The transaction was financed with a portion of the proceeds from the company's equity offering completed in June as well as the assumption of debt in the amount of $12.0 million.

"The company continues to execute its acquisition plan for the year adding well-anchored shopping centers in demographically solid trade areas within our core mid-west and southeast markets," says Dennis Gershenson, president and CEO. "Fairlane Meadows marks the third acquisition by the company in a little over two months and is an excellent addition to our portfolio."

In August, Southfield-based Ramco acquired 361,000-sf Lakeshore Marketplace in Norton Shores for $23 million. In July, the company purchased the 361,000-sf Lakeshore Marketplace in Norton Shores for $11.5 million.

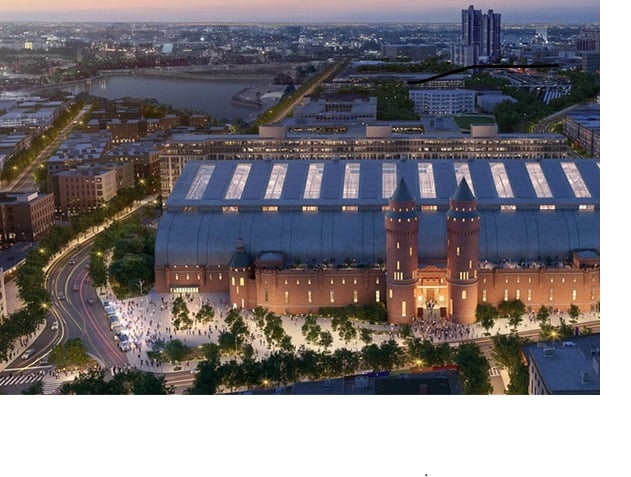

Fairlane Meadows is located on Ford Road between Mercury Drive and Greenfield Road, approximately 1/2 mile from the Ford World Headquarters complex and the super regional Fairlane Mall. The trade area for the shopping center includes a population base currently estimated at 414,000.

Malan said it anticipates using the funds from the sale to pay down additional debt, for working capital purposes and to fund any dividends to shareholders for the year ending Dec. 31, required for maintaining its REIT status.

Malan currently anticipates paying a required dividend based upon 2003 taxable income. The company says it has another eight properties and one vacant land parcel under contract for sale and one property under letter of intent. It is possible that no dividend will be required if certain of these sales do not close by year-end or other unforeseen events occur.

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.