CHICAGO—US venture capital firms have continued their pullback from the world of high tech. In the third quarter, these investments dropped 13.6% on a 12-month trailing basis, according to a study released last week by Chicago-based JLL. Additionally, the number of deals dropped 35% compared with this quarter last year.

The drop could eventually make an impact on the US office market. As reported in GlobeSt.com, the sector drove roughly 25% of the leasing activity in the top US metro areas over the past two years.

Experts say that after the explosion of interest in high tech following the 2007 release of the iPhone, many investors have adopted a wait-and-see attitude as entrepreneurs struggle catch the next wave of development, perhaps with driverless cars or virtual reality tools.

Investors continue to put money toward expansion and late stage companies, but the third quarter saw fewer deals above $100 million compared to the same time last year, JLL found. “While some of this large deal flow could be attributed to election uncertainty, seed funding also continued to recede,” according to the report.

Venture capital firms have put young start-ups under a microscope, and made grants far more competitive. “Those that have landed larger funding rounds ($45 million and greater) have been primarily software and media-related companies,” JLL says. “Specifically, cloud networking and big data startups are attracting attention.”

Therefore, early-stage funding isn't impossible to secure, but investors these days seem more comfortable with startups that run lean and concentrate on building their product and user-base. That also means early-stage tech users will probably consider signing leases for class A office spaces a much lower priority.

The Bay Area has, of course, remained the center of tech. Six of the ten largest third quarter investments happened in this region. San Francisco-based Airbnb, Inc., for example, was at the top with a total of $555.5 million in funding, and San Francisco-based Unity Technologies, a video game software designer, was third with $180.9 million.

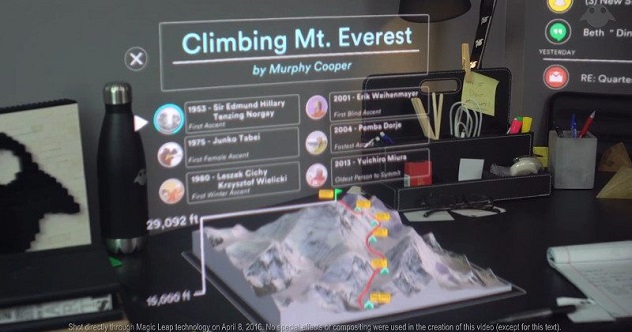

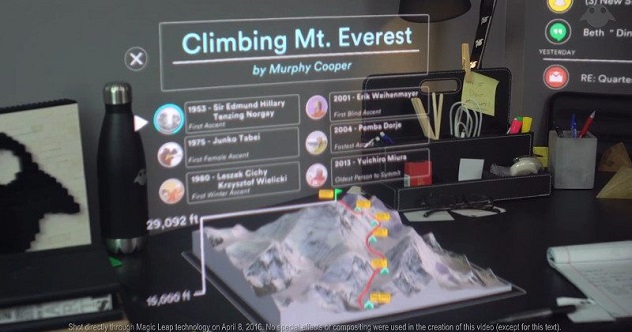

But this recent cycle has also shown that innovative tech firms exist throughout much of the US. Los Angeles-based Snapchat has begun prepping for a large IPO, JLL points out, and Dania Beach, FL-based Magic Leap, which has designed a head-mounted virtual retinal display that superimposes computer-generated images on reality, has already raised more than $1 billion. Meanwhile, markets like Raleigh-Durham, Chicago and Phoenix were among the few to see gains in funding volume this quarter.

And JLL experts don't seem too concerned about the funding slowdown. Instead, the current slide is seen as a sign of the fiscal discipline and caution needed to help the industry avoid another disaster like the dot-com era plunge.

Furthermore, “the political shift in Washington combined with potential changes in policy may dampen industry momentum,” JLL concludes, “so like most industries, we're waiting to see what 2017 will bring.”

CHICAGO—US venture capital firms have continued their pullback from the world of high tech. In the third quarter, these investments dropped 13.6% on a 12-month trailing basis, according to a study released last week by Chicago-based JLL. Additionally, the number of deals dropped 35% compared with this quarter last year.

The drop could eventually make an impact on the US office market. As reported in GlobeSt.com, the sector drove roughly 25% of the leasing activity in the top US metro areas over the past two years.

Experts say that after the explosion of interest in high tech following the 2007 release of the iPhone, many investors have adopted a wait-and-see attitude as entrepreneurs struggle catch the next wave of development, perhaps with driverless cars or virtual reality tools.

Investors continue to put money toward expansion and late stage companies, but the third quarter saw fewer deals above $100 million compared to the same time last year, JLL found. “While some of this large deal flow could be attributed to election uncertainty, seed funding also continued to recede,” according to the report.

Venture capital firms have put young start-ups under a microscope, and made grants far more competitive. “Those that have landed larger funding rounds ($45 million and greater) have been primarily software and media-related companies,” JLL says. “Specifically, cloud networking and big data startups are attracting attention.”

Therefore, early-stage funding isn't impossible to secure, but investors these days seem more comfortable with startups that run lean and concentrate on building their product and user-base. That also means early-stage tech users will probably consider signing leases for class A office spaces a much lower priority.

The Bay Area has, of course, remained the center of tech. Six of the ten largest third quarter investments happened in this region. San Francisco-based Airbnb, Inc., for example, was at the top with a total of $555.5 million in funding, and San Francisco-based Unity Technologies, a video game software designer, was third with $180.9 million.

But this recent cycle has also shown that innovative tech firms exist throughout much of the US. Los Angeles-based Snapchat has begun prepping for a large IPO, JLL points out, and Dania Beach, FL-based Magic Leap, which has designed a head-mounted virtual retinal display that superimposes computer-generated images on reality, has already raised more than $1 billion. Meanwhile, markets like Raleigh-Durham, Chicago and Phoenix were among the few to see gains in funding volume this quarter.

And JLL experts don't seem too concerned about the funding slowdown. Instead, the current slide is seen as a sign of the fiscal discipline and caution needed to help the industry avoid another disaster like the dot-com era plunge.

Furthermore, “the political shift in Washington combined with potential changes in policy may dampen industry momentum,” JLL concludes, “so like most industries, we're waiting to see what 2017 will bring.”

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.