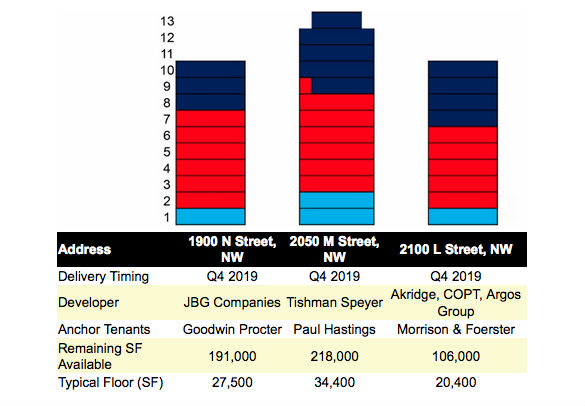

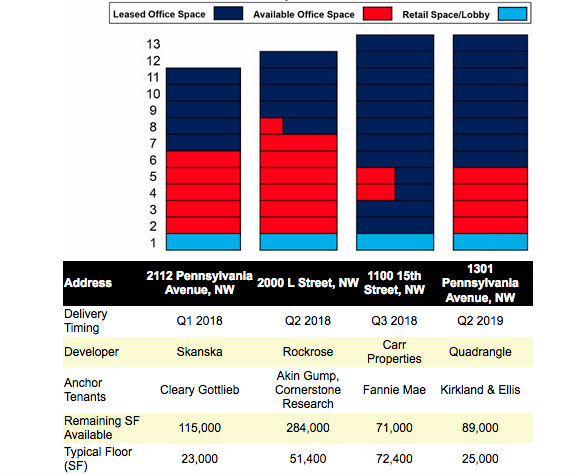

WASHINGTON, DC–Boston Properties' proposed development at 2100 Pennsylvania Ave, NW, is rumored to be close to signing a large law firm, according to a CBRE research report. That is good news for Boston Properties but bad news for the commodity office market because the pre-lease will probably lead to development — and that will add an additional 50,000 to 75,000 square feet of lower-to-mid stack space on the market [see charts].

And there it will join the influx of lower-to-mid stack office space in new buildings that are already set to come online, CBRE notes in its report — space that will compete with existing, older buildings that are also looking for tenants.

Specifically, it writes:

Seven development projects in DC's core submarkets, currently or soon to be under construction, have signed anchor tenants — primarily law firms — on the top floors. These projects total 2.6 million in rentable square feet of which 1.5 million square feet has been leased in the top stack. The seven buildings will deliver in 2018 and 2019, adding 1.1 million square feet of Trophy office availability in the lower-to-mid stack to the market.

An additional eight buildings totaling 2.5 million square feet are under construction or renovation in the core markets. These buildings currently have 1.7 million square feet of available space, with 700,000 square feet on the upper floors and 1.0 million square feet in the lower-to-mid stack.

Read DC Class A Office Vacancies to Top 20% in Next Two Years

The new space will offer some great deals for tenants looking to land in top quality buildings, CBRE Senior Research Director Tim Whitebread tells GlobeSt.com.

According to the research, in recently-delivered buildings that began construction upon signing a top-down lease, subsequent leases on lower floors saw a net effective rent discount of as much as 10%. Encumbered space — that is, space that is available for future growth but not yet leased by anchor tenants — is seeing a discount of as much as 16%.

And that is not even taking into account the significant concessions that can be had in the market, Research Manager Wei Xie tells GlobeSt.com.

“The average TI allowance is now $83 per square feet for a ten-year term,” a number that is based on deals that have already happened, she adds. “There is always going to be a range.”

WASHINGTON, DC–Boston Properties' proposed development at 2100 Pennsylvania Ave, NW, is rumored to be close to signing a large law firm, according to a CBRE research report. That is good news for Boston Properties but bad news for the commodity office market because the pre-lease will probably lead to development — and that will add an additional 50,000 to 75,000 square feet of lower-to-mid stack space on the market [see charts].

And there it will join the influx of lower-to-mid stack office space in new buildings that are already set to come online, CBRE notes in its report — space that will compete with existing, older buildings that are also looking for tenants.

Specifically, it writes:

Seven development projects in DC's core submarkets, currently or soon to be under construction, have signed anchor tenants — primarily law firms — on the top floors. These projects total 2.6 million in rentable square feet of which 1.5 million square feet has been leased in the top stack. The seven buildings will deliver in 2018 and 2019, adding 1.1 million square feet of Trophy office availability in the lower-to-mid stack to the market.

An additional eight buildings totaling 2.5 million square feet are under construction or renovation in the core markets. These buildings currently have 1.7 million square feet of available space, with 700,000 square feet on the upper floors and 1.0 million square feet in the lower-to-mid stack.

Read DC Class A Office Vacancies to Top 20% in Next Two Years

The new space will offer some great deals for tenants looking to land in top quality buildings, CBRE Senior Research Director Tim Whitebread tells GlobeSt.com.

According to the research, in recently-delivered buildings that began construction upon signing a top-down lease, subsequent leases on lower floors saw a net effective rent discount of as much as 10%. Encumbered space — that is, space that is available for future growth but not yet leased by anchor tenants — is seeing a discount of as much as 16%.

And that is not even taking into account the significant concessions that can be had in the market, Research Manager Wei Xie tells GlobeSt.com.

“The average TI allowance is now $83 per square feet for a ten-year term,” a number that is based on deals that have already happened, she adds. “There is always going to be a range.”

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.