NEW YORK CITY—Online investment platform Cadre said Wednesday it had closed on $250 million of commitments from Goldman Sachs' private wealth clients. The close represents the start of an ongoing strategic partnership between Cadre and Goldman that will allow the investment bank's clients to invest in a broad-based portfolio of US income- producing commercial real estate assets.

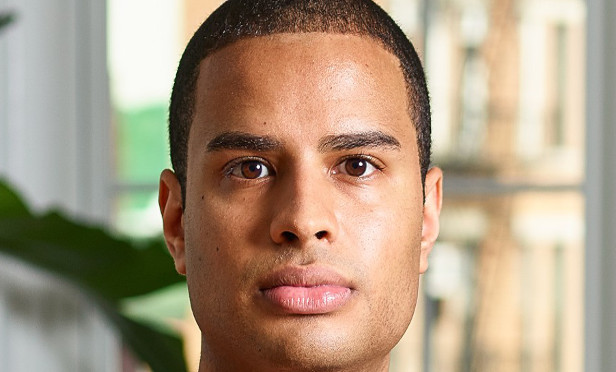

Since its founding three years ago, Cadre has closed on roughly $1 billion in total transaction value to date. “I've always been excited and, frankly, passionate about the potential for technology to be leveraged in a way that evolves the real estate investing world through greater transparency, greater efficiency and broader access,” as well as technology's capacity to reduce fee loads through greater distribution, Cadre co-founder and CEO Ryan Williams tells GlobeSt.com. “Cadre in many ways was the genesis of my being exposed to the institutional rigors of the fund world and the quality access that people who have been involved with LPs and funds have been able to realize.”

After two-plus years at the Blackstone Group, where he worked in the asset management giant's real estate private equity group, Williams realized he wanted to build a platform that provided institutions, family offices and high net worth individuals with “direct, transparent access to quality real estate investments in a similar vein to what we at Blackstone offered our LPs.” He left Blackstone in late 2014 to launch Cadre, which is now an organization of 75 that has raised a total of about $135 million in corporate venture capital from backers including Andreessen Horowitz, Khosla Ventures, Ford Foundation, Thrive Capital, SL Green Realty Corp. and General Catalyst.

The Goldman partnership facilitates a shift in Cadre's approach. Initially, the company's focus was on a “deal-by-deal” basis, says Williams. Over time, though, “the way we found that most investors should participate is in a diversified manner.”

Accordingly, the Goldman partnership provides Cadre with greater ability to scale its distribution. “This partnership is one of the key components in building a more diversified, large-scale base of individual investors that can access the asset class in a more efficient and risk-adjusted manner across asset classes, geographies, etc.—and do it in a way where they would have the same benefit that you would get from investing in a portfolio of quality stocks,” says Williams.

At Goldman, Eric Lane, global co-head of the investment management division, says, “Our goal is to ensure we provide our clients with innovative and diverse investment opportunities to help them drive returns and protect capital. Our ongoing partnership with Cadre underscores this commitment.”

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.