HOUSTON—Trade with Mexico has more than doubled since 2000 and has nearly quadrupled since the mid-1990s. Today, a total close to $1.5 billion worth of goods are being traded every single day with the United States' southern neighbor. The trade flow to and from Mexico profoundly impacts warehouse and distribution demand across Texas and supports close to 500,000 jobs statewide. CBRE recently released a study on Mexico's growing manufacturing sector and how it impacts warehouse and distribution demand across Texas.

Mexico's maturing manufacturers are sending more goods through South Texas ports–a half trillion more when measured in US dollars. Because of trade agreements, competitive wages and close proximity to an improved US consumer market, manufacturing in Mexico is thriving with investment and output well above pre-recessionary levels. This is once again boosting trade between the neighboring countries, in both directions, through raw materials and finished goods. In 2015, Mexico was the third largest total trading partner with the US and the country is quickly closing the relatively small gap with now number one China and number two Canada.

Robert Kramp, director of research and analysis with CBRE tells GlobeSt.com: “The strength of the industrial markets along the border, and the surge of foreign trade with Mexico, is driven by a global pattern. More manufacturers are choosing Mexico over China and other Asia Pacific countries for labor cost savings, as well as transportation cost and time savings. Reshoring in Mexico translates into bottom line common sense.”

Product mix varies across the border, but certain sectors dominate the general trade flow. Machinery and appliances, electronics and motor vehicles, including parts, dominate trade flow in both directions. At the same time, certain sectors are specific to particular regions. In Texas, for example, El Paso imports a large quantity of electronics and appliances; Laredo heavily imports vehicles, while McAllen imports the most produce into the US. This variety influences industrial market demand in different ways.

Land ports of entry comprise 85% of total trade with Mexico representing $452 billion via a steady parade trucks and railcars. Of that number, 75%, a whopping $337 billion, crosses through Texas. In fact, Texas is home to three of the top four most active land ports in the Southern US—Laredo, El Paso, McAllen. An overwhelming majority of goods are being traded alone through truck freight—in part because of limited infrastructure and time constraints which stimulates demand for warehouse and distribution space. Preliminary 2015 data shows total Texas northbound truck crossings increased by 2%, compared to 2014, with a total 3.8 million. Texas continues to capture the largest share of the record-high total volume.

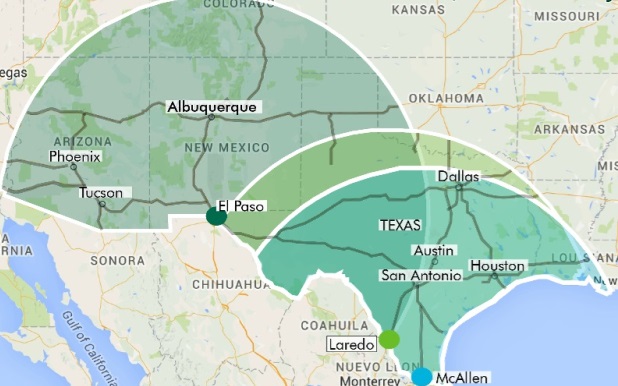

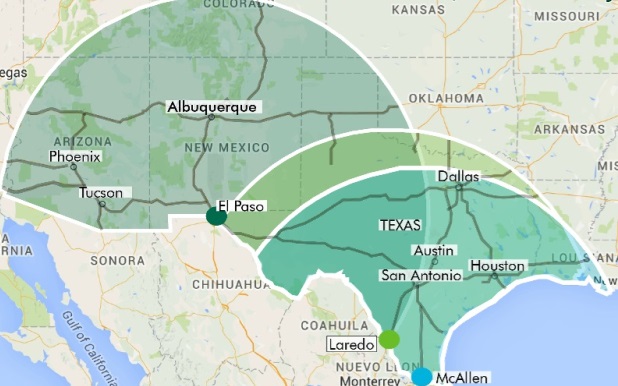

Border markets are not the only ones that benefit from increased trade with Mexico. Most of the traded product typically continues on to additional destinations in the supply chain, but face certain margins. Considering that 82% of weight and 62% of the value of goods travel less than 500 miles between origin (in this case, the border) and its next destination, most markets in Texas fall inside the supply network that connects the US and Mexico.

