SAN FRANCISCO—Recognizing the need for a fix to what was perceived as a broken workflow process, Mike Sroka co-founded Dealpath to encourage collaboration within investment teams and provide structured data. Dealpath is a workflow platform to be used when deploying capital as a buy-side principal.

More than 5,400 transactions with a total value exceeding $100 billion have been supported using the platform since October 2016. Dealpath is used by real estate investment firms including L + M Development, Regency Centers, Rockpoint Group, GMH Capital Partners, Four Corners Property Trust, Gaw Capital Partners, Fort Capital and US Restaurant Properties.

Sroka recently discussed the platform more in detail and shared his insights in this exclusive.

GlobeSt.com: Who is the target audience for this platform and what advantage does it offer?

Sroka: Dealpath customers range from small, privately held real estate investment firms to the largest public REITs, and they all have one thing in common–their workflows for pipeline tracking and deal management are inefficient and broken. Investment teams are accustomed to using Word document checklists, Excel reporting, various file sharing services, home-grown databases and email. Trying to manage and deploy institutional investment capital like this inevitably results in poor communication, critical oversights and ultimately missed value.

Investment and development teams need intuitive pipeline tracking, centralized deal information and up-to-date reporting available from wherever they might be working. The platform allows professionals to seamlessly organize, streamline and analyze transaction data, reducing risk and fostering better investment decisions in the process. By moving every phase of a transaction to a secure, cloud-based platform, it provides investment teams with risk management that institutions need. Many firms have found that Dealpath not only organizes and improves the myriad of tasks related to their work, but unlocks the highest and best use of their most valuable asset–their time.

GlobeSt.com: How does Dealpath provide information?

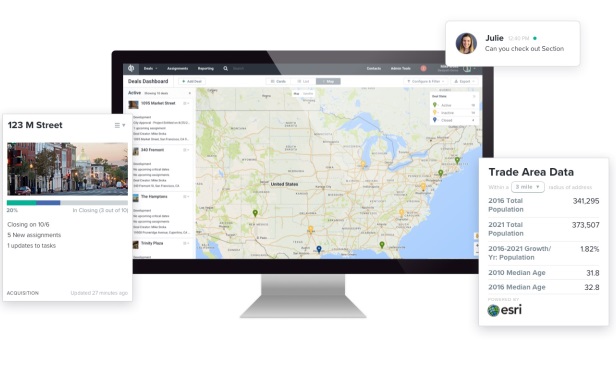

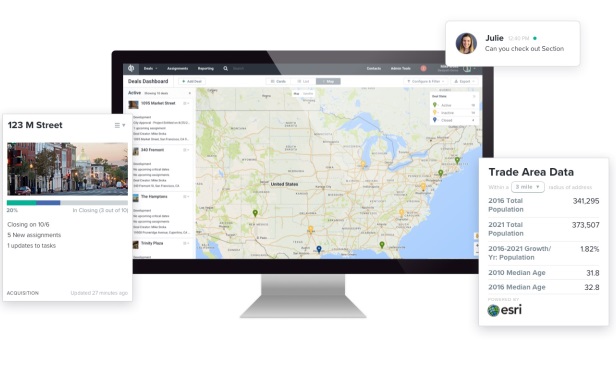

Sroka: Customers have an up-to-date visual overview of an entire pipeline, in addition to a knowledge base for all their previously evaluated deals. The dashboard provides customers with complete visibility and a command center for evaluating and executing deals.

GlobeSt.com: What comes next in the process?

Sroka: After adding an address or coordinates, relevant property photos, maps and demographic information are automatically populated. Dealpath's integrations with Esri, Google Images and Google Maps enable customers to gain an instant context of a property along with the surrounding area, including the population, growth, household income, unemployment rate and a bevy of other demographic and trade area data useful when evaluating a deal.

In addition, customers frequently make use of the integration with Google Street View to virtually explore the surrounding parcels, structures and activity. The data on the deal information page is current and the layout is entirely customizable, allowing team members the ability to easily access, create and share information in one central location.

Note that at this point in the process, the customer hasn't done anything but enter the address and specify the deal type–either acquisition, development, financing or disposition. Dealpath does all the heavy lifting so the customer gains instant visibility of an entire portfolio, regardless of deal type across both equity and debt structures.

GlobeSt.com: What other information can be added?

Sroka: Customers can then choose from pre-loaded task templates or customize their own task list, with a dedicated Dealpath account manager a phone call away. This flexibility removes the burden of manual administrative work, while enabling teams to quickly standardize processes.

Team members have a granular view into every step of the transaction via the deal's collaborative task management page. Dealpath helps track every task required for a given deal, typically from the initial origination through to closing and post-closing items. For each task, customers can assign due dates, share with team members and attach key files, including contractual agreements, financial models, third-party reports and architectural drawings via Box.

GlobeSt.com: Can you provide a hypothetical example?

Sroka: Take due diligence for instance: in a hypothetical deal, the due diligence process has 28 items to address, but the company is only 35% complete and a critical deadline is approaching, say tomorrow. The tasks, respective statuses and the assigned team member are all clearly established. Moreover, through the platform's permission controls, team members only have access to the tasks explicitly shared with them so they can prioritize the most pressing tasks.

