WASHINGTON, DC–Office investors across the Washington DC area are taking on greater risk despite a challenging leasing market, according to a new research note from JLL.

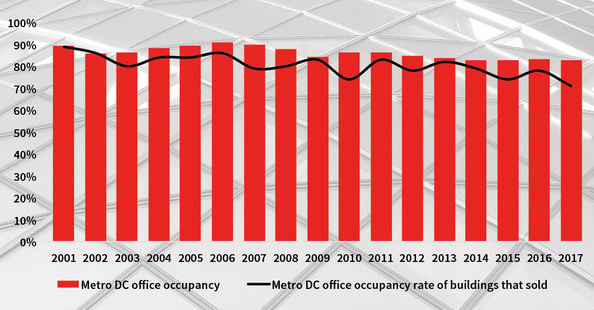

In 2001, office assets in Washington DC area typically sold with an average occupancy rate of 89% — the same as the occupancy rate of the broader market. Today however, following a period of recession, sequestration and rightsizing, total occupancy has dropped down to 83%.

Yet despite the leasing market correction, investors continued to flock to market, JLL pointed out. In 2017 investment sales volume rose to the third-highest level in a decade. The average occupancy rate of these properties? In 2017 it was 71% at the time of the sale, JLL said.

Foreign Investors Are The Exception

Foreign investors, however, have avoided such properties. Last year foreign investors bought 20 assets totaling 5.3 million square feet at an average occupancy rate of 88%. JLL explains:

Foreign buyers look to DC for stable, long-term-hold opportunities, and so it stands to reason their standards have not wavered. Furthermore, they tend to focus mostly downtown, where direct vacancy sits at just 11.1% compared to 15.9% regionally.

Local Companies Look For Value Add

Investment by local companies focused on the value-add and opportunistic segment of the market, acquiring assets with an average occupancy of 44%. Sixty-eight percent of these were Class B or Class C properties and their new owners generally plan to add value through lease-up and/or redevelopment.

Of the 34 purchases made by local companies in 2017, 24 were concentrated in Northern Virginia. JLL noted that:

Considering the current administration's position toward Defense and Homeland Security spending, Northern Virginia stands to make a major comeback if Congress manages to pass a budget and breathe life into the government contracting sector that forms this market's backbone. The under-leased, value-add purchases of 2017 could very well reemerge on the market as stabilized offerings in the coming years.

Save

Save

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.