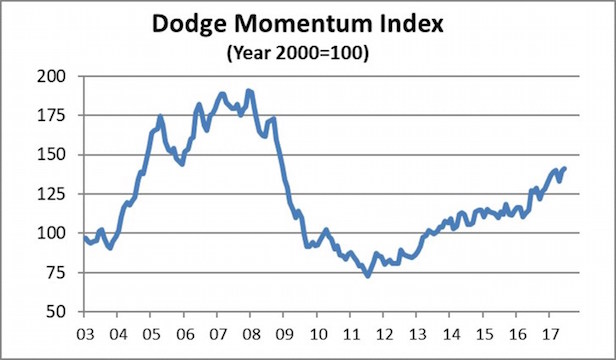

NEW YORK CITY—The latest Dodge Momentum Index for first reports of nonresidential building projects in planning provides another indicator of a generally strong outlook for development and construction. The index from Dodge Data & Analytics, issued Tuesday, increased 1.1% to 141.1 from its revised May reading of 139.6. As a predictor, projects in planning generally lead construction spending for nonresidential buildings by a full year, according to Dodge Data.

Near term, the latest construction spending figures point to monthly fluctuations but an overall upward trend. The Census Bureau said earlier this month that total construction spending during May was at a seasonally adjusted annual rate of $1,230.1 billion, nearly the same as the upwardly revised April estimate of $1,230.4 billion. The May figure is 4.5% above the May 2016 estimate of $1,177.0 billion. During the first five months of this year, construction spending amounted to $469.2 billion, up 6.1% from $442.4 billion in the year-ago period.

Similarly, the most recent Architectural Billings Index from the American Institute of Architects, released late last month, represented the fourth consecutive month of growth. The ABI for May was 53.0, up from a score of 50.9 in April. In common with the Dodge Momentum Index, the ABI leads construction spending by a 12-month period.

AIA says this score reflects an increase in design services, since any score above 50 indicates an increase in billings. The new projects inquiry index was 62.4, up from a reading of 60.2 the previous month, while the new design contracts index increased from 53.2 to 54.8.

“The fact that the data surrounding both new project inquiries and design contracts have remained positive every month this year, while reaching their highest scores for the year, is a good indication that both the architecture and construction sectors will remain healthy for the foreseeable future,” says Kermit Baker, chief economist with AIA. “This growth hasn't been an overnight escalation, but rather a steady, stable increase.”

Dodge Data says that June's lift in the Momentum Index was due to a 4.8% increase in the institutional component, while the commercial component fell 1.3%. The Momentum Index has exhibited substantial strength over the past year, with the institutional and commercial components trading off as the driver of growth almost on a month-to-month basis, according to Dodge Data.

Although the commercial component of the Momentum Index declined in May, it's up 11.8% year over year, while the institutional component is 9.5% above a year ago. Dodge Data says the overall rising trend for both sectors continues to suggest that construction activity will remain healthy through the end of the year.

Largest of the commercial building projects that entered the planning stage in June were the $300-million Palace Station Hotel renovation in Las Vegas and a $200-million office/warehouse building in American Canyon, CA. For the institutional building sector, the leading projects were the $150-million Legacy Sports Complex in Glendale, AZ and the $100-million Highmark Health Cancer Facility in Pittsburgh. In all, seven projects with a value of $100 million or more entered planning last month.

As other indicators of construction activity have shown Y-O-Y gains, it stands to reason that employment in the sector would have done the same. The latest analysis of federal employment data from the Associated General Contractors of America, issued in late June, showed that construction employment increased in 245 out of 358 metro areas between May '16 and May of this year, declined in 59 and stagnated in 54. AGC says construction employment gains in many parts of the country are occurring even as most firms report difficulty finding qualified workers to hire.

“Construction employment gains in many parts of the country likely would have been even more robust if it were easier for most firms to find qualified workers,” says Ken Simonson, chief economist at AGC. “As a result of tight labor market conditions, many firms are opting to invest more in training, find ways to become more efficient or use new techniques like off-site prefabrication or robotics to reduce labor needs.”

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.