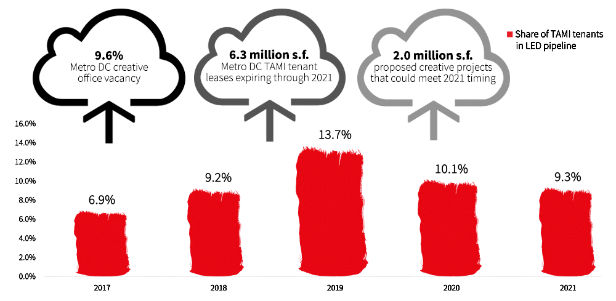

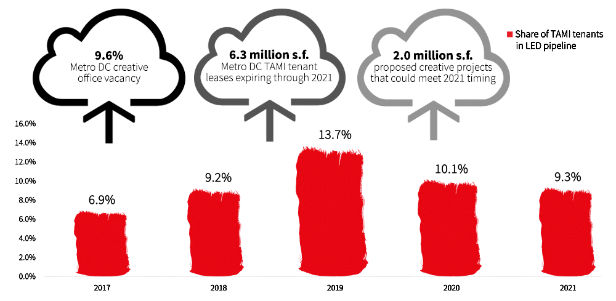

WASHINGTON, DC–With construction activity in the Washington DC office market at a cyclical high of 4.9 million square feet you would think that there would be enough product to satisfy the growing demand for creative office space. You'd be wrong, though, according to JLL.

It reports that proposed creative projects with the potential to deliver by 2021 total a mere 2 million square feet.

The bottom line? While the number of TAMI (technology, advertising, media and information) companies in the region is growing — along with their demand for creative office space — developers are still building with the traditional office tenant in mind, such as a contracting company or a law firm.

Developers are ignoring such hints as the vacancy rate in creative office assets, which is now 9.6% or 730 basis points below the average for all office product types, according to JLL.

Another stat from CBRE tells a similar story: Washington, DC's co-working segment was the key driver of net occupancy gain last year, accounting for 7.6% of total leasing activity, up from 2% in 2015. Here's another: The District's vacancy rates ended at 12.6%– an increase of 120 basis points year-over-year, the highest since 1992, CBRE said. Now what was that vacancy rate for creative office again?

The problem will only worsen as TAMI leases roll over. By 2021 — the same time period in which 2 million square feet of creative office space is set to deliver — 6.3 million square feet of TAMI leases will roll, JLL says.

One obvious conclusion to this brewing mismatch is that landlords of creative product will have more leverage to push rents and the few creative developments that do get underway, are likely to see very strong interest and lease-up.

WASHINGTON, DC–With construction activity in the Washington DC office market at a cyclical high of 4.9 million square feet you would think that there would be enough product to satisfy the growing demand for creative office space. You'd be wrong, though, according to JLL.

It reports that proposed creative projects with the potential to deliver by 2021 total a mere 2 million square feet.

The bottom line? While the number of TAMI (technology, advertising, media and information) companies in the region is growing — along with their demand for creative office space — developers are still building with the traditional office tenant in mind, such as a contracting company or a law firm.

Developers are ignoring such hints as the vacancy rate in creative office assets, which is now 9.6% or 730 basis points below the average for all office product types, according to JLL.

Another stat from CBRE tells a similar story: Washington, DC's co-working segment was the key driver of net occupancy gain last year, accounting for 7.6% of total leasing activity, up from 2% in 2015. Here's another: The District's vacancy rates ended at 12.6%– an increase of 120 basis points year-over-year, the highest since 1992, CBRE said. Now what was that vacancy rate for creative office again?

The problem will only worsen as TAMI leases roll over. By 2021 — the same time period in which 2 million square feet of creative office space is set to deliver — 6.3 million square feet of TAMI leases will roll, JLL says.

One obvious conclusion to this brewing mismatch is that landlords of creative product will have more leverage to push rents and the few creative developments that do get underway, are likely to see very strong interest and lease-up.

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.