MCLEAN, VA—A combination of increasing rents and stagnant household incomes has caused the already-acute shortfall of affordable rental units to widen considerably over the past six years, according to a new report by Freddie Mac. Furthermore, the problem is expected to worsen problem if nothing is done to increase the supply of affordable units commensurate with the increasing demand from lower-income renters.

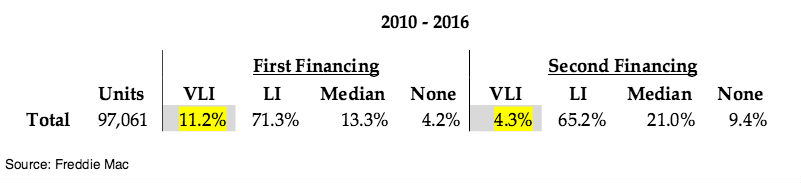

The GSE dug into this issue using a new approach to analyzing affordability. It looked at loans that Freddie Mac Multifamily financed multiple times between 2010 and 2016. It found that at the first financing, 11.2% of the total number of underlying rental units across the United States were categorized as affordable to very low-income (VLI) households with incomes no greater than 50% of area median income. At the second financing, rents had increased so significantly that just 4.3% of the same units were categorized as affordable to VLI households — amounting to more than a 60% reduction in the number of units deemed affordable to VLI households.

“Our analysis looked at the affordability of the same rental units at two close but different points in time,” said Steve Guggenmos, vice president of Freddie Mac Multifamily Research and Modeling in a prepared statement. “In a matter of just a few years, we found that a large number of units previously affordable to very-low income families could no longer be considered affordable.”

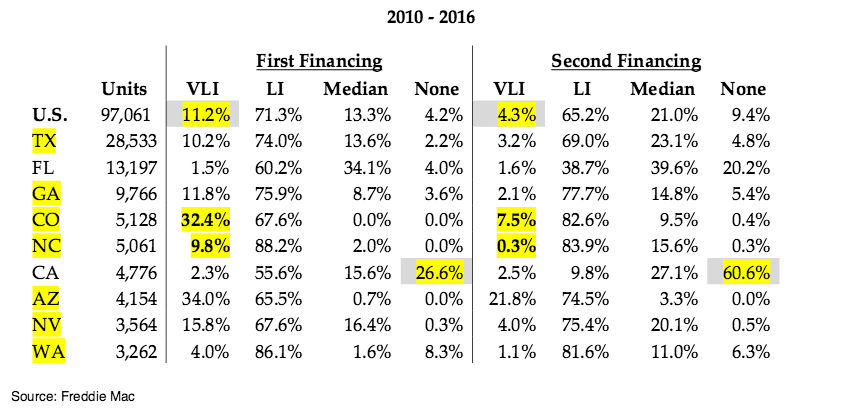

The analysis also looked at nine states where Freddie Mac Multifamily financed the most rental units twice during this six-year period. While the overall change in affordable VLI units varies greatly by state, the report finds that in seven of the states, a significantly smaller percentage of rental units qualified as VLI during the second financing. These include Texas, Georgia, Colorado, North Carolina, Arizona, Nevada and Washington State. In Colorado, for example, the number fell from 32.4% to just 7.5% of units. In North Carolina, it plunged from 9.8% to just 0.3 percent.

While Florida and California did see increases in the number of units considered VLI, it was minimal — 0.1% and 0.2%, respectively — and the percentage of units in the two states stayed below 3% during both financings. In California, the number of rental units affordable to even median-income renters, earning between 80% and 100% of AMI, fell from 73.4% in the first financing to 39.4% by the second financing.

The bottom line, according to Freddie Mac: Even as Freddie Mac Multifamily funds units that are affordable, those units will not stay affordable for long if rents grow at market-level rates. The GSE concluded that as it sources capital to the rental market, it needs to look for affordable housing opportunities “that have incentives to stay that way.”

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.