NEW YORK CITY—With an executive team being assembled by industry veteran Michael Carroll, ShopOne Centers REIT Inc. has launched as a private real estate trust focused on grocery-anchored shopping centers. The new platform comes to market with a portfolio of 46 assets in eight states, with the majority of its equity owned by funds affiliated with Davidson Kempner Capital Management LP.

“We believe strongly in the long-term fundamentals supporting continued investment in shopping centers anchored by top-performing grocers, leading discounters and off-price apparel retailers,” says Carroll, CEO of the newly launched REIT. “We intend to be very active in the market as we seek to grow our portfolio and gain scale in high-density, in-fill metro areas. With a proven operating platform, deep institutional knowledge of the dynamic retail landscape and an extensive professional network, we are well-positioned to carry out our business objectives.”

Most of ShopOne's existing assets, which total more than 4.65 million square feet, were acquired from Devonshire REIT Inc. The company is looking to take advantage of dislocation in the retail marketplace through strategic acquisitions and pursuing value-add redevelopment and leasing initiatives.

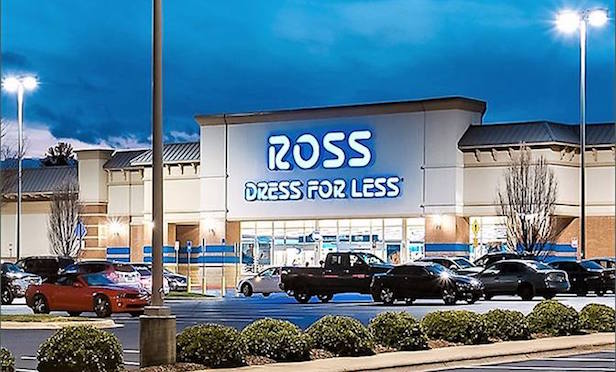

In line with its growth strategy, ShopOne recently acquired Conyers Commons, a 118,420 square foot shopping center located in Conyers, GA, a suburb of Atlanta. The center is anchored by Target and its tenant roster also includes Ross Dress for Less, Kirkland's, Mattress Firm, FedEx Office and Panda Express.

Carroll has more than 25 years of retail real estate experience and has overseen more than $1 billion in repositioning and redevelopment projects. Before joining ShopOne, he was CEO of Brixmor Property Group, one of the country's largest owners and operators of open-air shopping centers. During his tenure at Brixmor, Carroll spearheaded the company's IPO and rebranding from Centro Properties Group US in 2011, where he helped grow its enterprise value to over $14 billion.

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.