Each month, ABODO releases reports aimed at taking the pulse of the American rental market: cities experiencing the greatest increase (and decrease) in rent, cities with the highest rent, and how individual markets compare to the national average.

Each month, ABODO releases reports aimed at taking the pulse of the American rental market: cities experiencing the greatest increase (and decrease) in rent, cities with the highest rent, and how individual markets compare to the national average.

But according to the most recent midyear report, which looks back at the first half of 2017 (as well as the month of July), nationally, the report concludes that rental prices were relatively stable through the first six months of 2017. The report also tackles the following questions: How did rent prices change nationally? At the state level? Where did rent increase the most over the past six months, and where did it decline? Where are the 10 most expensive rental markets?

Over the first half of 2017, the national median rent fluctuated, but it ended up exactly where it began: $1,016 for a one-bedroom. Prices fell from January to March, bottoming out at $1,003 before creeping back up in the spring. In all, the national median rent always stayed within 1.3% of its starting value, the report says.

A slight majority of states (26, plus the District of Columbia) saw rental increases over the first six months of 2017, with the largest average percent changes coming in South Carolina (7.3%), Maine (7.3%), Vermont (7.2%), and Rhode Island (7.0%). The greatest average decreases were significantly lower: Utah (-4.4%), Oklahoma (-3.3%), Pennsylvania (-2.7%), Connecticut (-2.3%).

The majority of states, 31, saw average changes in rent price of 1.3% or lower.

The states with the highest average rents will surprise no one. The District of Columbia had the highest average rent from January to July, with one-bedrooms going for $2,138 per month. Massachusetts ($1,896), California ($1,630), Hawaii ($1,572), and New York ($1,571) followed. The four states with the lowest average rents were all in the West or Southwest: South Dakota ($525), Wyoming ($596), Idaho ($613), and New Mexico ($620).

In December, the company's annual rent report noted that many of the cities with the fastest-growing rents were between the coasts. That trend continued in the first half of 2017: Eight of the top 10 cities for rental hikes were in the South or Southwest. New Orleans, LA, led the way, with an average monthly change of 6.3% and an average rent of $1,167. Glendale, AZ (4.7%, $764), and Houston, TX (3.8%; $1,053), followed closely behind, with Reno, NV; Atlanta, GA; Miami, FL; Phoenix, AZ; and Lexington, KY, also making appearances.

The only geographic outliers were Seattle, WA, which saw rents rise an average of 3.6% over the first half of the year, and Honolulu, HI (2.6%).

The biggest drops in rent also continued to veer west and south. Fort Wayne, IN, saw the largest rent drop, with an average decline of 4.9% per month and an average rent of $562. Lincoln, NE, where the average rent is $700, experienced an average decline of 4% per month. And booming Nashville, TN, where the average one-bedroom rents for $1,373, saw an average drop of 3.1% per month.

From June to July, the biggest rental hike was in Newark, NJ, which saw its one-bedroom rent increase 10.2% to $1,120. Philadelphia, PA (8.5%; $1,305); and Honolulu, HI (8%; $1,654), rounded out the top three. In June, Reno, NV, saw its rent rise 6.7% to $832, and New Orleans, LA, jumped 5.8% to $1,397, continuing the months-long upward trend that landed them on the list for highest year-to-date change.

For the second month in a row, Buffalo, NY, and St. Paul, MN, experienced the largest drops in rent in the country. This month, the order was reversed: St. Paul, MN, leads the way, with a 7.4% decrease to $1,233. Buffalo, NY, saw its rent drop 7.2% to $939. Glendale, AZ, which over the first six months of 2017 had the second-highest average monthly increase in rent, saw its median one-bedroom decrease 6.8% over the month of June, bottoming out at $833.

