WASHINGTON, DC–When the White House unveiled its plan to remake US infrastructure earlier this week there was a widespread assumption that Congress did not have the appetite or political will to find the $200 billion the plan had slated. However as the Wall Street Journal later reported, there is movement on the Hill to address infrastructure albeit in smaller pieces. “I certainly think it could be packaged,” said Senate Majority Whip John Cornyn (R., Texas) told the WSJ.

But as Congress moves forward there are some gaps in the proposal that need to be filled in.

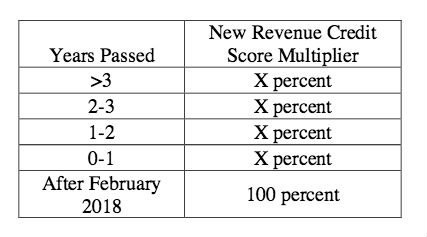

For example, the document released by the White House [PDF] outlines the evaluation criteria for securing funds for the incentive portion of the program, Heidi Learner, chief economist with Savills Studley tells GlobeSt.com. In that section it discusses how to score the look back — only a chart with key information has been filled in with Xs, she said.

”Perhaps the criteria for the Incentives Program were hashed out hastily. Why is the applicable multiplier for programs established within the last three years left blank — or filled in with 'Xs'? What about the rest of the data?”

”Perhaps the criteria for the Incentives Program were hashed out hastily. Why is the applicable multiplier for programs established within the last three years left blank — or filled in with 'Xs'? What about the rest of the data?”

There are other areas of inconsistency or missing or unclear information, she said. The incentive grant cannot exceed 20% of the new revenue, according to the proposal, which implies 4 to 1 matching. “Any agreement with incomplete milestones after two years would be voided but there are not many infrastructure projects that could be completed within two years.”

It is also unclear what type of cooperation the plan would bring on a federal level if everything is being done on the state level, she continued. This is key for transit projects where a transit line cannot just stop at a state border.

Then there is the transformative project program, which doesn't specify what type of programs would be involved, Learner said, other than, as the proposal says, they are to be “ground-breaking, ambitious and exploratory.” She also notes that up to 80% of the eligible costs for these projects could be used for demonstration and project planning “which suggests to me that there could be scope for a lot waste before anything actually gets built.”

Other observations Learner had about the proposal:

- Some of the eligible projects would not be limited to just federal projects but expanded to non-federal projects as well. This is a positive for the proposal but it is only a small part of the overall package.

- There seems to be a bias against leasing and the proposal does call for the creation of the Federal Capital Financing Fund, which is to enable some of the agencies to own rather than lease assets. “I think in some cases that could be preferable but it is not clear to me that leasing is necessarily something that should be avoided. It's also not clear how those decisions will be made.”

- In the 120-page budget document released with the proposal, it talks about leveraging $200 billion to reach $1 trillion in infrastructure investment but in the document where the infrastructure plan is discussed the $200 billion will be leveraged to reach $1.5 trillion.

- The $200 billion is meant to be spent over a period of 10 years, so all Congress really has to do is find $20 billion every year. “I don't think the $200 billion will be the heavy lift. I think the heavy lift will be suggesting that $200 billion can remotely be turned into $1.5 trillion.”

Save

Save

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.