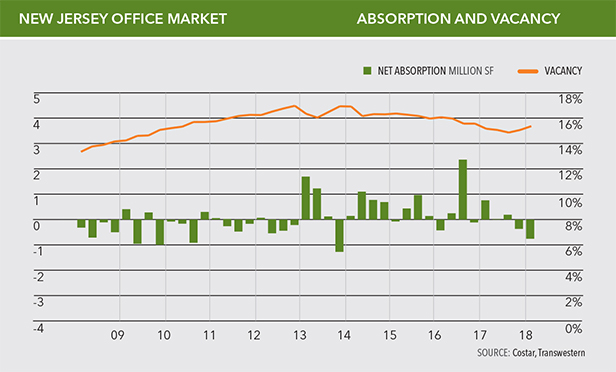

PISCATAWAY, NJ—The New Jersey office market experienced historically low net absorption during the first quarter of 2018, according to Transwestern's First-Quarter 2018 Office Market Report. Abnormally high losses in two submarkets— the Hudson Waterfront and Somerset/I-78 East submarkets—accounted for decreasing occupancy levels.

The balance of the market witnessed nearly a quarter-million square feet of positive absorption. The Hudson Waterfront and Somerset/I-78 East submarkets weighed heavily on the market, and, as a result, the office sector overall registered its slowest first quarter in more than two decades. Despite this, New Jersey's office market has been known to rebound strongly after slow starts.

“The first quarter did not exhibit vibrant growth in the office market, but it's worth remembering that vacancy levels are still substantially lower than their post-recession highs,” says James Postell, partner and city leader in Transwestern's New Jersey office. “Despite significant tenant move-outs in a few areas, there are several large office deals in the pipeline.”

Positive news for the first quarter include average asking rents, which trended upward in 17 of 21 submarkets. The Bergen East, Edison South and Union/Parkway submarkets recorded strong rental rates. Market-wide, rents rose to $26.44 per square foot from $26.34 during the previous quarter—and from $26.38 on a year-over-year basis. Transwestern's report attributed this uptick to the fact that the bulk of newly available space has largely consisted of class A buildings.

“While the New Jersey office sector has borne the brunt of substantial negative net absorption over the past six months, it did see a majority of submarkets record positive net absorption this past quarter,” says Transwestern's New Jersey research director Matthew Dolly. “In addition, private-sector employment is on the rise, including recent growth in the technology industry, boding well for the office market.”

The market is well-positioned to bounce back and attract new businesses through repurposed aging office space that meets the requirements of today's occupiers.

“Traditionally, leasing activity tends to pick up at the end of the first quarter, but the winter storms we experienced throughout March were undoubtedly a disruption to the New Jersey market,” says Postell. “As an example, it was very challenging to schedule property tours or walk-throughs during this period.”

Owners zeroed in on creating spaces designed for the growing healthcare, life science and industrial arenas, all of which are sectors targeted for growth by both local and state governments in New Jersey. Nevertheless, some uncertainty about state government policy direction is causing developers to slow decision-making.

“There is still a great deal of concern regarding proposed major tax increases, which some industry leaders feel hinders growth and the State's ability to compete within the region,” says Dolly.

The office sector's most-active industries during the first quarter were financial services, health services, technology/telecommunications and insurance.

Correction, 4/13/2018, 9:13 a.m.: Because of two editing errors, the headline on an earlier version of this story incorrectly characterized the absorption slowdown reported by Transwestern. The as the slowest quarter in 20 years. It was actually the slowest first quarter in 20 years. The headline also attributed the slowdown, in part, to the Somerset submarket. It was actually due to the Somerset/I-78 East submarket, which is distinct from the Somerset submarket.

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.