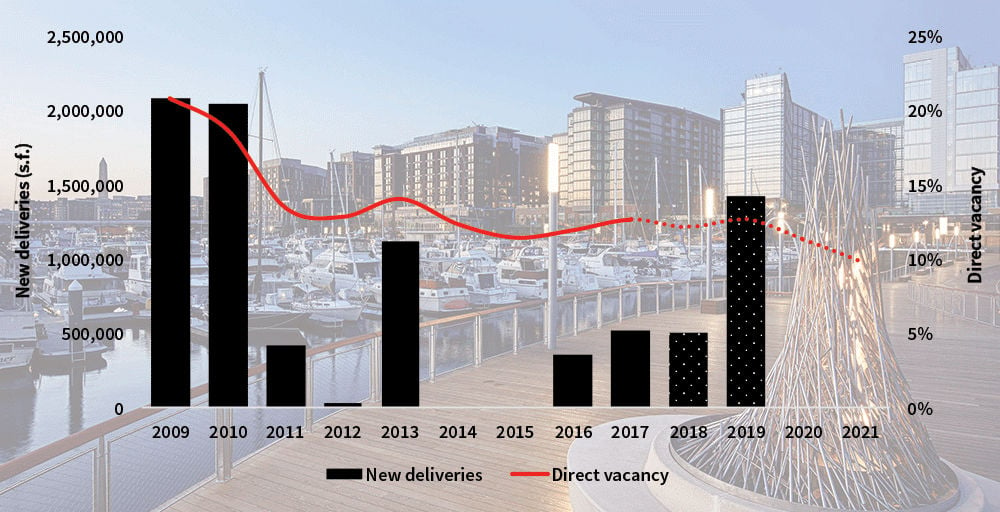

WASHINGTON, DC–Such emerging submarkets in the District as the Ballpark, NoMa, Market District and Southwest — including The Wharf — will capture more than 2.5 million square feet of occupancy gains through 2021, according to a new JLL research note. This will cause vacancy to decline from 12.6% to 9.8% and continue to place upward pressure on rents. Already rents have risen above $50 per square foot for relet product and into the upper-$50s for new construction, outside of The Wharf, JLL notes. Also land prices have escalated and pricing for proposed office product is now in the low $60s per square foot FS.

How did this happen? In large part because the tenant base in these submarkets has gradually diversified away from government agencies and contractors to nonprofits, associations, media companies, tech firms and coworking providers. These firms were drawn to the submarkets' increasingly mixed-use atmosphere: according to JLL more than 6,000 multifamily units exist across the four emerging submarkets and more than 2,000 units are under construction. Also more than 120 retailers either opened in 2017 or are slated to open in 2018.

Meanwhile the government agencies have been forced to relocate to properties in the emerging markets priced that are priced below the $50 per square foot FS prospectus cap. Developers, for their part, are not only resetting price points in these markets, “but are also designing these developments with unrivaled amenities and vistas, which will lead to even more demand,” JLL concluded.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.