HOUSTON—It's been nearly 10 years since the financial crisis delivered a major blow to the US economy. The commercial real estate market's resilience was severely tested and there were serious concerns even after the 2015 post-recession peak that things could get ugly once the dreaded 2016 and 2017 wall of loan maturities would come into view.

Using office sales data from Yardi Matrix and Moody's loan stats, Commercial Cafe analyzed the last 20 years of the US office sales market from 1997 to October 28, 2017.

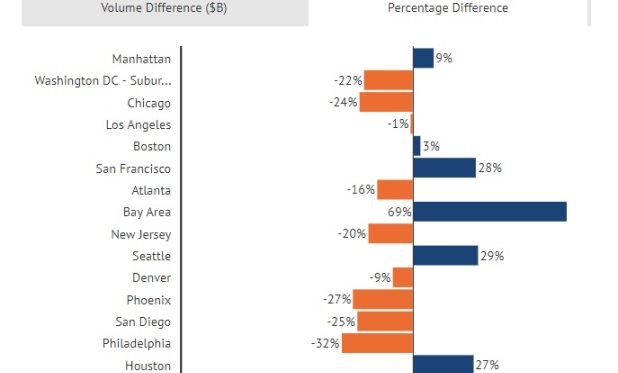

One of the key takeaways is that Texas has been one of the big winners of the decade following the financial crisis–Dallas gained six spots on the list of top markets for office investment, going from number 16 to number 10; Houston jumped from number 15 to number 11, while Austin–absent on the list before the recession–made its entry at number 18.

“Looking back 20 years, to the decade before the crisis and then analyzing the aftermath, we can see that Texas office markets like Houston and Dallas have been success stories,” Ionut Ciutac, Commercial Café research analyst for the project, tells GlobeSt.com. “Not only have both improved their rankings in the list of top 20 markets for office investment, but the transaction volumes have also increased. Houston amassed an additional $3.6 billion in transactions between 2008 and 2007.”

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 established a new framework that sought to rein in some of the bad practices that were widespread during the pre-crisis years. In terms of loan issuance, the market dug itself out of the hole it had gotten into in 2009 (when the number of new loans fell by 68% compared to 2007), but the 2015 post-recession peak was still 30 points behind the 2005 pre-crisis record.

The days of the 6 to 7% interest rates seem a distant memory, as this metric has seen an almost constant drop since 2010, resting at 4.07% at the close of second quarter 2017. The average maturity for office loans at the close of second quarter 2017 (around 10 years) was roughly three years longer than in 2007 and 2008 (seven years) and on par with values recorded 20 years ago.

“Unlike most of the other US markets, the Houston office market reached its post-recession peak in 2012, just as crude oil prices peaked, scoring $3.34 billion in sales volume,” Ciutac continues. “By comparison, the total transaction volume in 2015 was around $2.2 billion. After a drop below the $2 billion mark in 2016, sales volume in H1 2017 has already exceeded last year's total.”

The landscape of the top office buyers before and after the crash also experienced some major upheavals. Several key players such as Tishman Speyer and Macklowe Properties dropped out of the top 10 after 2007. Other investors have dropped several places in the ranking: Equity Office Properties Trust went from number two to number seven, while Beacon Capital Partners took a dive from number three to number 10. At the same time, many other newcomers have taken over the list, most notably JPMorgan Asset Management at number one with a $10.8 billion post-recession sales volume.

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.