WASHINGTON, DC–For the most part, law firms nationwide have been right-sizing their real estate footprints for the past several years. With a few exceptions — and unfortunately, the Washington, DC area is not among them — this will continue, according to JLL's Annual Law Firm report.

According to the report:

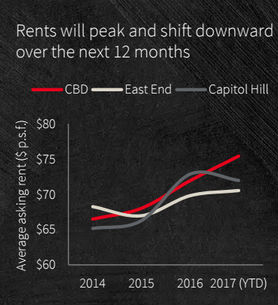

Leverage remains strongly in law firms' favor as both free rent and tenant improvement allowances have grown by 25-30 percent since 2013, negating growth in face rates and resulting in declining net effective rents for landlords.

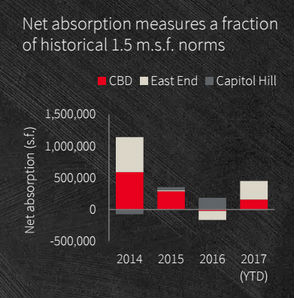

Supply will outpace demand through 2021, shifting vacancy from 15% to 20% and resulting in a 10–15% decline in net effective rents over that time frame.

“In the class A trophy space it is a tenant market right now and there are no market forces out there that will change that,” Bobby Blair II, VP with JLL tells GlobeSt.com.

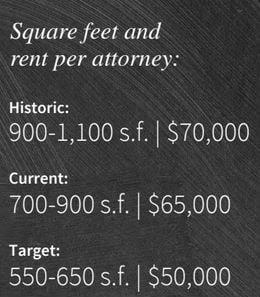

In addition, he adds, the average law firm is reducing size by 30 to 35% that goes into lease today and the attorney to assistant ratios are changing as well, further reducing the need for space.

These trends, as stated, are nationwide, but Washington DC has the dubious distinction of being poised to have a longer, more pronounced tenant-friendly market compared to the rest of the nation, according to Blair.

“San Francisco has the tech industry, for example, but we were always focused around the government, non-profit and law firm sectors.

“We will be in a trough or tenant friendly market longer than other markets because our traditional areas of growth are not excelling right now,” he said.

Blair said this will be the status quo for the next four to five years. By 2023-2024 lease expirations will be coming up for large tenants and deals will start to get done again, he said.

WASHINGTON, DC–For the most part, law firms nationwide have been right-sizing their real estate footprints for the past several years. With a few exceptions — and unfortunately, the Washington, DC area is not among them — this will continue, according to JLL's Annual Law Firm report.

According to the report:

Leverage remains strongly in law firms' favor as both free rent and tenant improvement allowances have grown by 25-30 percent since 2013, negating growth in face rates and resulting in declining net effective rents for landlords.

Supply will outpace demand through 2021, shifting vacancy from 15% to 20% and resulting in a 10–15% decline in net effective rents over that time frame.

“In the class A trophy space it is a tenant market right now and there are no market forces out there that will change that,” Bobby Blair II, VP with JLL tells GlobeSt.com.

In addition, he adds, the average law firm is reducing size by 30 to 35% that goes into lease today and the attorney to assistant ratios are changing as well, further reducing the need for space.

These trends, as stated, are nationwide, but Washington DC has the dubious distinction of being poised to have a longer, more pronounced tenant-friendly market compared to the rest of the nation, according to Blair.

“San Francisco has the tech industry, for example, but we were always focused around the government, non-profit and law firm sectors.

“We will be in a trough or tenant friendly market longer than other markets because our traditional areas of growth are not excelling right now,” he said.

Blair said this will be the status quo for the next four to five years. By 2023-2024 lease expirations will be coming up for large tenants and deals will start to get done again, he said.

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.