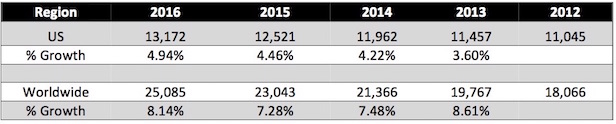

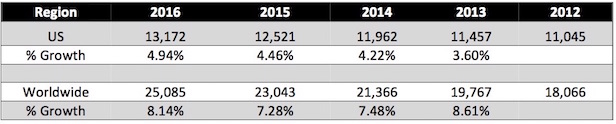

Starbucks has seen large amounts of growth over the past few years. With numbers taken from Starbucks Annual Reports from 2012 through 2016, we have seen growth accelerating in the number of US locations while the worldwide growth remains strong. Between 2015 and 2016, the number of US locations grew by nearly 5%. With this amount of growth in such a competitive space, will Starbucks be able to sustain its expansions?

Starbucks has developed a fan base by building an experience around the cup of coffee. The lighting and furniture are designed to add to the atmosphere. This route has been successful for Starbucks driving a 6% growth in comparable store sales, consisting of an increase in the average ticket and number of transactions. This growth also indicates that new stores are not cannibalizing current stores. With new stores opening and current stores pulling in more revenue, there is no reason for Starbucks to halt its current growth.

The comparable store sales will continue to grow faster next year with Starbucks shutting down its online store. Most of the products previously offered at the online store will continue to be available in person at Starbucks locations. Customers who previously ordered a bag of coffee grounds online to enjoy a cup of coffee at home will now have to get down to the nearest location. This gives Starbucks a chance to sell this customer more than just grounds.

Only time will tell what the overall effect on revenue removing the online store has. It is much more certain that in-store sales and visits will see a bump. This may even add more demand for increasing the rate of expansion of brick-and-mortar locations.

Starbucks has seen large amounts of growth over the past few years. With numbers taken from Starbucks Annual Reports from 2012 through 2016, we have seen growth accelerating in the number of US locations while the worldwide growth remains strong. Between 2015 and 2016, the number of US locations grew by nearly 5%. With this amount of growth in such a competitive space, will Starbucks be able to sustain its expansions?

Starbucks has developed a fan base by building an experience around the cup of coffee. The lighting and furniture are designed to add to the atmosphere. This route has been successful for Starbucks driving a 6% growth in comparable store sales, consisting of an increase in the average ticket and number of transactions. This growth also indicates that new stores are not cannibalizing current stores. With new stores opening and current stores pulling in more revenue, there is no reason for Starbucks to halt its current growth.

The comparable store sales will continue to grow faster next year with Starbucks shutting down its online store. Most of the products previously offered at the online store will continue to be available in person at Starbucks locations. Customers who previously ordered a bag of coffee grounds online to enjoy a cup of coffee at home will now have to get down to the nearest location. This gives Starbucks a chance to sell this customer more than just grounds.

Only time will tell what the overall effect on revenue removing the online store has. It is much more certain that in-store sales and visits will see a bump. This may even add more demand for increasing the rate of expansion of brick-and-mortar locations.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.