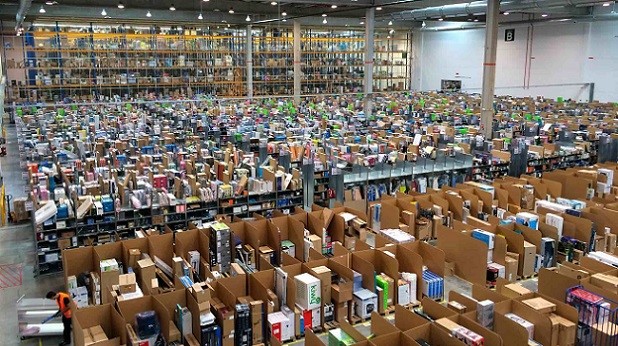

Amazon’s fulfillment centers typically need higher ceilings than older buildings are able to provide.

Amazon’s fulfillment centers typically need higher ceilings than older buildings are able to provide.

CHICAGO, COLUMBUS—E-commerce has doubled the average footprint of warehouses built in the US in the past decade, with the largest expansions coming in metro areas with the big populations that online sellers covet and the ample land that developers need, according to a new report from CBRE.

Company researchers analyzed the average size of warehouses built in the US during the last development upswing from 2002 to 2007 and compared those figures to the buildings developed since 2012. They found that the average size swelled to 184,693 square feet, a 143% boost, and the average clear height rose by 3.7 feet, to 32.3 feet in total. In Columbus, for example, one of the nation’s rising distribution hubs, the average warehouse size increased from 125,153 square feet to 277,916 square feet.

“Columbus has always seen the construction of a lot of very large warehouses, but the biggest of these were usually built for specific end users,” says Rick Trott, first vice president at CBRE’s Columbus office. “What’s different today is that developers are now building much larger speculative warehouses that are often close to one million square feet or larger. Three projects are currently under construction in Central OH that are either over one million square feet, or can be expanded to over one million square feet. These larger buildings attract attention nationally from major e-commerce and Fortune 500 companies looking to distribute to the eastern US.”

“This dramatic expansion of warehouse size and height in the US is almost purely a product of e-commerce, which has created demand for massive warehouses with high ceilings to store extensive, fast-moving inventories,” adds David Egan, CBRE’s global head of industrial and logistics research. “This demand is a long-term factor, meaning that U.S. markets without enough modern logistics facilities will see continued construction as they catch up.”

The largest gains in average warehouse size came in markets with big, growing populations and a ready supply of developable land. Atlanta led the nation with a 284% gain, followed by Cincinnati with 237%, and CA’s Inland Empire with 222%.

Copyright © 2025 ALM Global, LLC. All Rights Reserved.

Copyright © 2025 ALM Global, LLC. All Rights Reserved.