CRE community, at least at the time this survey was taken, is not expecting to see four interest rate increases.

Besides the psychological impact, four rate increases would lead to such adverse reactions as a decrease in valuations, Gart said.

“Transactions will slow down and valuations will clearly be impacted,” he said. “The decision-making to acquire assets, with debt in particular, would be adversely impacted as well.”

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.