WASHINGTON, DC–Fannie Mae has priced a $1 billion CMBS — or to use agency-speak, a DUS REMIC — that has two green tranches. It is, as far as the GSE can tell, the first green agency CMBS deal.

This transaction, FNA 2017-M2, is the second multifamily DUS REMIC in 2017 under the Fannie Mae Guaranteed Multifamily Structures (Fannie Mae GeMS) program.

The A1 and the A2 tranches are backed by 30 loans originated under Fannie Mae's various green lending initiatives. A1 priced at swaps plus 50 and A2 at swaps plus 66. All of the tranches were oversubscribed.

This story behind this benchmark deal began several years ago when Fannie Mae began quietly and then not-so-quietly marketing its green MBS securities.

The agency had been rolling out various initiatives to encourage borrowers to make water and energy improvements to the GSE's asset base, Lisa Bozzelli, director of Multifamily Capital Markets at Fannie Mae, tells GlobeSt.com.

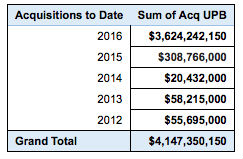

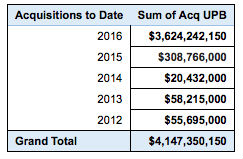

Finally last year, after a steady climb in lending [see chart] some $3.5 billion in green MBS was issued. At that point the GSE had accumulated the critical mass to re-securitize the paper in its REMIC program.

Lending volumes for Fannie Mae's green multifamily finance programs

Lending volumes for Fannie Mae's green multifamily finance programs Of course $600 million — the size of the green tranches — falls far short of $3.6 billion, but Bozzelli explains that Fannie Mae has been only able to acquire about one-third of the green paper it issued.

“DUS lenders bring those securities to market every day,” she says. “We compete as every other investor does for those securities.”

For that reason appetite for FNA 2017-M2 was not a concern — even without the green assets there is strong demand for these securities. Instead Fannie Mae wanted to see if new investors would participate in the bidding.

They did, Bozzelli says. They ranged from large existing GeMS investors with separate green accounts to green funds that were completely new to the GeMS program.

Fannie Mae is hopeful this will become a regular offering but much depends on what collateral it is able to accumulate. That said, “I see no reason why we couldn't do more,” Bozzelli offers.

A report from Moody's Investors Service last August makes the case for ongoing strong demand for green mortgage paper — although in this case it was looking at office assets.

Sustainability, the report said, has become an increasingly important factor in the leasing decisions of office building tenants, which in turn has made it an increasingly important factor in assessing the credit quality of the office collateral that backs commercial mortgage loans. It wrote:

“Green” building features are therefore credit positive for US commercial mortgage-backed securities (CMBS) backed by those loans. Such features help ensure a property maintains occupancy and value, which in turn increases the likelihood of debt repayment both during a loans term and at maturity.

WASHINGTON, DC–Fannie Mae has priced a $1 billion CMBS — or to use agency-speak, a DUS REMIC — that has two green tranches. It is, as far as the GSE can tell, the first green agency CMBS deal.

This transaction, FNA 2017-M2, is the second multifamily DUS REMIC in 2017 under the

The A1 and the A2 tranches are backed by 30 loans originated under

This story behind this benchmark deal began several years ago when

The agency had been rolling out various initiatives to encourage borrowers to make water and energy improvements to the GSE's asset base, Lisa Bozzelli, director of Multifamily Capital Markets at

Finally last year, after a steady climb in lending [see chart] some $3.5 billion in green MBS was issued. At that point the GSE had accumulated the critical mass to re-securitize the paper in its REMIC program.

Lending volumes for

Lending volumes for Of course $600 million — the size of the green tranches — falls far short of $3.6 billion, but Bozzelli explains that

“DUS lenders bring those securities to market every day,” she says. “We compete as every other investor does for those securities.”

For that reason appetite for FNA 2017-M2 was not a concern — even without the green assets there is strong demand for these securities. Instead

They did, Bozzelli says. They ranged from large existing GeMS investors with separate green accounts to green funds that were completely new to the GeMS program.

A report from Moody's Investors Service last August makes the case for ongoing strong demand for green mortgage paper — although in this case it was looking at office assets.

Sustainability, the report said, has become an increasingly important factor in the leasing decisions of office building tenants, which in turn has made it an increasingly important factor in assessing the credit quality of the office collateral that backs commercial mortgage loans. It wrote:

“Green” building features are therefore credit positive for US commercial mortgage-backed securities (CMBS) backed by those loans. Such features help ensure a property maintains occupancy and value, which in turn increases the likelihood of debt repayment both during a loans term and at maturity.

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.