WASHINGTON, DC–Local CMBS delinquencies continue to increase, according to Trepp. In March they registered 14.54% following February's 14.37% rate, which was the highest in a year. Now March can claim that dubious distinction.

What is happening in the Washington DC area is a reflection of the national trends, Research Analyst Sean Barrie tells GlobeSt.com. “The national rate has been rising as more loans mature and are not able to get refinancing,” he says. Trepp reports that delinquency rate for CMBS reached 5.37% in March, an increase of six basis points from February.

The rising rate also reflects that fact that there hasn't been that many new loans issued, Barrie says.

Read Commercial Real Estate Finance Council Executive Director Lisa Pendergast's explanation for why CMBS originations have been low.

In an individual market this equation may translate into a delinquency rate that looks a bit frightening. “With the total outstanding balance decreasing because of lowered new issuance, any sort of increase in delinquencies — even if it is marginal — would result in a rate increase for a given area,” Barrie says.

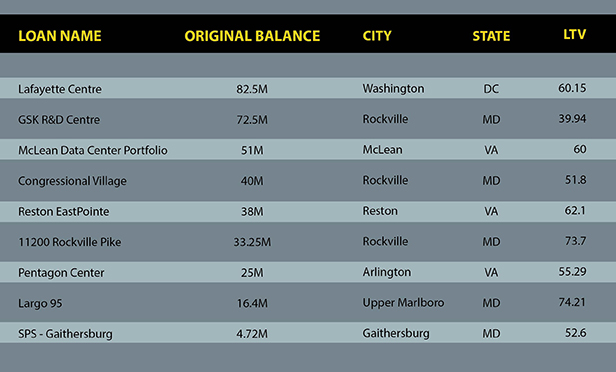

There was one welcome sign from Trepp's latest statistics for the Washington DC area: underwriting for local loans appears solid. Of the nine loans Trepp included in its report [see chart below] only one was close to that worrisome 75% LTV. “The closer you get to [a 75% LTV], the more indicative it is of 2007-2008 prices,” Barrie says.

WASHINGTON, DC–Local CMBS delinquencies continue to increase, according to Trepp. In March they registered 14.54% following February's 14.37% rate, which was the highest in a year. Now March can claim that dubious distinction.

What is happening in the Washington DC area is a reflection of the national trends, Research Analyst Sean Barrie tells GlobeSt.com. “The national rate has been rising as more loans mature and are not able to get refinancing,” he says. Trepp reports that delinquency rate for CMBS reached 5.37% in March, an increase of six basis points from February.

The rising rate also reflects that fact that there hasn't been that many new loans issued, Barrie says.

Read Commercial Real Estate Finance Council Executive Director Lisa Pendergast's explanation for why CMBS originations have been low.

In an individual market this equation may translate into a delinquency rate that looks a bit frightening. “With the total outstanding balance decreasing because of lowered new issuance, any sort of increase in delinquencies — even if it is marginal — would result in a rate increase for a given area,” Barrie says.

There was one welcome sign from Trepp's latest statistics for the Washington DC area: underwriting for local loans appears solid. Of the nine loans Trepp included in its report [see chart below] only one was close to that worrisome 75% LTV. “The closer you get to [a 75% LTV], the more indicative it is of 2007-2008 prices,” Barrie says.

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.