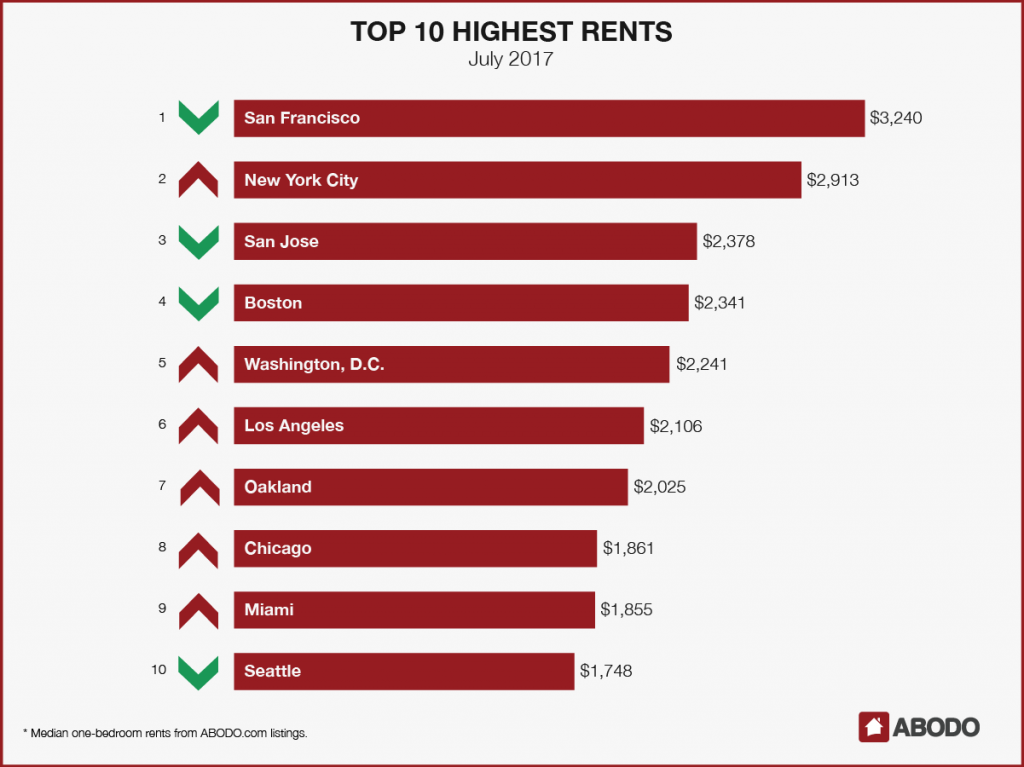

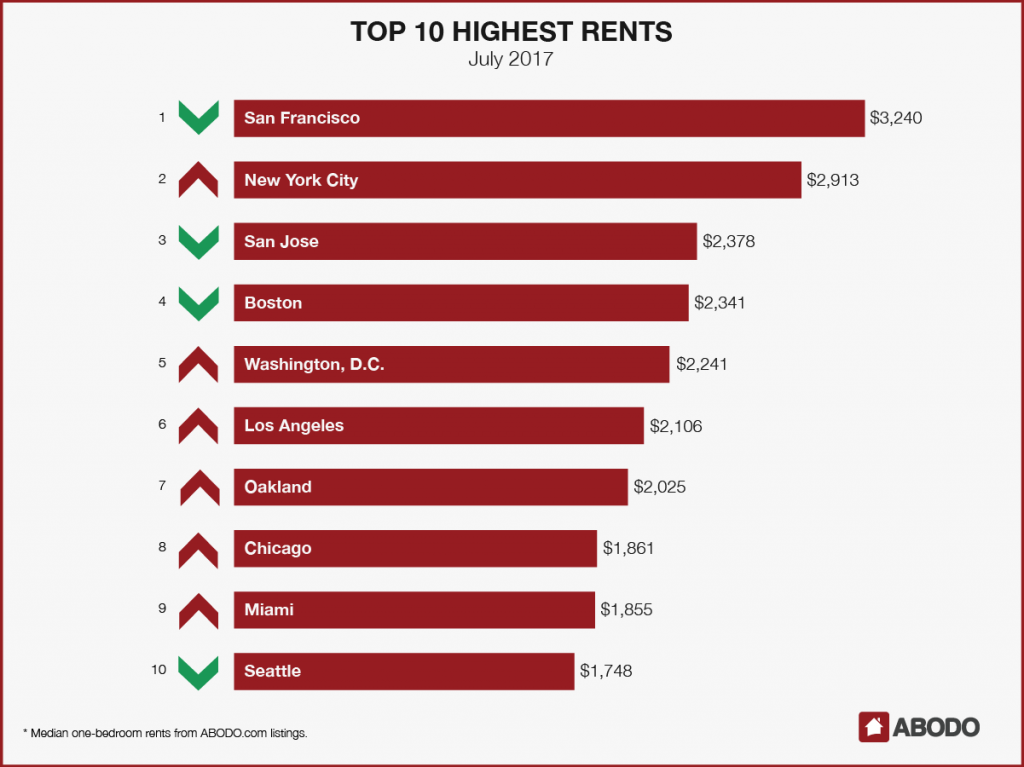

The cities with the highest rents are largely unchanged since last month's report. San Francisco rents dropped $40 to $3,240, but that wasn't enough to bump the city from its spot atop the rankings. As usual, New York City ($2,913) and San Jose ($2,378) rounded out the top three. The only real movement in the list of the country's highest rents, according to the report, was near the bottom: Chicago ($1,861) superseded Miami ($1,855) for eighth place.

