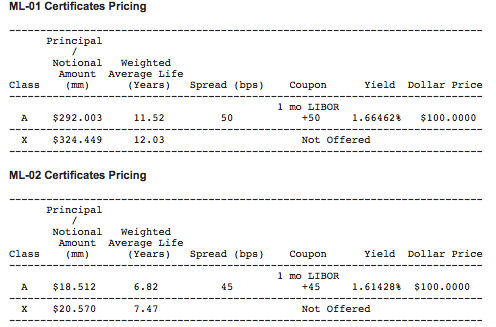

WASHINGTON, DC–Freddie Mac has begun securitizing tax-exempt loans made by state or local housing agencies and secured by affordable rental housing. It has priced [see chart] its first issuance of $292 million in ML Certificates backed by TELs on 25 properties in one transaction. In a second, it priced $18.5 million backed by taxable subordinate loans on three of the same properties as the first. Both series of ML Certificates are expected to settle around June 29, 2017.

The proceeds will be used to finance multifamily affordable housing projects.

Freddie's Tax-Exempt Products

The ML (municipal loan) securities join a related product on the M shelf, which is a wrap of tax-exempt bonds securitizations, or its TEBs program, says Aaron Dunn, Director, Investor Relations at Freddie Mac Multifamily.

The tax-exempt bonds in the wrap are not originated by Freddie Mac, Dunn tells GlobeSt.com. “That is collateral aggregated through other financial institutions and we provide our guarantee.”

With the ML Certificates, Freddie Mac is originating the loans directly using its own network. “We have a group — the Target Affordable Housing Group — which uses a group of seller servicers,” Dunn says.

The ML Certificates are additive and more efficient compared to the tax-exempt bond wrap, he adds.

Investors in the ML Certificates will be the traditional buyers of the GSE's flagship K Certificates, buyers of structured products and municipal bonds.

There will be one more issuance this year and the next year Freddie Mac will begin a regular schedule of quarterly issuance.

2014's TEL Program

The ML Certificates are the logical progression of the TEL program — a variation on the 4% Low-Income Housing Tax Credit execution — that Freddie Mac launched in 2014.

Read Freddie Mac Plans Regular Securitizations of Tax-Exempt Loans

Following the launch Freddie began incrementally expanding the program over the years.

First it added a forward TEL commitment product. Then the GSE began providing its own bridge loan to TEL financing. Then it offered a floating-to-fixed rate TEL, a product that offers a variable interest rate of up to two years after which the borrower can flip to the fixed rate.

And then Freddie began offering fixed-rate loans, executing at 10 years and then 18 years and then, in 2016, at 30 years.

WASHINGTON, DC–Freddie Mac has begun securitizing tax-exempt loans made by state or local housing agencies and secured by affordable rental housing. It has priced [see chart] its first issuance of $292 million in ML Certificates backed by TELs on 25 properties in one transaction. In a second, it priced $18.5 million backed by taxable subordinate loans on three of the same properties as the first. Both series of ML Certificates are expected to settle around June 29, 2017.

The proceeds will be used to finance multifamily affordable housing projects.

Freddie's Tax-Exempt Products

The ML (municipal loan) securities join a related product on the M shelf, which is a wrap of tax-exempt bonds securitizations, or its TEBs program, says Aaron Dunn, Director, Investor Relations at

The tax-exempt bonds in the wrap are not originated by

With the ML Certificates,

The ML Certificates are additive and more efficient compared to the tax-exempt bond wrap, he adds.

Investors in the ML Certificates will be the traditional buyers of the GSE's flagship K Certificates, buyers of structured products and municipal bonds.

There will be one more issuance this year and the next year

2014's TEL Program

The ML Certificates are the logical progression of the TEL program — a variation on the 4% Low-Income Housing Tax Credit execution — that

Read

Following the launch Freddie began incrementally expanding the program over the years.

First it added a forward TEL commitment product. Then the GSE began providing its own bridge loan to TEL financing. Then it offered a floating-to-fixed rate TEL, a product that offers a variable interest rate of up to two years after which the borrower can flip to the fixed rate.

And then Freddie began offering fixed-rate loans, executing at 10 years and then 18 years and then, in 2016, at 30 years.

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.