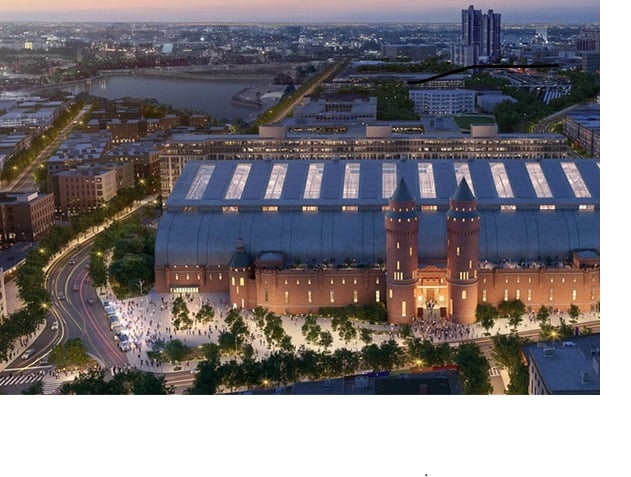

"We are pleased to have maximized the value of this asset since the property is located in a site-restricted urban environment, coupled with a multi-level physical plant that does not fit the profile of our core retail holdings, offering minimal prospects for increased profitability," says Louis P. Meshon, Sr., president and chief executive officer of Kramont, the former owner, which is headquartered in Plymouth Meeting, PA.

According to Meshon, the REIT is engaging in an asset-conversion program that calls for concentrating its resources on its existing centers with the greatest growth and profit potential, as well as buying undervalued properties in and around major markets in the East and Southeast.

Kramont Realty Trust is a self-administered, self-managed equity REIT specializing in neighborhood and community shopping center acquisition, leasing, development and management. The company owns and operates 88 properties with a total of 12 million sf of leasable space in 16 states.

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.