WASHINGTON, DC–Since 2011 the co-working and creative tech space have been driving growth in the office sector. Now, a new JLL research note concludes that they will continue to do so over the next few years as the traditional engines of office growth remain in flux.

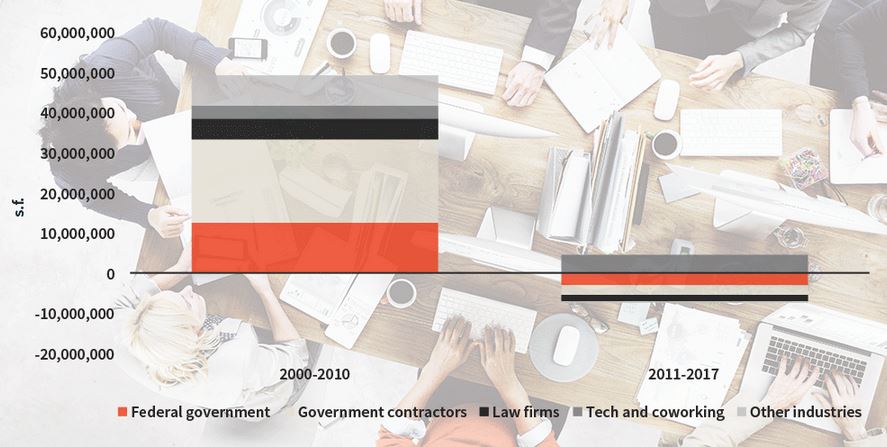

It wasn't until recently that metro DC's traditional engines of office demand stop generating significant growth. Indeed between 2000 to 2010 they drove a majority of the 50 million square feet of occupancy gains. During this time period, JLL writes, federal government spending increased consistently post 9/11 and during the financial crisis; defense contractors' contract award levels rose 286% to $28.5 billion, and legal revenues rose more than 5% — often into the double-digits — on an annual basis pre-recession.

Since 2010, growth has been stymied by reduce-the-footprint mandates, budget cuts, fee compression and rightsizing, JLL said. As a result, since 2010 the federal government has reduced its footprint by 3 million square feet, contractors by 2.5 million square feet and law firms by 1.6 million square feet.

Enter 2011 and the co-working and tech tenants. They have grown by 4.4 million square feet, JLL says, with the former comprising 75% of that growth. Furthermore their utilization rate is close to the traditional tenants: the combined federal government, contractor and law firm sectors average 210 square feet per employee and tech's utilization rate is right around 155 square foot per employee. Co-working hovers around 55 square foot per user.

These two office-using segments will continue to flourish, JLL writes.

With the political and legislative environment murkiness expected to continue over the next three years, Metro DC's traditional drivers are not likely to contribute significantly to occupancy growth over that timeframe. As a result, the overall office market will remain more or less flat with the exception of creative, intelligence / defense and out-of-market tenants contributing to occupancy gains.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.