Rent is rising in just over half of the nation's states, and certain cities are seeing sustained increases in rent month to month, the report says. Cities where rent was already high—New York, D.C., Los Angeles—are still high, but the most notable rental increases are in growing markets in the South and Southwest, a continuation of a trend the company noticed in its 2016 Annual Report. “In the next six months, rental prices in those markets will be a good barometer for how well new development is keeping up with what appears to be continued—and rising—demand for rentals,” the report says.

Each month, ABODO releases reports aimed at taking the pulse of the American rental market: cities experiencing the greatest increase (and decrease) in rent, cities with the highest rent, and how individual markets compare to the national average.

Each month, ABODO releases reports aimed at taking the pulse of the American rental market: cities experiencing the greatest increase (and decrease) in rent, cities with the highest rent, and how individual markets compare to the national average.

But according to the most recent midyear report, which looks back at the first half of 2017 (as well as the month of July), nationally, the report concludes that rental prices were relatively stable through the first six months of 2017. The report also tackles the following questions: How did rent prices change nationally? At the state level? Where did rent increase the most over the past six months, and where did it decline? Where are the 10 most expensive rental markets?

Over the first half of 2017, the national median rent fluctuated, but it ended up exactly where it began: $1,016 for a one-bedroom. Prices fell from January to March, bottoming out at $1,003 before creeping back up in the spring. In all, the national median rent always stayed within 1.3% of its starting value, the report says.

A slight majority of states (26, plus the District of Columbia) saw rental increases over the first six months of 2017, with the largest average percent changes coming in South Carolina (7.3%), Maine (7.3%), Vermont (7.2%), and Rhode Island (7.0%). The greatest average decreases were significantly lower: Utah (-4.4%), Oklahoma (-3.3%), Pennsylvania (-2.7%), Connecticut (-2.3%).

The majority of states, 31, saw average changes in rent price of 1.3% or lower.

The states with the highest average rents will surprise no one. The District of Columbia had the highest average rent from January to July, with one-bedrooms going for $2,138 per month.

In December, the company's annual rent report noted that many of the cities with the fastest-growing rents were between the coasts. That trend continued in the first half of 2017: Eight of the top 10 cities for rental hikes were in the South or Southwest. New Orleans, LA, led the way, with an average monthly change of 6.3% and an average rent of $1,167. Glendale, AZ (4.7%, $764), and Houston, TX (3.8%; $1,053), followed closely behind, with Reno, NV; Atlanta, GA; Miami, FL; Phoenix, AZ; and Lexington, KY, also making appearances.

The only geographic outliers were Seattle, WA, which saw rents rise an average of 3.6% over the first half of the year, and Honolulu, HI (2.6%).

The biggest drops in rent also continued to veer west and south. Fort Wayne, IN, saw the largest rent drop, with an average decline of 4.9% per month and an average rent of $562. Lincoln, NE, where the average rent is $700, experienced an average decline of 4% per month. And booming Nashville, TN, where the average one-bedroom rents for $1,373, saw an average drop of 3.1% per month.

From June to July, the biggest rental hike was in Newark, NJ, which saw its one-bedroom rent increase 10.2% to $1,120. Philadelphia, PA (8.5%; $1,305); and Honolulu, HI (8%; $1,654), rounded out the top three. In June, Reno, NV, saw its rent rise 6.7% to $832, and New Orleans, LA, jumped 5.8% to $1,397, continuing the months-long upward trend that landed them on the list for highest year-to-date change.

For the second month in a row, Buffalo, NY, and St. Paul, MN, experienced the largest drops in rent in the country. This month, the order was reversed: St. Paul, MN, leads the way, with a 7.4% decrease to $1,233. Buffalo, NY, saw its rent drop 7.2% to $939. Glendale, AZ, which over the first six months of 2017 had the second-highest average monthly increase in rent, saw its median one-bedroom decrease 6.8% over the month of June, bottoming out at $833.

The cities with the highest rents are largely unchanged since last month's report. San Francisco rents dropped $40 to $3,240, but that wasn't enough to bump the city from its spot atop the rankings. As usual,

Rent is rising in just over half of the nation's states, and certain cities are seeing sustained increases in rent month to month, the report says. Cities where rent was already high—

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.