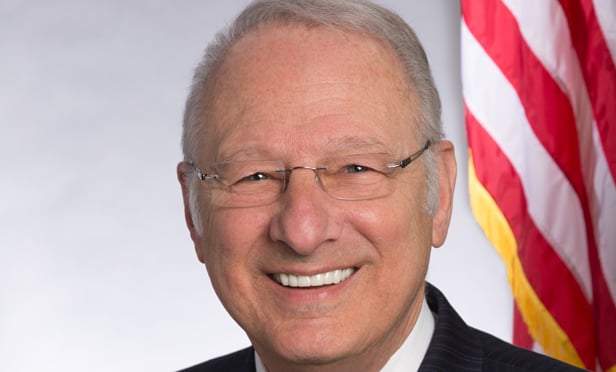

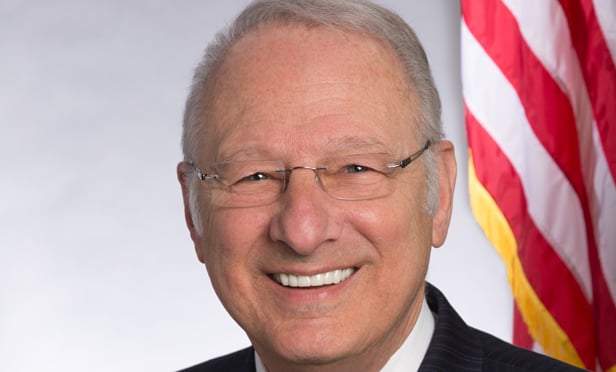

OAK BROOK, IL--They're back! Mega-mergers, massive real estate firms gobbling up equally massive competitors, or at least regionals, in an attempt to build bench-strength or diversity, or at the very least, stave off being gobbled up themselves. Marriott and Starwood, DTZ and Cassidy Turley, Cushman & Wakefield and DTZ. Inland Real Estate Group Joseph Cosenza GlobeSt.com: First, Joe, what are you seeing in terms of the increased competition in top-tier MSAs and the focus on secondary and tertiary markets? Joseph Cosenza: GlobeSt.com: Are you seeing a lot of foreign capital coming into the market? Cosenza: GlobeSt.com: As a novice, thoughts on Firpta? Cosenza: GlobeSt.com: So Inland stands to gain. Cosenza: GlobeSt.com: Does Inland face a new kind of competition given the mega-merger trend we find ourselves in once again? Cosenza: GlobeSt.com: And what about the trend as it relates to the industry? Cosenza:

OAK BROOK, IL--They're back! Mega-mergers, massive real estate firms gobbling up equally massive competitors, or at least regionals, in an attempt to build bench-strength or diversity, or at the very least, stave off being gobbled up themselves. Marriott and Starwood, DTZ and Cassidy Turley, Cushman & Wakefield and DTZ. Inland Real Estate Group Joseph Cosenza GlobeSt.com: First, Joe, what are you seeing in terms of the increased competition in top-tier MSAs and the focus on secondary and tertiary markets? Joseph Cosenza: GlobeSt.com: Are you seeing a lot of foreign capital coming into the market? Cosenza: GlobeSt.com: As a novice, thoughts on Firpta? Cosenza: GlobeSt.com: So Inland stands to gain. Cosenza: GlobeSt.com: Does Inland face a new kind of competition given the mega-merger trend we find ourselves in once again? Cosenza: GlobeSt.com: And what about the trend as it relates to the industry? Cosenza:  OAK BROOK, IL--They're back! Mega-mergers, massive real estate firms gobbling up equally massive competitors, or at least regionals, in an attempt to build bench-strength or diversity, or at the very least, stave off being gobbled up themselves. Marriott and Starwood, DTZ and Cassidy Turley, Cushman & Wakefield and DTZ. Inland Real Estate Group Joseph Cosenza GlobeSt.com: First, Joe, what are you seeing in terms of the increased competition in top-tier MSAs and the focus on secondary and tertiary markets? Joseph Cosenza:

OAK BROOK, IL--They're back! Mega-mergers, massive real estate firms gobbling up equally massive competitors, or at least regionals, in an attempt to build bench-strength or diversity, or at the very least, stave off being gobbled up themselves. Marriott and Starwood, DTZ and Cassidy Turley, Cushman & Wakefield and DTZ. Inland Real Estate Group Joseph Cosenza GlobeSt.com: First, Joe, what are you seeing in terms of the increased competition in top-tier MSAs and the focus on secondary and tertiary markets? Joseph Cosenza: © Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.