Bridging the Gap Between Acquisitions and Asset Management

When property performance doesn’t meet proforma, investors lose. Gathering the correct data during due diligence goes a long way towards keeping investment properties on track.

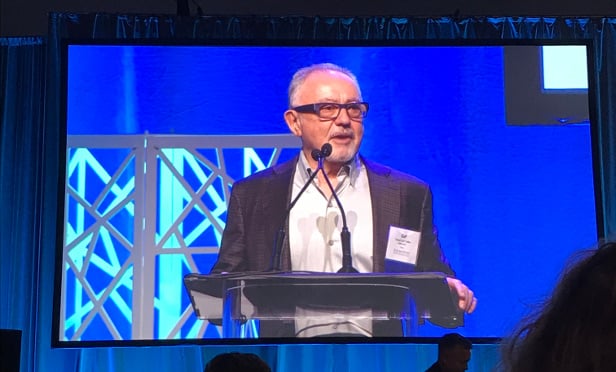

Gaffen said his firm won the RFP because its program was solid and its commitment was to build community.

Gaffen said his firm won the RFP because its program was solid and its commitment was to build community.SAN DIEGO—The massive, mixed-use development project known as Seaport San Diego,taking place along Downtown San Diego’s waterfront and Seaport Village has moved into its second evolution, Yehudi “Gaf” Gaffen, CEO of Gafcon Inc., told attendees at the BMC’s 22nd Annual Real Estate Conference here Thursday. Gaffen addressed a full ballroom of attendees, offering a background of the project—spearheaded by the Port of San Diego—as well as an update on its progress and why it will benefit San Diego.

Gaffen explained that his staff was selected in 2016 to redevelop the area, expanding Seaport Village from 13 acres to 70 acres and including a wide variety of uses along the waterfront, including three classes of hotels, retail, a parking structure that can be converted once no longer needed into other uses, health-and-wellness area, an observation spire, educational and aquarium uses, a public beach, a park and a variety of open spaces intended to creating a true community feel that connects the city to the waterfront.

*May exclude premium content

Already have an account? Sign In Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to asset-and-logo-licensing@alm.com. For more information visit Asset & Logo Licensing.

When property performance doesn’t meet proforma, investors lose. Gathering the correct data during due diligence goes a long way towards keeping investment properties on track.

Here’s a look at the trends, announcements and deals you may have missed in Texas, New Mexico, Colorado, Oklahoma and Arkansas.

Starts for attached single-family homes rose more than 3%.

Trend Report

Sponsored by MSCI Real Assets

2025 February US Capital Trends & Analysis

How is investment and capital activity shaping up for the start of 2025? Discover key trends in capital flows, lending dynamics, and the emerging path to recovery in 2025.

Guide

Sponsored by Placer.ai

The Return to Office: Recovery Still Underway

Are you noticing unexpected shifts in office occupancy and commuter behavior? This report reveals how evolving work patterns are challenging CRE brokers and offers crucial, data-backed insights for 2025. Discover a detailed analysis of office visit fluctuations, an in-depth look at midweek work trends, accurate forecasts for market recovery, real-world examples to inform strategic decisions, and actionable metrics to guide client advising. Download your copy today!

Report

Sponsored by Building Engines

The State of Commercial Property Management Technology in 2025

Commercial property teams are navigating changing times where technology plays a crucial role in operations, tenant satisfaction, and sustainability. This report, based on insights from 370 industry professionals, reveals the biggest priorities, challenges, and opportunities for CRE technology adoption in 2025. Don’t miss it.

Copyright © 2025 ALM Global, LLC. All Rights Reserved.

Copyright © 2025 ALM Global, LLC. All Rights Reserved.