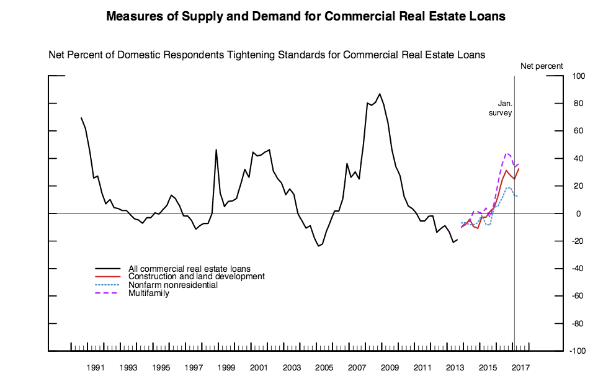

WASHINGTON, DC–For the sixth consecutive quarter, banks have told the Fed that they were tightening lending standards for commercial real estate loans, according to the April survey of senior loan officers.

In particular, most banks indicated that their lending standards for construction and land development and for multifamily loans tightened during the first quarter, while many banks reported tightening standards for loans secured by nonfarm nonresidential properties.

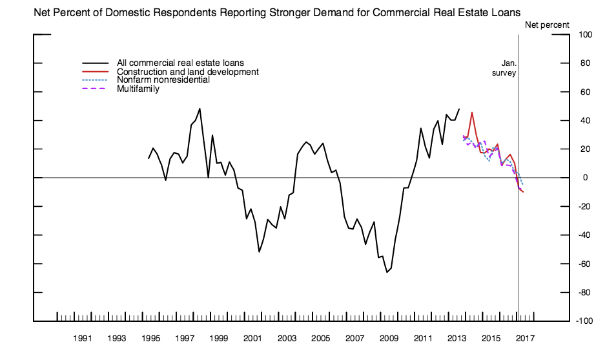

US banks also reported weaker demand for CRE loans in the first quarter.

Foreign banks reported that their credit standards for approving applications for CRE loans were basically unchanged. Furthermore, some foreign banks reported stronger demand for CRE loans.

Read GlobeSt.com's top story today: S&P Sees Banks' CRE Risk on the Rise

Special Questions

For this survey the Fed asked banks a set of special questions. It asked about the changes in their credit policies over the past year for each of the three major CRE loan categories and about their reasons for tightening or easing their CRE credit policies over the past year. In response banks reported tightening most credit policies on CRE loans over the past year, citing a less favorable or more uncertain outlook for CRE property prices, capitalization rates, and vacancy rates or other fundamentals as their most important factors.

Participants also cited a reduced tolerance for risk as an important reason for tightening CRE credit policies.

Following are highlights of the responses.

How Underwriting Tightened

On balance, banks reported tightening most credit policies on CRE loans. A significant net share of banks reported increasing spreads over their cost of funds on all three major types of CRE loans surveyed. Significant net percentages of banks also reported lowering loan-to-value ratios on construction and land development and on multifamily loans, while a moderate net share of banks did so on nonfarm nonresidential loans.

A significant net fraction of banks raised debt service coverage ratios on multifamily loans, while moderate and modest net shares of banks did so on construction and land development and on nonfarm nonresidential loans, respectively. Moderate and modest net shares of banks also reported reducing the market areas served for multifamily and for construction and land development loans, respectively.

Furthermore, moderate and modest net percentages of banks reduced the length of the interest-only payment period on multifamily and nonfarm nonresidential loans, respectively, while modest net shares of banks lowered maximum loan maturities on these types of loans.

The Reasons

Major net fractions of banks cited a less favorable or more uncertain outlook for CRE property prices, vacancy rates or other fundamentals on CRE properties, and capitalization rates, as well as reduced tolerance for risk. Significant net shares of banks also reported less aggressive competition from other banks or nonbank financial institutions and increased concerns about the effects of regulatory changes or supervisory actions as important reasons for tightening CRE credit policies.

Moderate and modest net percentages of banks also cited increased concerns about their capital adequacy or liquidity position and their diminished ability to securitize CRE loans as important reasons for tightening CRE credit policies, respectively. Banks that reportedly eased their CRE credit policies over the past year gave a range of reasons for doing so. A major net share of banks cited more aggressive competition from other banks or nonbank financial institutions as an important factor.

A significant net percentage of banks cited a more favorable or less uncertain outlook for vacancy rates or other fundamentals as an important reason for easing CRE credit policies. Furthermore, moderate net shares of banks reported a more favorable or less uncertain outlook for CRE property prices and increased tolerance for risk, and a modest net percentage of banks cited more favorable or less uncertain capitalization rates as important reasons for easing CRE credit policies.