Specifically, goods can easily reach the Dallas/Fort Worth and Houston markets, recognized as global logistics hubs, and can push trade quickly throughout the US and abroad. The triple net is that the benefits of growing trade with Mexico ripple throughout the Texas industrial sector and its statewide economy, and translate into economic growth and job creation nationwide.

Christian Perez Giese, senior vice president and director of CBRE's El Paso/Juárez offices tells GlobeSt.com: “The twin plant model on the US/Mexico border is alive and well, although it's more complex today. The term is used to describe warehousing on the US side of the border to support manufacturing in Mexico. This system is vitally important for many companies and it is positively affecting the El Paso, McAllen and Laredo industrial markets with high occupancy and in some cases, new construction.”

HOUSTON—Trade with Mexico has more than doubled since 2000 and has nearly quadrupled since the mid-1990s. Today, a total close to $1.5 billion worth of goods are being traded every single day with the United States' southern neighbor. The trade flow to and from Mexico profoundly impacts warehouse and distribution demand across Texas and supports close to 500,000 jobs statewide. CBRE recently released a study on Mexico's growing manufacturing sector and how it impacts warehouse and distribution demand across Texas.

Mexico's maturing manufacturers are sending more goods through South Texas ports–a half trillion more when measured in US dollars. Because of trade agreements, competitive wages and close proximity to an improved US consumer market, manufacturing in Mexico is thriving with investment and output well above pre-recessionary levels. This is once again boosting trade between the neighboring countries, in both directions, through raw materials and finished goods. In 2015, Mexico was the third largest total trading partner with the US and the country is quickly closing the relatively small gap with now number one China and number two Canada.

Robert Kramp, director of research and analysis with CBRE tells GlobeSt.com: “The strength of the industrial markets along the border, and the surge of foreign trade with Mexico, is driven by a global pattern. More manufacturers are choosing Mexico over China and other Asia Pacific countries for labor cost savings, as well as transportation cost and time savings. Reshoring in Mexico translates into bottom line common sense.”

Product mix varies across the border, but certain sectors dominate the general trade flow. Machinery and appliances, electronics and motor vehicles, including parts, dominate trade flow in both directions. At the same time, certain sectors are specific to particular regions. In Texas, for example, El Paso imports a large quantity of electronics and appliances; Laredo heavily imports vehicles, while McAllen imports the most produce into the US. This variety influences industrial market demand in different ways.

Land ports of entry comprise 85% of total trade with Mexico representing $452 billion via a steady parade trucks and railcars. Of that number, 75%, a whopping $337 billion, crosses through Texas. In fact, Texas is home to three of the top four most active land ports in the Southern US—Laredo, El Paso, McAllen. An overwhelming majority of goods are being traded alone through truck freight—in part because of limited infrastructure and time constraints which stimulates demand for warehouse and distribution space. Preliminary 2015 data shows total Texas northbound truck crossings increased by 2%, compared to 2014, with a total 3.8 million. Texas continues to capture the largest share of the record-high total volume.

Border markets are not the only ones that benefit from increased trade with Mexico. Most of the traded product typically continues on to additional destinations in the supply chain, but face certain margins. Considering that 82% of weight and 62% of the value of goods travel less than 500 miles between origin (in this case, the border) and its next destination, most markets in Texas fall inside the supply network that connects the US and Mexico.

Specifically, goods can easily reach the Dallas/Fort Worth and Houston markets, recognized as global logistics hubs, and can push trade quickly throughout the US and abroad. The triple net is that the benefits of growing trade with Mexico ripple throughout the Texas industrial sector and its statewide economy, and translate into economic growth and job creation nationwide.

Christian Perez Giese, senior vice president and director of CBRE's El Paso/Juárez offices tells GlobeSt.com: “The twin plant model on the US/Mexico border is alive and well, although it's more complex today. The term is used to describe warehousing on the US side of the border to support manufacturing in Mexico. This system is vitally important for many companies and it is positively affecting the El Paso, McAllen and Laredo industrial markets with high occupancy and in some cases, new construction.”

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.