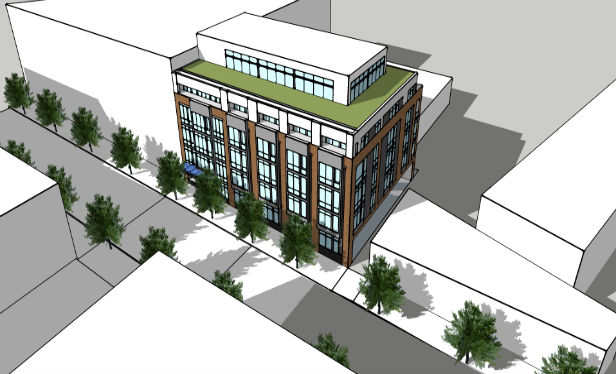

1724 Kalorama Rd., NW rendering

1724 Kalorama Rd., NW rendering

WASHINGTON, DC–A local developer recently acquired a vacant office building at 1724 Kalorama Rd., NW for about $9 million. For another $10 million he plans to convert the property into a 48-unit multifamily property with four parking spaces. He recently secured, via Greysteel, a financial package of $14.9 million in senior debt and preferred equity to help cover the acquisition and construction costs. This is the story about that financing, or rather, the story of why the financing was a bit more complicated than it had to be.

The financing consists of a senior construction loan and preferred equity, which were provided by different investors. The two-year construction loan is nonrecourse with a fixed interest rate. The preferred equity was provided by a crowdfunding site, which Greysteel Senior Director Brendan Scanlon declined to name. Scanlon negotiated the financing on behalf of the developer.

Greysteel and the developer made the decision to use a private lender instead of a commercial bank for three reasons, Scanlon told GlobeSt.com.

One, the client wanted to maximize leverage and stretch to 75% LTV. “We wanted to be sure there was take out financing available so we didn't stretch to 80% LTV,” Scanlon said.

Two, the developer has more than one deal in the works and didn't want to sign personal guarantees to too many banks.

Three, he wanted to minimize his risk associated with the deal. The seller had already received a building permit to transform the building into an apartment but the developer wanted to build ten more units than the original plan allowed. “So he must do the redesign and seek out reapproval,” Scanlon said. With at least six months devoted to that process he had another reason for wanting the loan to be non-recourse.

Interestingly, this list does not include the typical reasons why a non-institutional developer might opt for a private lender — namely that the banks aren't interested or have run out of capital in the fourth quarter.

Neither was true for this project, Scanlon said, as there was a lot of competition for it from all quarters.

Steady gains in the US economy have resulted in net positives for the multifamily sector—will this wave continue for the foreseeable future? What's driving development and capital flows? Join us at RealShare Apartments on October 19 & 20 for impactful information from the leaders in the National multifamily space. Learn more.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.