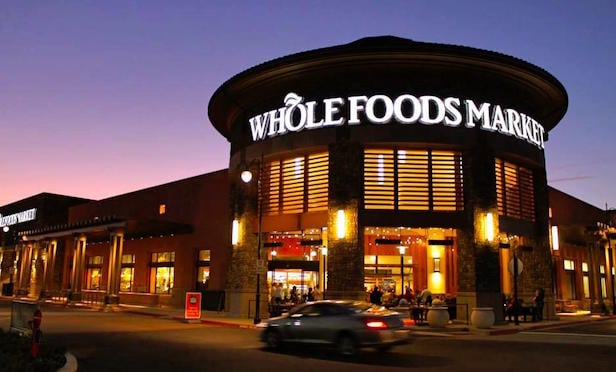

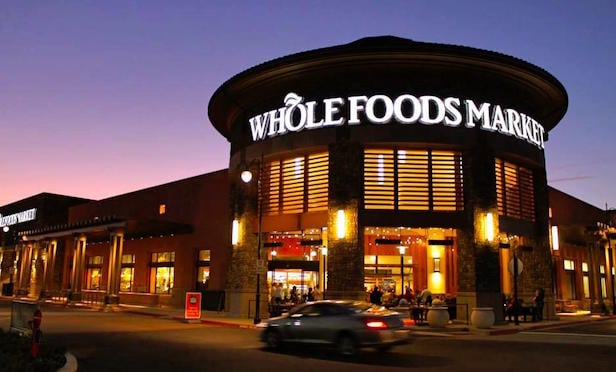

SEATTLE and AUSTIN, TX—Marking its biggest foray into brick-and-mortar retail yet, Amazon is acquiring natural grocery chain Whole Foods Market in an all-cash transaction. The deal announced Friday morning is valued at approximately $13.7 billion, including the assumption of debt.

“Millions of people love Whole Foods Market because they offer the best natural and organic foods, and they make it fun to eat healthy,” says Jeff Bezos, Amazon founder and CEO. “Whole Foods Market has been satisfying, delighting and nourishing customers for nearly four decades—they're doing an amazing job and we want that to continue.”

Accordingly, Whole Foods will continue to operate stores under its own brand, and CEO John Mackey will remain in that position from the company's current headquarters in Austin, TX. “This partnership presents an opportunity to maximize value for Whole Foods Market's shareholders, while at the same time extending our mission and bringing the highest quality, experience, convenience and innovation to our customers,” says Mackey.

Published reports earlier this spring had suggested that Amazon, the world's largest online retailer, was a leading bidder for Whole Foods, which operates 460 stores in the US, Canada and the UK and had sales of $16 billion in fiscal 2016. The merger is subject to approval by shareholders in Whole Foods Market, and closing is expected for the second half of this year.

Quito Anderson, CEO of Ben Carter Enterprises, recently told GlobeSt.com's Natalie Dolce that “Brick and mortar retail is not dying, it's evolving.” The developer of Savannah, GA's Broughton Street Collection said that “Many retailers are enhancing their brand experiences and redefining how their brands are manifested in physical stores.”

Anderson adds that “They are also looking beyond the lease lines, bending traditional standards and opening in new and unique locations that better resonate and complement their brand experience.”—With additional reporting by Natalie Dolce

SEATTLE and AUSTIN, TX—Marking its biggest foray into brick-and-mortar retail yet, Amazon is acquiring natural grocery chain

“Millions of people love

Accordingly, Whole Foods will continue to operate stores under its own brand, and CEO John Mackey will remain in that position from the company's current headquarters in Austin, TX. “This partnership presents an opportunity to maximize value for

Published reports earlier this spring had suggested that Amazon, the world's largest online retailer, was a leading bidder for Whole Foods, which operates 460 stores in the US, Canada and the UK and had sales of $16 billion in fiscal 2016. The merger is subject to approval by shareholders in

Quito Anderson, CEO of Ben Carter Enterprises, recently told GlobeSt.com's Natalie Dolce that “Brick and mortar retail is not dying, it's evolving.” The developer of Savannah, GA's Broughton Street Collection said that “Many retailers are enhancing their brand experiences and redefining how their brands are manifested in physical stores.”

Anderson adds that “They are also looking beyond the lease lines, bending traditional standards and opening in new and unique locations that better resonate and complement their brand experience.”—With additional reporting by Natalie Dolce

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.