Dollar stores were once looked upon as second-class citizens in the retail world. Well, that is far from the case nowadays. Since the recession, consumers have been more discerning in their shopping choices, and looking for deals at various outlets instead of just going to a single store to do their purchasing. Dollar stores are at the forefront of this consumer pattern now, in part due to enhancements in their merchandise mix, offering a wider array of food, health products and over-the-counter healthcare products at inexpensive prices. We are going to examine the country's two largest dollar chains, Dollar General, and Dollar Tree, which is in the midst of absorbing competitor Family Dollar through an acquisition that was completed last year. In the case of Dollar General and its 12,500 stores, sales were steady in its most recent quarterly filing . Same-store revenues were up 2.2% over the same year, while net income rose from $253 million, to $295 million. Dollar Tree's same-store sales increased 2.3% during its most recent quarter. It now operates just under 14,000 stores, including its Family Dollar purchase, and the two are still being combined in its financial reports.

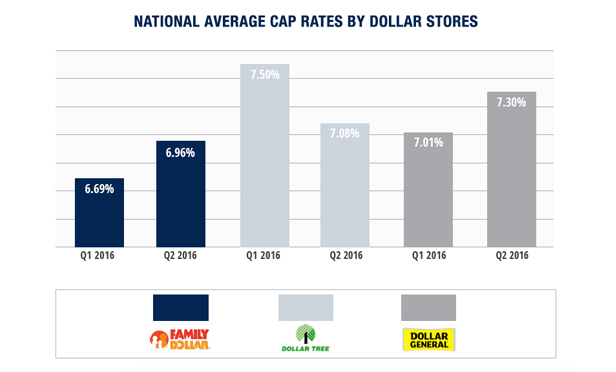

Dollar stores were once looked upon as second-class citizens in the retail world. Well, that is far from the case nowadays. Since the recession, consumers have been more discerning in their shopping choices, and looking for deals at various outlets instead of just going to a single store to do their purchasing. Dollar stores are at the forefront of this consumer pattern now, in part due to enhancements in their merchandise mix, offering a wider array of food, health products and over-the-counter healthcare products at inexpensive prices. We are going to examine the country's two largest dollar chains, Dollar General, and Dollar Tree, which is in the midst of absorbing competitor Family Dollar through an acquisition that was completed last year. In the case of Dollar General and its 12,500 stores, sales were steady in its most recent quarterly filing . Same-store revenues were up 2.2% over the same year, while net income rose from $253 million, to $295 million. Dollar Tree's same-store sales increased 2.3% during its most recent quarter. It now operates just under 14,000 stores, including its Family Dollar purchase, and the two are still being combined in its financial reports.  On the cap rate end, Dollar General's traded at 7.30% on average for Q2 2016, this included sales with less than 10 year remaining. Stores generally are bought for just over $1.3 million, and buildings typically are around 9,100 square feet. Dollar Tree traded for a cap rate with an average of 7.08% over the last quarter, with its buildings that average between 8,000 and 12,000 square feet and sell for around $1.9 million. Family Dollar, meanwhile, has an average cap rate of 6.96% for Q2 2016, our sample size included anomalies. Its stores are between 8,500 and 9,500 square feet and transactions involving them are usually just over $1.5 million. As far as corporate-bond ratings go, Dollar General clocks in at “BBB” with Standard & Poors, and “Baa2,” as rated by Moody's. Dollar Tree ranks a bit higher, at “BB+” with S&P and a Moody's rating of “Ba2” since the acquisition of Family Dollar. Both the stocks of Dollar General (DG) and Dollar Tree (DLTR) are performing very well as of late. Recent quotes see them hovering just over the $90-per-share range, both near their 52-week highs, and unless there is a drastic change in the economy toward luxury, this is not likely to change.

On the cap rate end, Dollar General's traded at 7.30% on average for Q2 2016, this included sales with less than 10 year remaining. Stores generally are bought for just over $1.3 million, and buildings typically are around 9,100 square feet. Dollar Tree traded for a cap rate with an average of 7.08% over the last quarter, with its buildings that average between 8,000 and 12,000 square feet and sell for around $1.9 million. Family Dollar, meanwhile, has an average cap rate of 6.96% for Q2 2016, our sample size included anomalies. Its stores are between 8,500 and 9,500 square feet and transactions involving them are usually just over $1.5 million. As far as corporate-bond ratings go, Dollar General clocks in at “BBB” with Standard & Poors, and “Baa2,” as rated by Moody's. Dollar Tree ranks a bit higher, at “BB+” with S&P and a Moody's rating of “Ba2” since the acquisition of Family Dollar. Both the stocks of Dollar General (DG) and Dollar Tree (DLTR) are performing very well as of late. Recent quotes see them hovering just over the $90-per-share range, both near their 52-week highs, and unless there is a drastic change in the economy toward luxury, this is not likely to change.  Dollar stores were once looked upon as second-class citizens in the retail world. Well, that is far from the case nowadays. Since the recession, consumers have been more discerning in their shopping choices, and looking for deals at various outlets instead of just going to a single store to do their purchasing. Dollar stores are at the forefront of this consumer pattern now, in part due to enhancements in their merchandise mix, offering a wider array of food, health products and over-the-counter healthcare products at inexpensive prices. We are going to examine the country's two largest dollar chains,

Dollar stores were once looked upon as second-class citizens in the retail world. Well, that is far from the case nowadays. Since the recession, consumers have been more discerning in their shopping choices, and looking for deals at various outlets instead of just going to a single store to do their purchasing. Dollar stores are at the forefront of this consumer pattern now, in part due to enhancements in their merchandise mix, offering a wider array of food, health products and over-the-counter healthcare products at inexpensive prices. We are going to examine the country's two largest dollar chains,  On the cap rate end,

On the cap rate end,

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.