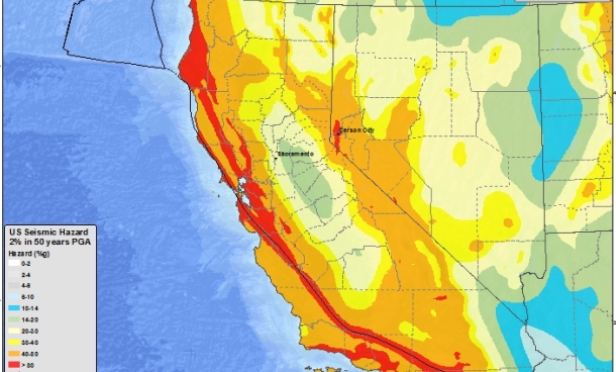

High-risk areas are highlighted in this map, courtesy of United States Geological Survey.

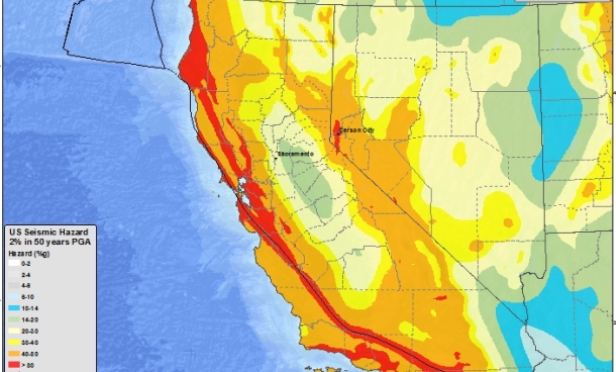

High-risk areas are highlighted in this map, courtesy of United States Geological Survey.

SAN FRANCISCO—According to the California Department of Conservation, two to three earthquakes occur each year within the state that are large enough to cause moderate damage to building structures. In the aftermath of this year’s hurricane season, the topic of earthquake risk is on the minds of a number of CMBS investors, according to Kroll Bond Rating Agency.

The concerns focus on the potential impact of an event, whether large or small, and on assets that may not be adequately insured, if at all. While insurance is generally required for properties in seismic zones 3 or 4 with a probable maximum loss/PML greater than 20%, properties that are close to this threshold could still suffer moderate to significant damage in an earthquake, but fall under the insurance threshold, says Kroll. This could meaningfully impact the collateral securing a loan, and the potential for losses if uninsured borrowers choose to forgo repairs and surrender the asset to the lender.

Copyright © 2025 ALM Global, LLC. All Rights Reserved.

Copyright © 2025 ALM Global, LLC. All Rights Reserved.