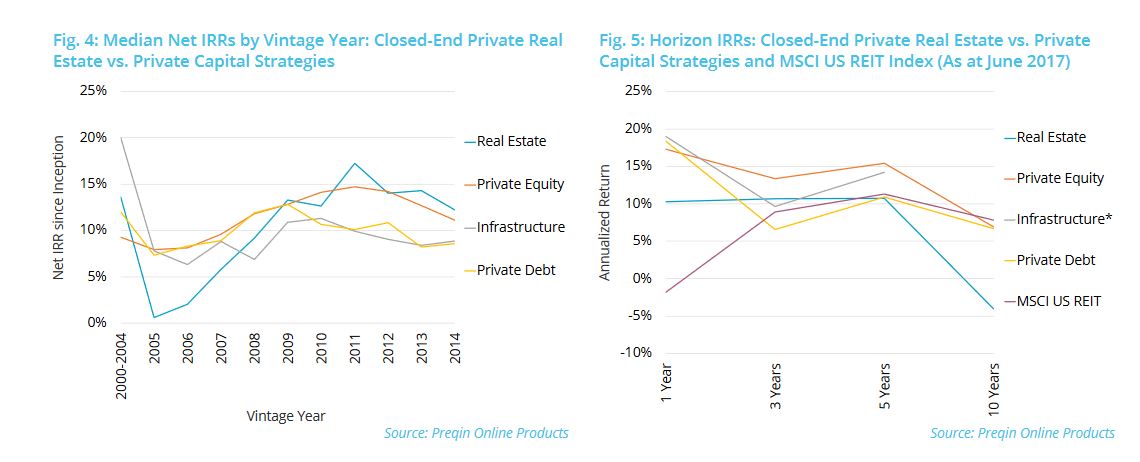

LONDON—Recent vintage private equity funds have outperformed other private capital asset classes, according to a new report by Preqin—namely, real estate funds from 2013 and 2014, which returned 14.3% and 12.2% respectively.

The strong performance has generated a strong sense of goodwill for the real estate asset class among investors, 88% of which felt their CRE investments met or exceeded expectations last year. In addition 91% felt that way about their portfolios over the past three years.

Reducing Target Returns

However, at the same time, the report also said there is a creeping sense of doubt among investors that the industry will be able to sustain this level of performance. Half of investors and more than half of fund managers believe the market has reached its peak and pricing concerns are at an all-time high, noted Oliver Senchal, head of Real Estate Products at Preqin.

For these reasons a quarter of investors expect performance this year to be worse than last year. Perhaps more significantly, 61% of fund managers that are bringing a fund to market have said they are reducing their targeted returns.

Increasing Investor Appetite

And yet, 56% of fund managers report that investor appetite has increased over 2017, despite concerns over asset pricing and performance. Preqin also reports that investors are still set to commit significant capital to real estate in the year ahead. Twenty-six percent intend to invest more in 2018 than in 2017, while the proportion that will reduce their exposure has fallen to 16% in December 2017, down from 24% 12 months prior. As a result, the report concludes, 69% of fund managers believe that the size of the real estate industry will continue to grow over the year ahead.

Indeed Senchal also noted that “performance relative to expectations may remain on course: investors value factors beyond headline figures, such as diversification, inflation protection, low correlation and risk adjustment.”

The high-point in the market may mean that top-level returns in the years to come may not match current levels, but real estate is likely to play an important role in investors' portfolios nonetheless, he also said.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.