WASHINGTON, DC–Shortly before it announced its quarterly earnings earlier this month Overland Park, Kan.-based QTS Realty Trust had something else to say to the market: the data center provider was restructuring its operations to focus on hyperscale and hybrid colocation, placing its cloud and managed services in the non-core category. It was also making management changes, with Jim Reinhart, QTS' COO-Operations, transitioning out of the organization and the company planning to hire a chief revenue officer, among other moves.

Days later activist investor Land and Building sent a letter to the REIT outlining the areas in which it felt it needed improvement. The letter was, as Land and Building's letters tend to be, pretty harsh.

QTS has been a perennial underperformer, delivering inferior total shareholder returns to Data Center peers over several years, including underperforming by nearly 100% since the company's October 2013 IPO…..We believe the root cause of the underperformance falls at the feet of management – specifically Chairman, CEO and Founder Chad Williams. Mr. Williams, who dominates investor presentations and earnings conference calls, has repeatedly overestimated the company's future operating performance, presided over poor capital allocation decisions and created a misleading outlook for the profitability of QTS, opening the company up to potential class action claims.

It was fortunate that the company had announced the changes beforehand, according to the school of thought that is emerging about how REITs should handle activist shareholders such as Land and Buildings.

Who Can Tell The Better Story?

“This is a battle for shareholders — a battle over who is telling the better story,” Phil Denning, partner at ICR, a shareholder communications firms that advises boards and management teams on activist funds, tells GlobeSt.com. “The management teams that do a good job of knowing their vulnerabilities, having a clear plan of attack and articulating that plan, will have the best defense.”

There are two narratives about activist investors: they push for positive change at a company to benefit shareholders or they push for changes to add short-term value to a company without regard for the long term. A possible third are the funds that push for societal change.

Whichever camp you believe these investment funds fall in — and a good case can be made for all three categories — they are becoming more prolific in the CRE industry. “We are seeing a rise in the level of activism and a rise in the level of capital that's flown into activist-focused funds,” Denning says.

According to the EY report [PDF] “Shareholder Activism in the REIT Sector,” there were 473 companies targeted by activists in 2016, a 291% increase over the 121 companies in 2010. “From early 2014 through the first half of 2017, activist shareholders have targeted 39 REITs….Activists continue to build a case for change across a broad range of issues, including operational performance, strategic direction, asset concentration and allocation conflicts of interest and corporate governance,” it wrote.

Perhaps more key: as activism becomes more mainstream, ICR is seeing traditional funds using activism as a tool. “It used to be something that was 'ungentlemanly' to do and now it has become an accepted strategy,” Denning says.

To Concede Or Not

With these funds working their way deeper into the CRE, and in particular the REIT space, a discussion over whether the changes they push for are good for the company is timely.

Oftentimes the market will cheer their arrival. For instance, last November when Elliott Management Corp. acquired a stake in mall owner Taubman Centers, the stock rose close to 7%.

Denning says activist investors can be most effective when they are pushing for changes that are already underway. “What we find is when the activist comes in they are not necessarily bringing in new ideas — they just kind of accelerate or force the pace of change.”

But not always. “We've seen activist investors pushing for the acquisition and construction of more commercial properties before the rise of interest rates,” Jeff Miller, co-founder of AE Home Group, tells GlobeSt.com. “These large acquisitions and construction projects have been great for their company's short term valuation, but many are overlooking the risks of their 5-year loan products and paying top of market.”

But more often than not the headline battles are usually over whether a REIT should sell itself or consider other “strategic alternatives”. Or activist shareholders will go to war over a proposed merger, such as RLJ Lodging's merger with FelCor, which Land and Buildings has bitterly protested.

Perhaps because of such scenarios many companies tend to negotiate directly with the activist investor, says Patrick Healey, an investment management professional serving retail and institutional clients at Caliber Financial Partners.

“In my experience, activist investors can and occasionally do effectuate certain marginal improvements for investors of commercial real estate companies, but for the most part, empirical evidence is extremely limited,” he told GlobeSt.com. “From the company's perspective, it can be much easier to simply placate an activist investor looking to gain certain concessions, rather than risk a protracted fight that can be disruptive to their business or one that may result in a change of control.”

Earlier this month, as one example, Cedar Realty Trust reached a settlement agreement with Snow Park Capital Partners, which is a 3.9% common stock shareholder. Under the deal, Snow Park will be consulted and can interview the candidate to fill the Cedar Realty board director position left open by Paul Kirk, who had retired. In return, Snow Park has agreed to vote all of its shares in support of all of Cedar's director nominees at the 2018 annual meeting and to end its activist campaign.

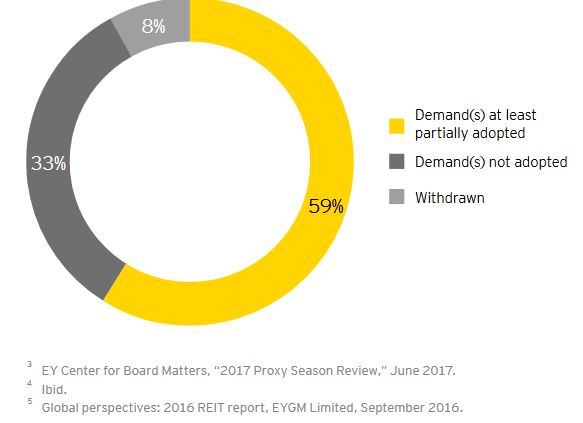

Indeed, according to E&Y nearly 60% of campaigns since 2010 have been a catalyst for changes made at the target company.

“We Focus On Solutions”

But not all funds fit these models, says Kristin Hull, CEO of Nia Impact Advisors. “While we are advocates and activist investors, we are pushing for the betterment of companies for all concerned,” she tells GlobeSt.com. “We focus on solutions, and thus, in the commercial real estate space we want to see diverse executive teams and boards of directors to make great governance teams, as well as solid business decisions for the long term of the company.”

Nia Impact also seeks sustainability throughout its portfolio of companies, Hull said, “and advocates for REITs to be mindful of sustainability practices intended to benefit the environment, as well as the company financial bottom line.”

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.