NEW YORK–Moody's Investors Service has announced it is contemplating a change to its treatment of leases when making financial statements adjustments for non-financial companies and institutions.

Moody's is proposing to use the company's lease liability estimate instead of its own. Moody's already brings off-balance sheet operating leases onto the balance sheet but new accounting will also require Moody's to make slightly different adjustments to the income statements and cash flow.

The rating agency said it does not expect any impact on outstanding ratings as a result of the proposed changes.

The changes are being proposed in response to upcoming lease accounting standard change mandated by the International Accounting Standards Board and the US Financial Accounting Standards Board, which will, among other measures, require companies to bring operating leases onto the balance sheet.

People can submit comments in response to Moody's proposal on its Request for Comment page.

Few Ready For Lease Accounting Standard

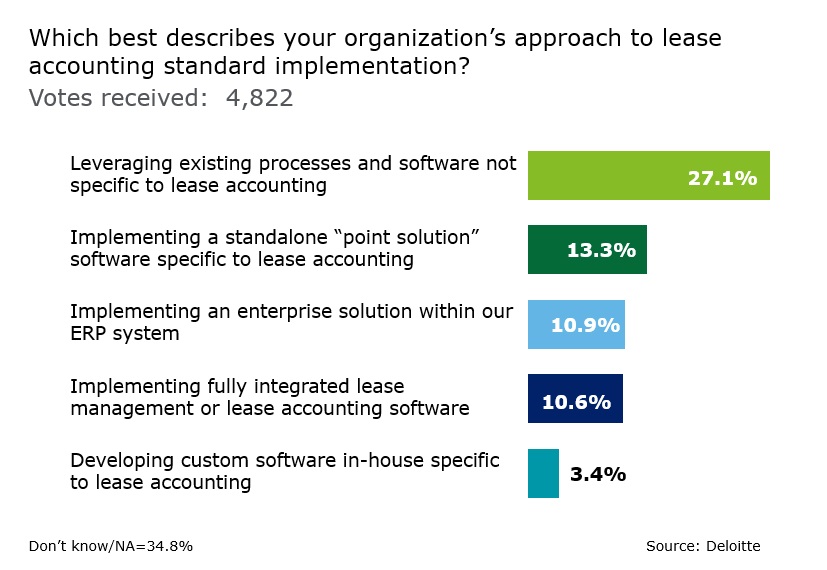

The lease accounting standard for publicly-traded companies is going into effect Jan. 1, 2019 yet few companies profess to be ready for it, according to a separate survey by Deloitte.

It found that just 21.2% of finance, accounting and other professionals say their companies are “extremely” or “very” prepared to comply with the standard, according to a recent poll from the Deloitte Center for Controllership. Granted, that's more than double the number expressing confidence from early 2016, which was 9.8, when the standards were initially issued, but still relatively low considering the deadline is less than a year away.

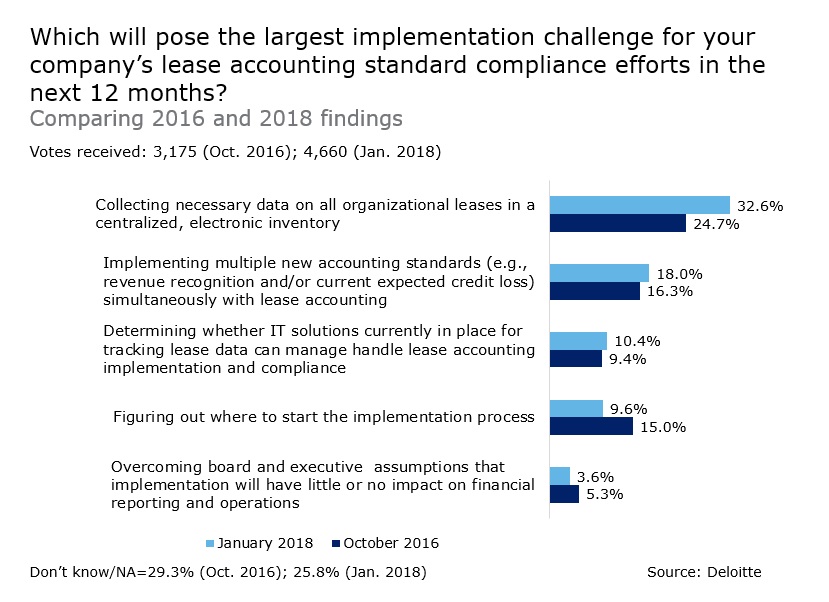

Last November FASB issued new proposed guidance to simplify the lease accounting implementation process, including: eliminating the requirement to evaluate pre-existing land easements to determine if they meet the definition of a lease under the new standard; introducing the option to not restate comparative reporting periods in transition; and providing lessors with the option of combining lease and non-lease components under certain conditions.

But even with the new guidance, only 10.2% of respondents anticipate the FASB's practical expedient measures will reduce the amount of time and effort needed to implement the new standard.

“These recent changes proposed by the FASB are all intended to help companies achieve a timely adoption but it's clear from the poll results that, despite the help, many companies will likely still struggle to be ready by the effective date,” said James Barker, senior consultation partner for lease accounting in the national office of Deloitte & Touche LLP.

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.