SAN DIEGO—A sale-leaseback can allow office owner-users to liquidate their property's appreciated value while still maintaining occupancy, a smart decision as office values rise, Lee & Associates' associate Jordan Phillips tells GlobeSt.com. Phillips has studied the dynamics of office sale-leasebacks in the San Diego market. We sat down with him to discuss how this works and when it makes sense for office owner-users.

GlobeSt.com: Why would it make sense for office owner-users to explore a potential sale-leaseback arrangement?

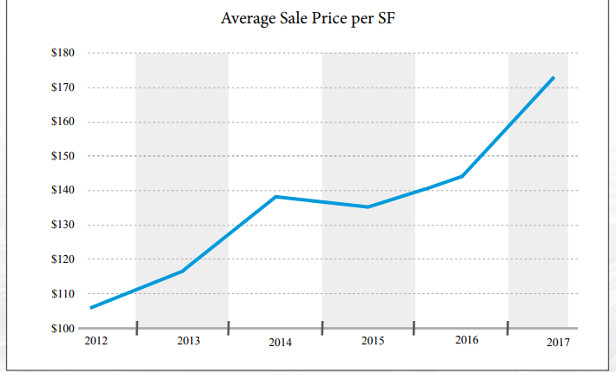

Phillips: Recent market statistics show that industrial and flex property values in the I-15 corridor (Poway, Escondido, Rancho Bernardo and Scripps Ranch) have dramatically risen over the last five years.

This is great news for property owners within this submarket. However, without selling the property or borrowing against its current market value, this appreciation will go unrealized. For many owner-users who plan to continue occupying their space, cashing in on their increased value might not seem like an option, but a sale-leaseback will allow these owners to liquidate their property's appreciated value while still maintaining occupancy.

GlobeSt.com: Please explain how this works.

Phillips: A sale-leaseback is created when the seller of a property immediately leases the same property back from the buyer. This is a frequent and well-known method used to free up capital in a business. Making the transition from the owner-user to the tenant has both pros and cons. Some of the most prominent effects are listed below. (For tax purposes, we'll assume here that the transaction is a valid sale-leaseback and the seller does not have an option to repurchase the property.)

Sale-Leaseback Pros:

- Frees up capital by achieving and liquidating market value while still holding the property for occupancy

- Creates the potential for a larger business expense deduction (deduction of rent versus. deduction of mortgage interest payments plus the depreciation)

- Raises potential sale value of the property by marketing an income-producing property rather than a vacant property

- Allows flexibility of lease terms for the seller (soon-to-be-tenant)

- Eliminates risk and cost associated with property ownership

- Avoids potential problems that may arise with conventional financing

Sale-Leaseback Cons:

- Potential rise in property taxes (depending on purchase price versus sale price)

- Possibility of monthly rents that exceed the previous mortgage payments

- Potential payment of capital-gains tax (if sale price exceeds adjusted basis)

- Loss of control of property

GlobeSt.com: How should owner-users assess these pros and cons?

Phillips: The above-listed pros and cons are always important factors to consider, regardless of timing and condition of the market. However, it is still critical to have an understanding of the current conditions in your market. In reviewing the I-15 industrial/flex corridor, we find that the average sale price per square foot has risen $106 in Q2 2012 to the current average of $173. It is notable that the last time prices were above $170 per square foot, in 2007, prices soon after showed a sharp decline.

Also, there is currently 938,099 square feet of inventory available for sale, which represents 3.6% of the total usable square feet in the submarket. The exceptionally low availability of for-sale properties has led to historically brief periods of time properties spend on the market before being sold. Currently, the average time spent on market is five months.

We also need to look at capitalization rates. A capitalization rate is expected income from an income-producing property. It is calculated by the net operating income divided by the purchase price. Over the past three years, cap rates have averaged 6.5%. Triple-net rents are currently averaging between $.95 and $1.05. These two factors will be critically important when we analyze a hypothetical case study.

GlobeSt.com: Let's talk about that hypothetical case study.

Phillips: Sale lease-backs are one of the more flexible tools used in commercial real estate. Below is a very basic hypothetical that uses current market statistics of the I-15 industrial flex corridor.

Say a 10,000-square-foot building was purchased in 2012 for $1 million, with a debt of $700,000. The adjusted basis of the building was $800,000; the adjusted basis of land was $200,000, and the total adjusted basis was $1 million. Under the current books, the assumptions are a 20-year mortgage at 5% interest rate, straight-line depreciation and no additional capital improvements made to the building.

Under this current scenario, the seller would receive $1,169,662.11 ($753,846.15 of gross profit), before taking into account any closing costs, potential prepayment penalties, capital gains taxes, etc.

GlobeSt.com: What else should owner-users take into consideration?

Phillips: As one can see, a sale-leaseback can be a very valuable method for liquidating equity from a commercial property. However, every owner-user's situation is different and unique. If you are an owner who is considering a sale-leaseback, it is important to analyze and outline all of the potential avenues you may pursue. These may include the benefits of signing a long-term lease versus a short-term lease, conducting a 1031 exchange with the proceeds, cost analysis of selling versus holding, etc.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.