Foreign Banks' Responses

Foreign banks' reporting of changes in their CRE credit policies over the past year were mixed. On the one hand, foreign banks reported easing some terms: Significant and moderate net shares of foreign banks reported increasing the maximum loan size and expanding the market areas served on nonfarm nonresidential loans, respectively. On the other hand, other terms tightened: Significant and moderate net shares of foreign banks increased the spread of loan rates over their cost of funds and lowered loan-to-value ratios on nonfarm nonresidential loans, respectively.

Moderate net shares of foreign banks reported lowering the maximum loan size, increasing the spread of loan rates over their cost of funds, and reducing the market areas served on construction and land development loans. Foreign banks' terms on multifamily loans reportedly remained basically unchanged on net.

WASHINGTON, DC–For the sixth consecutive quarter, banks have told the Fed that they were tightening lending standards for commercial real estate loans, according to the April survey of senior loan officers.

In particular, most banks indicated that their lending standards for construction and land development and for multifamily loans tightened during the first quarter, while many banks reported tightening standards for loans secured by nonfarm nonresidential properties.

US banks also reported weaker demand for CRE loans in the first quarter.

Foreign banks reported that their credit standards for approving applications for CRE loans were basically unchanged. Furthermore, some foreign banks reported stronger demand for CRE loans.

Read GlobeSt.com's top story today: S&P Sees Banks' CRE Risk on the Rise

Special Questions

For this survey the Fed asked banks a set of special questions. It asked about the changes in their credit policies over the past year for each of the three major CRE loan categories and about their reasons for tightening or easing their CRE credit policies over the past year. In response banks reported tightening most credit policies on CRE loans over the past year, citing a less favorable or more uncertain outlook for CRE property prices, capitalization rates, and vacancy rates or other fundamentals as their most important factors.

Participants also cited a reduced tolerance for risk as an important reason for tightening CRE credit policies.

Following are highlights of the responses.

How Underwriting Tightened

On balance, banks reported tightening most credit policies on CRE loans. A significant net share of banks reported increasing spreads over their cost of funds on all three major types of CRE loans surveyed. Significant net percentages of banks also reported lowering loan-to-value ratios on construction and land development and on multifamily loans, while a moderate net share of banks did so on nonfarm nonresidential loans.

A significant net fraction of banks raised debt service coverage ratios on multifamily loans, while moderate and modest net shares of banks did so on construction and land development and on nonfarm nonresidential loans, respectively. Moderate and modest net shares of banks also reported reducing the market areas served for multifamily and for construction and land development loans, respectively.

Furthermore, moderate and modest net percentages of banks reduced the length of the interest-only payment period on multifamily and nonfarm nonresidential loans, respectively, while modest net shares of banks lowered maximum loan maturities on these types of loans.

The Reasons

Major net fractions of banks cited a less favorable or more uncertain outlook for CRE property prices, vacancy rates or other fundamentals on CRE properties, and capitalization rates, as well as reduced tolerance for risk. Significant net shares of banks also reported less aggressive competition from other banks or nonbank financial institutions and increased concerns about the effects of regulatory changes or supervisory actions as important reasons for tightening CRE credit policies.

Moderate and modest net percentages of banks also cited increased concerns about their capital adequacy or liquidity position and their diminished ability to securitize CRE loans as important reasons for tightening CRE credit policies, respectively. Banks that reportedly eased their CRE credit policies over the past year gave a range of reasons for doing so. A major net share of banks cited more aggressive competition from other banks or nonbank financial institutions as an important factor.

A significant net percentage of banks cited a more favorable or less uncertain outlook for vacancy rates or other fundamentals as an important reason for easing CRE credit policies. Furthermore, moderate net shares of banks reported a more favorable or less uncertain outlook for CRE property prices and increased tolerance for risk, and a modest net percentage of banks cited more favorable or less uncertain capitalization rates as important reasons for easing CRE credit policies.

Foreign Banks' Responses

Foreign banks' reporting of changes in their CRE credit policies over the past year were mixed. On the one hand, foreign banks reported easing some terms: Significant and moderate net shares of foreign banks reported increasing the maximum loan size and expanding the market areas served on nonfarm nonresidential loans, respectively. On the other hand, other terms tightened: Significant and moderate net shares of foreign banks increased the spread of loan rates over their cost of funds and lowered loan-to-value ratios on nonfarm nonresidential loans, respectively.

Moderate net shares of foreign banks reported lowering the maximum loan size, increasing the spread of loan rates over their cost of funds, and reducing the market areas served on construction and land development loans. Foreign banks' terms on multifamily loans reportedly remained basically unchanged on net.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.