WASHINGTON, DC–There are currently 24 buildings under construction in the city. Vacancies are at cyclical highs and the much of the product that has delivered in the last 24 months still remains largely vacant. Yet speculative construction continues.

One example is Dallas, Texas-based Lincoln Property Co. and Chicago-based private equity firm Pearlmark Real Estate, which plan to develop 699 14th Street NW, an 11-story trophy office in the city's East End. Another is 1050 17th St., which is both a redevelopment and spec construction, JLL Senior Research Analyst Carl Caputo tells GlobeSt.com.

From the developers' perspective, the construction makes sense, Caputo explains.

“The prospect of landing a large law firm is still enticing enough for a developer to move forward with a spec project,” he says. “There will be a spike in lease expirations in 2023 and 2024 and a lot of law firms are already in the market or are interviewing brokers. There is this thinking in the developer community that if you are starting a project you are more legit and committed.”

Unfortunately, Caputo adds, there are not that many law firm tenants out there and there is still a surplus of trophy class space on the market — or coming on the market in short order — that they could consider now.

Washington, DC's office supply-demand equilibrium is already out of whack and as new supply continues to enter the market the effects are already trickling down all the way to Class B product.

“We are seeing growth in supply but what we are not seeing is tenant growth keep pace,” Caputo says.

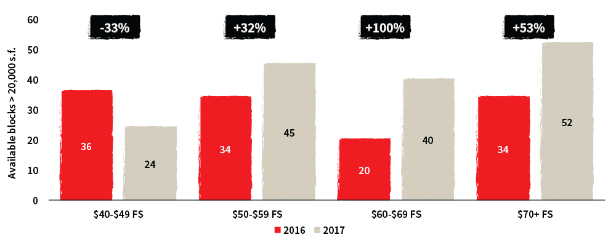

Over the next 36 months, the trophy and Class A market will grow by 2 and 5 million square feet, respectively, as 24 buildings deliver with average asking rents of $74 per square foot, according to JLL. At the same time, supply will outpace demand with 3.5 million square feet of tenants looking for space above $60 per square foot. [see chart].

Here is how that new supply will play out across the market.

Trophy Product, Ground-up New Construction

Asking rents for these buildings are $85 per square foot, full service. Demand is strong for these offices, but even at this level the pool of prospective tenants in the pipeline is just not that much, Caputo says.

“Trophy will continue to perform well and see steady demand but as more trophy supply comes online with next 36 months we will start to see some softness in this segment.”

Class A Reskinned

These are class A products that still have the bones of a B building but now have a new glass facade and upgrades to the mechanical systems and beautiful amenities. “These buildings are largely vacant and are targeting large users,” Caputo says.

Asking rents are about $75 per square foot.

“When law firms tour this space it is not that breathtaking compared to new ground up construction,” Caputo says. What usually happens is that they will opt for the trophy space, like Paul Hastings did when it decided to take 97,000 square feet at 2050 M St.

“There are going to be definite winners and losers in this category,” Caputo says.

Commodity A to True A Space

These are buildings in the $60 to $70 per square foot range and have been the hardest hit by law firms' rightsizing. There is little backfilling of space, especially as even smaller law firms are gravitating to the trophy space. Meanwhile, large-block options priced above $60 per square foot have increased by 70% since May 2016, according to JLL.

Class B+/A-

Here too, tenants that would ordinarily look at these buildings will flock to the Class A segment because of the overall flight to quality trajectory.

“This product will have a lot of trouble,” Caputo says. It is generally priced at $60 per square foot — a price point for which demand is expected to drop sharply.

True Class B

These buildings are priced in the mid-50s per square foot and they are still seeing strong demand from nonprofits, technology and the creative industries. This is the tenant that will not pay $60 per square foot but is willing to pay $55 per square foot, Caputo says. Because no new supply is entering this segment, demand is overtaking supply and already some of these tenants are having trouble finding space, he reports.

Some 2 million square feet of B product has been taken office line and potentially another one million square feet will go as well,” Caputo says.

WASHINGTON, DC–There are currently 24 buildings under construction in the city. Vacancies are at cyclical highs and the much of the product that has delivered in the last 24 months still remains largely vacant. Yet speculative construction continues.

One example is Dallas, Texas-based Lincoln Property Co. and Chicago-based private equity firm Pearlmark Real Estate, which plan to develop 699 14th Street NW, an 11-story trophy office in the city's East End. Another is 1050 17th St., which is both a redevelopment and spec construction, JLL Senior Research Analyst Carl Caputo tells GlobeSt.com.

From the developers' perspective, the construction makes sense, Caputo explains.

“The prospect of landing a large law firm is still enticing enough for a developer to move forward with a spec project,” he says. “There will be a spike in lease expirations in 2023 and 2024 and a lot of law firms are already in the market or are interviewing brokers. There is this thinking in the developer community that if you are starting a project you are more legit and committed.”

Unfortunately, Caputo adds, there are not that many law firm tenants out there and there is still a surplus of trophy class space on the market — or coming on the market in short order — that they could consider now.

Washington, DC's office supply-demand equilibrium is already out of whack and as new supply continues to enter the market the effects are already trickling down all the way to Class B product.

“We are seeing growth in supply but what we are not seeing is tenant growth keep pace,” Caputo says.

Over the next 36 months, the trophy and Class A market will grow by 2 and 5 million square feet, respectively, as 24 buildings deliver with average asking rents of $74 per square foot, according to JLL. At the same time, supply will outpace demand with 3.5 million square feet of tenants looking for space above $60 per square foot. [see chart].

Here is how that new supply will play out across the market.

Trophy Product, Ground-up New Construction

Asking rents for these buildings are $85 per square foot, full service. Demand is strong for these offices, but even at this level the pool of prospective tenants in the pipeline is just not that much, Caputo says.

“Trophy will continue to perform well and see steady demand but as more trophy supply comes online with next 36 months we will start to see some softness in this segment.”

Class A Reskinned

These are class A products that still have the bones of a B building but now have a new glass facade and upgrades to the mechanical systems and beautiful amenities. “These buildings are largely vacant and are targeting large users,” Caputo says.

Asking rents are about $75 per square foot.

“When law firms tour this space it is not that breathtaking compared to new ground up construction,” Caputo says. What usually happens is that they will opt for the trophy space, like

“There are going to be definite winners and losers in this category,” Caputo says.

Commodity A to True A Space

These are buildings in the $60 to $70 per square foot range and have been the hardest hit by law firms' rightsizing. There is little backfilling of space, especially as even smaller law firms are gravitating to the trophy space. Meanwhile, large-block options priced above $60 per square foot have increased by 70% since May 2016, according to JLL.

Class B+/A-

Here too, tenants that would ordinarily look at these buildings will flock to the Class A segment because of the overall flight to quality trajectory.

“This product will have a lot of trouble,” Caputo says. It is generally priced at $60 per square foot — a price point for which demand is expected to drop sharply.

True Class B

These buildings are priced in the mid-50s per square foot and they are still seeing strong demand from nonprofits, technology and the creative industries. This is the tenant that will not pay $60 per square foot but is willing to pay $55 per square foot, Caputo says. Because no new supply is entering this segment, demand is overtaking supply and already some of these tenants are having trouble finding space, he reports.

Some 2 million square feet of B product has been taken office line and potentially another one million square feet will go as well,” Caputo says.

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.