CHICAGO—The multifamily and office sectors in the Chicago region have been riding high for years, and each still attracts a great deal of interest from investors. But several subtle shifts in the market are underway, and some potential buyers, looking for diversity in their portfolios, have begun recalibrating their priorities. And these moves could mean making more capital available for other sectors, especially industrial, now seen as potentially more rewarding.

“Multifamily is still a very desirable asset class that people need exposure to,” Matt Wurtzebach, vice president with Draper and Kramer's commercial finance group, tells GlobeSt.com. But worries over a possible softening in the sector means “some capital sources have become more selective on which multifamily assets they will finance,” and now look for ones in even better locations and higher quality sponsorship.

Recently, many banks would finance up to 75% of a sound project's construction costs. Today, however, “they have dialed back that level into the 60s,” potentially 70% under the right circumstances, Wurtzebach says.

Some of the same concerns surround the office sector. But he cautions that any analysis has to carefully consider the conditions of each individual market. In River North, the West Loop, and the Fulton Market neighborhood, for example, “we're seeing heavy demand right across the spectrum.”

It's certainly no secret that the retail sector is troubled these days. The rise of e-commerce has bled many stores, and the next few years will probably see even more damage done to brick-and-mortar locations. But Wurtzebach says grocery stores, which can withstand internet competition, still attract capital. But “most lenders are only looking to finance the top three or four grocers in a given region.” And Amazon's recent $13.7 billion acquisition of Whole Foods has “some investors taking a step back to see how that will impact the marketplace.”

Still, lenders and investors remain interested in the retailers that have great locations and loyal customer bases. “These assets are just receiving more scrutiny,” Wurtzebach says.

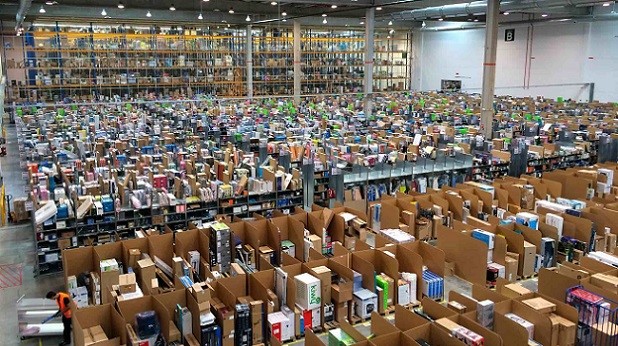

The industrial sector may benefit the most from this caution. The same factor that has most damaged retail, the rise of e-commerce, has made industrial into the darling of commercial real estate. Tremendous demand for new distribution centers from internet giants like Amazon has sent new construction levels and rental rates to dizzying heights. And most experts believe the reconstruction of corporate supply chains has in some ways just begun, ensuring that demand for new class A product will continue for years.

“Over the last year or so,” Wurtzebach says, “we've seen more interest in industrial assets.” Life insurance companies, for example, “have started to consider industrial assets for construction-to-permanent programs and are more aggressively pursuing industrial exposure for their equity platforms.”

Overall, capital providers express optimism about the commercial real estate market's prospects in 2018, he adds. Therefore, even though most want to diversify their portfolios next year, “they anticipate putting about the same amount of funds into real estate as they did in 2017, and perhaps more.”

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.