In our scenario, the company was able to obtain the city permits on time and complete the rest of the due diligence process without issue. As the deal progressed, the collaborative task list continuously updated the deal progress. The team completes each task, from the early stages of origination, underwriting and contract negotiation, through due diligence, closing and the hand-off to asset management.

GlobeSt.com: How does the reporting portion work?

Sroka: To easily access and review active deals along with an archive of all closed and inactive deals, reporting compiles deal information and real-time data into a central location. It can be formatted to the customer's preference and exported to PDF or Excel. Teams can build a collaborative database of every deal they've ever looked at or worked on.

The data contained in these reports is easily retrievable and can be analyzed with granular detail. This reporting functionality has proven to minimize the inaccuracies and time-consuming tasks that have plagued the manual reporting process.

The pipeline tracking tools enable employees to create institutional-level quality reports to share with potential project and deal partners, ensures all tasks have been completed and streamlines many of the manual processes associated with traditional real estate investments.

SAN FRANCISCO—Recognizing the need for a fix to what was perceived as a broken workflow process, Mike Sroka co-founded Dealpath to encourage collaboration within investment teams and provide structured data. Dealpath is a workflow platform to be used when deploying capital as a buy-side principal.

More than 5,400 transactions with a total value exceeding $100 billion have been supported using the platform since October 2016. Dealpath is used by real estate investment firms including L + M Development, Regency Centers, Rockpoint Group, GMH Capital Partners, Four Corners Property Trust, Gaw Capital Partners, Fort Capital and US Restaurant Properties.

Sroka recently discussed the platform more in detail and shared his insights in this exclusive.

GlobeSt.com: Who is the target audience for this platform and what advantage does it offer?

Sroka: Dealpath customers range from small, privately held real estate investment firms to the largest public REITs, and they all have one thing in common–their workflows for pipeline tracking and deal management are inefficient and broken. Investment teams are accustomed to using Word document checklists, Excel reporting, various file sharing services, home-grown databases and email. Trying to manage and deploy institutional investment capital like this inevitably results in poor communication, critical oversights and ultimately missed value.

Investment and development teams need intuitive pipeline tracking, centralized deal information and up-to-date reporting available from wherever they might be working. The platform allows professionals to seamlessly organize, streamline and analyze transaction data, reducing risk and fostering better investment decisions in the process. By moving every phase of a transaction to a secure, cloud-based platform, it provides investment teams with risk management that institutions need. Many firms have found that Dealpath not only organizes and improves the myriad of tasks related to their work, but unlocks the highest and best use of their most valuable asset–their time.

GlobeSt.com: How does Dealpath provide information?

Sroka: Customers have an up-to-date visual overview of an entire pipeline, in addition to a knowledge base for all their previously evaluated deals. The dashboard provides customers with complete visibility and a command center for evaluating and executing deals.

GlobeSt.com: What comes next in the process?

Sroka: After adding an address or coordinates, relevant property photos, maps and demographic information are automatically populated. Dealpath's integrations with Esri,

In addition, customers frequently make use of the integration with

Note that at this point in the process, the customer hasn't done anything but enter the address and specify the deal type–either acquisition, development, financing or disposition. Dealpath does all the heavy lifting so the customer gains instant visibility of an entire portfolio, regardless of deal type across both equity and debt structures.

GlobeSt.com: What other information can be added?

Sroka: Customers can then choose from pre-loaded task templates or customize their own task list, with a dedicated Dealpath account manager a phone call away. This flexibility removes the burden of manual administrative work, while enabling teams to quickly standardize processes.

Team members have a granular view into every step of the transaction via the deal's collaborative task management page. Dealpath helps track every task required for a given deal, typically from the initial origination through to closing and post-closing items. For each task, customers can assign due dates, share with team members and attach key files, including contractual agreements, financial models, third-party reports and architectural drawings via Box.

GlobeSt.com: Can you provide a hypothetical example?

Sroka: Take due diligence for instance: in a hypothetical deal, the due diligence process has 28 items to address, but the company is only 35% complete and a critical deadline is approaching, say tomorrow. The tasks, respective statuses and the assigned team member are all clearly established. Moreover, through the platform's permission controls, team members only have access to the tasks explicitly shared with them so they can prioritize the most pressing tasks.

In our scenario, the company was able to obtain the city permits on time and complete the rest of the due diligence process without issue. As the deal progressed, the collaborative task list continuously updated the deal progress. The team completes each task, from the early stages of origination, underwriting and contract negotiation, through due diligence, closing and the hand-off to asset management.

GlobeSt.com: How does the reporting portion work?

Sroka: To easily access and review active deals along with an archive of all closed and inactive deals, reporting compiles deal information and real-time data into a central location. It can be formatted to the customer's preference and exported to PDF or Excel. Teams can build a collaborative database of every deal they've ever looked at or worked on.

The data contained in these reports is easily retrievable and can be analyzed with granular detail. This reporting functionality has proven to minimize the inaccuracies and time-consuming tasks that have plagued the manual reporting process.

The pipeline tracking tools enable employees to create institutional-level quality reports to share with potential project and deal partners, ensures all tasks have been completed and streamlines many of the manual processes associated with traditional real estate investments.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.