WASHINGTON, DC–American Hotel Income Properties REIT, a Canadian REIT based in Vancouver, British Columbia, has acquired an 18-asset hotel portfolio located along the Eastern Seaboard for $407.4 million, or $186,000 per key. The cap rate is 7.9% on trailing twelve months of net operating income.

About The Portfolio

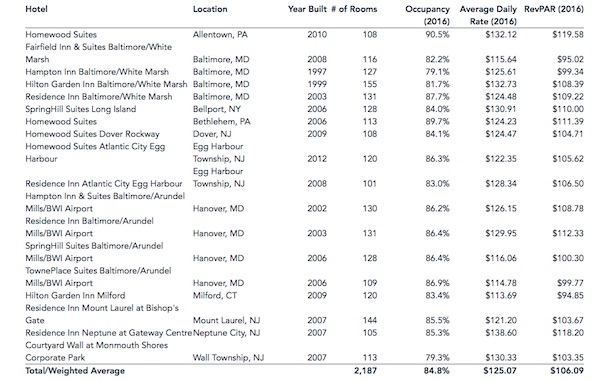

The properties [see chart below] are located in Maryland, New Jersey, New York, Connecticut and Pennsylvania. Their average age is about ten years and they are located in areas where the acquisition costs are lower than the replacement costs — which is one of the reasons why AHIP likes the portfolio, according to CEO Rob O'Neill.

“Additionally, these branded hotels are located within high barrier-to-entry secondary metropolitan markets in close proximity to major population centers such as Washington, D.C., Philadelphia, Baltimore and New York City,” O'Neill said in a prepared statement.

The portfolio includes ten Marriott totaling 1,206 guestrooms — five Residence Inns, two Springhill Suites, one Courtyard, one Fairfield Inn and Suites and one TownePlace Suites. There are also eight Hilton hotels totaling 981 guestrooms — four Homewood Suites, two Hampton Inns and two Hilton Garden Inns.

Each property is outperforming its competitive set in occupancy and revenue per available room in part, according to President Ian McAuley. “Suite-style guestrooms make up 69% of this portfolio leading to above average RevPAR potential and higher margins given their extended stay clientele,” he said in a prepared statement.

The seller was not revealed. A call from GlobeSt.com was not immediately returned prior to publication.

Geography Matters

One final reason why the Canadian company decided to acquire the portfolio was its geographic location — the Northeast corridor of the United States generates approximately 20% of the country's GDP, McAuley noted.

Indeed, earlier this year the REIT sold the 77-room Country Inn & Suites by Carlson hotel located in Norman, OK for gross proceeds of US$4.5 million. The Norman Property was acquired in June 2015 as part of a larger portfolio acquisition, but citing the continued weakness in the Oklahoma market expected for this year, AHIP decided to sell the property and redeploy the proceeds.

The company is funding the purchase with an offering and approximately $236.2 million in CMBS loans.

WASHINGTON, DC–American Hotel Income Properties REIT, a Canadian REIT based in Vancouver, British Columbia, has acquired an 18-asset hotel portfolio located along the Eastern Seaboard for $407.4 million, or $186,000 per key. The cap rate is 7.9% on trailing twelve months of net operating income.

About The Portfolio

The properties [see chart below] are located in Maryland, New Jersey,

“Additionally, these branded hotels are located within high barrier-to-entry secondary metropolitan markets in close proximity to major population centers such as Washington, D.C., Philadelphia, Baltimore and

The portfolio includes ten Marriott totaling 1,206 guestrooms — five Residence Inns, two Springhill Suites, one Courtyard, one Fairfield Inn and Suites and one TownePlace Suites. There are also eight Hilton hotels totaling 981 guestrooms — four Homewood Suites, two Hampton Inns and two Hilton Garden Inns.

Each property is outperforming its competitive set in occupancy and revenue per available room in part, according to President Ian McAuley. “Suite-style guestrooms make up 69% of this portfolio leading to above average RevPAR potential and higher margins given their extended stay clientele,” he said in a prepared statement.

The seller was not revealed. A call from GlobeSt.com was not immediately returned prior to publication.

Geography Matters

One final reason why the Canadian company decided to acquire the portfolio was its geographic location — the Northeast corridor of the United States generates approximately 20% of the country's GDP, McAuley noted.

Indeed, earlier this year the REIT sold the 77-room Country Inn & Suites by Carlson hotel located in Norman, OK for gross proceeds of US$4.5 million. The Norman Property was acquired in June 2015 as part of a larger portfolio acquisition, but citing the continued weakness in the Oklahoma market expected for this year, AHIP decided to sell the property and redeploy the proceeds.

The company is funding the purchase with an offering and approximately $236.2 million in CMBS loans.

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.