NEW YORK–Last week Mizuho Research Managing Director Richard Anderson upgraded Sabra Health Care REIT to Buy from Neutral, making it the second healthcare REIT to achieve that status at the research company — the other being HCP, Inc.

Anderson has his reasons for the upgrade, which he explained in a research note, but a larger point also emerged about the industry as a whole: namely, the current issues besetting the space are expected to pass.

Anderson and Research Associate Zachary Silverberg wrote that:

With no ceiling formed yet on the 10-year and still uncertain fundamentals across many healthcare REIT asset classes, now is not the time to accumulate an increment position in the sector in our view. But we also think there is longer-term research for optimism that we think investors should dial into their thought-processes for future consideration, particularly as it relates to senior housing.

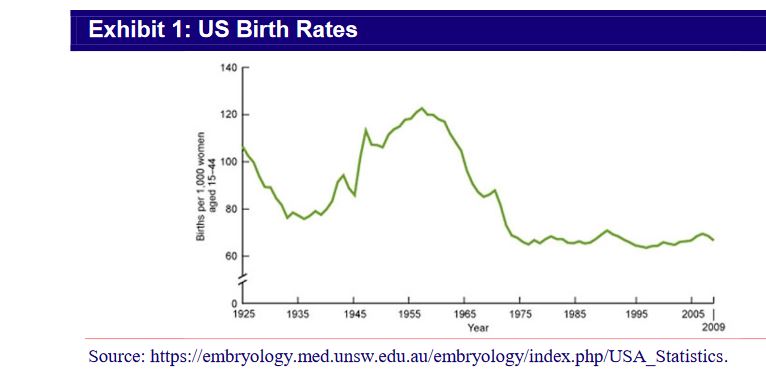

One factor that has been holding back senior housing is that demographically-speaking, it has been in a trough for demand, Anderson tells GlobeSt.com. Eighty-three years ago the birth rate dropped during the Great Depression; likewise the average age of a person entering senior housing is 83.

“We are going to start to see that demand cycle trend back up starting this year,” he says. It will be a long-lasting cycle in which the flow of residents into senior housing will increase dramatically, Anderson says — a flow that will also affect skilled nursing, which has its separate issues.

On top of these demographics, there is the current market situation, namely excessive supply, Anderson says, specifically in assisted living. This too is starting to change as developers have scaled back their activity and it will likely remain that way as project costs have risen and will rise even further with interest rates increasing.

“It's been a perfect storm for senior housing, in that it is the worst of both worlds from a demand and supply perspective.”

Anderson adds that change will not happen overnight but as the trendline turns positive over the next few years it will stay there for a few decades.

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.