SAN FRANCISCO—According to the California Department of Conservation, two to three earthquakes occur each year within the state that are large enough to cause moderate damage to building structures. In the aftermath of this year's hurricane season, the topic of earthquake risk is on the minds of a number of CMBS investors, according to Kroll Bond Rating Agency.

The concerns focus on the potential impact of an event, whether large or small, and on assets that may not be adequately insured, if at all. While insurance is generally required for properties in seismic zones 3 or 4 with a probable maximum loss/PML greater than 20%, properties that are close to this threshold could still suffer moderate to significant damage in an earthquake, but fall under the insurance threshold, says Kroll. This could meaningfully impact the collateral securing a loan, and the potential for losses if uninsured borrowers choose to forgo repairs and surrender the asset to the lender.

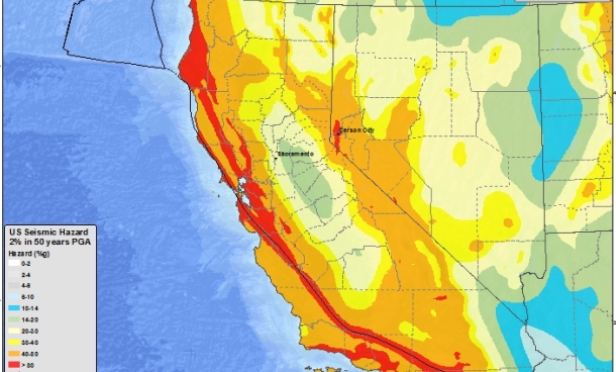

Seismic zones were established by the Uniform Building Code/UBC, which was intended to promote standardized requirements for safe construction. The UBC, which was succeeded by the international building code, established that all of California is classified as a seismic zone 3 or 4, GlobeSt.com learns.

The 20% probable maximum loss threshold is a generally accepted lending industry standard for high-risk properties requiring loss prevention through earthquake insurance. The maximum loss is basically the ratio of the building's expected damage as a percentage of its replacement cost. Naturally, the higher the percentage, the higher the expected damage in the event of an earthquake.

The proportion of California assets with PMLs between 18% and 20% is meaningful (10%) when viewed in the aggregate. If loans with PMLs from 15 to less than 18 were included, it would represent a quarter of the study population. The study population includes $30.6 billion or 1,728 loans, according to Kroll.

To better understand the distribution of PML exposure in CMBS 2.0, data provided by Trepp along with information KBRA mined from the rating process was leveraged. In total, the California conduit population includes $39.7 billion (2,185 loans) of non-defeased collateral. Although PML information was not available for all California properties in a form that was readily usable for the analysis, there was enough information obtained from this population ($30.6 billion, 1,728 loans) to draw some insights on the topic. The study population included California private-label conduit loans that were securitized between 2010 and year-to-date November 2017. For purposes of the analysis, portfolio loans were excluded.

For the analysis, this segment of the population was referred to as close range. Of the conduits in the study population, there were 254 transactions that had close range exposures. Of these, 209 transactions had minor exposure (0 to 2% of the pool balance), 31 had exposures ranging from 3% to 5%, 13 had moderate concentrations between 6 and 10%, and there was one outlier at 17%, says Kroll.

For the total population, office and retail have the largest California exposure at $12.9 and $12.4 billion respectively. This is consistent with the overall CMBS 2.0 conduit universe, where these are the two largest property type exposures. However, for the study population, Kroll indicates that industrial has the largest percentage of close range PMLs, at 18% by both balance and loan count.

Of course, older vintage assets had a higher proportion of close range PMLs, without the benefit of improvements in construction technology that has been introduced in more recent years. For example, of the 59 buildings built between 1900 and 1925, 46% of the loans were close range PMLs. Properties that were built post-2000 didn't have any loans that were either within close range or with PMLs greater than 20%, according to the study.

Although the CRE finance industry has drawn a line in the sand by requiring earthquake insurance for assets with a PML in excess of 20%, it is important to note that a PML is an estimate, and not an exact science. As such, there will be some variability around the proportion of assets that will require earthquake coverage in a given securitization, GlobeSt.com learns.

“Transactions with a sizeable proportion of PMLs that are close to 20% may warrant a closer look by the marketplace, as they can pose additional risk to CMBS trusts,” Larry Kay, senior director of Kroll Bond Rating Agency, tells GlobeSt.com.

For more information, the Northern California Earthquake Data Center is a permanent archive and distribution center primarily for multiple types of digital data relating to earthquakes in central and Northern California. The data center is located at the Berkeley Seismological Laboratory and has been accessible online since mid-1992, GlobeSt.com learns. The center was formed as a joint project of the Berkeley Seismological Laboratory and the US Geological Survey/USGS at Menlo Park in 1991. Current USGS funding is provided under a cooperative agreement for seismic network operations.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.