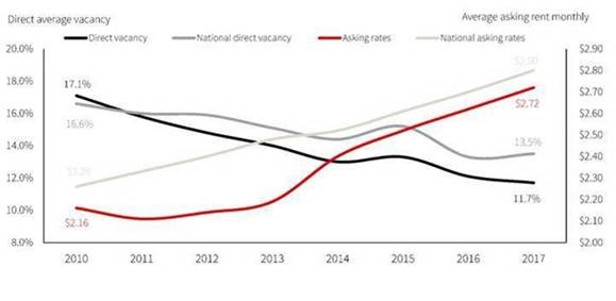

SAN DIEGO—Like the national average, the San Diego office market has seen rising asking rental rates since 2012, but the velocity of this increase has now surpassed that of the national average, according to a report from JLL. National rents increased 3.6% from the end of 2016 to the end of 2017 and 23.8% since 2010, while San Diego saw a 3.8% year-over-year increase and a 25.9% increase since 2010.

Vacancy has also improved over the national average. The report finds that national direct vacancy for office space rose 20 basis points, while San Diego's dropped 40 basis points from 2016 to 2017, while average asking-rent growth was very similar to that of the previous year.

Pat Ashton, senior research analyst for JLL, tells GlobeSt.com the fundamental factor driving office asking rents up in San Diego is the minimal amount of ground-up speculative construction as compared to the last pre-recession cycle. “With less supply and consistent demand over the last five years, the asking rents have steadily increased and have now even surpassed the last peak (2007) in some submarkets.”

Ashton adds that 2017's San Diego market trend of new deliveries and slightly more tenant occupancy resulted in minimal decrease in vacancy. “This year, with even less ground-up speculative development than the year before and high tenant demand, we expect the vacancy rates to decline and average asking rents to continue to rise.”

Large-tenant demand may be a reason for the decreasing vacancy rate. JLL EVP Tim Olson recently told us that in addition to the I-15 corridor and North County West submarkets, the market is seeing large tenant demand in the 40,000-square-foot-to-150,000-square-foot range picking up in Sorrento Mesa, UTC and a few in Mission Valley. “The life-science market is also seeing large tenant demand in the Torrey Pines, Campus Point/UTC and Sorrento Mesa submarkets.”

In addition, JLL reports that San Diego's office-space demand has outpaced the 10-year average of 500,000 square feet of positive absorption by double for the last two years, with more than 1 million square feet of positive absorption each year. And the market is poised for another banner year, with 650,000 square feet of tenants scheduled to take occupancy, 440,000 square feet of build to-suits to deliver and 3.7 million square feet of tenants touring the market. The firm reports that these strong and steady trends could be a sign that the San Diego market will outpace the national average for asking rents this year or next.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.