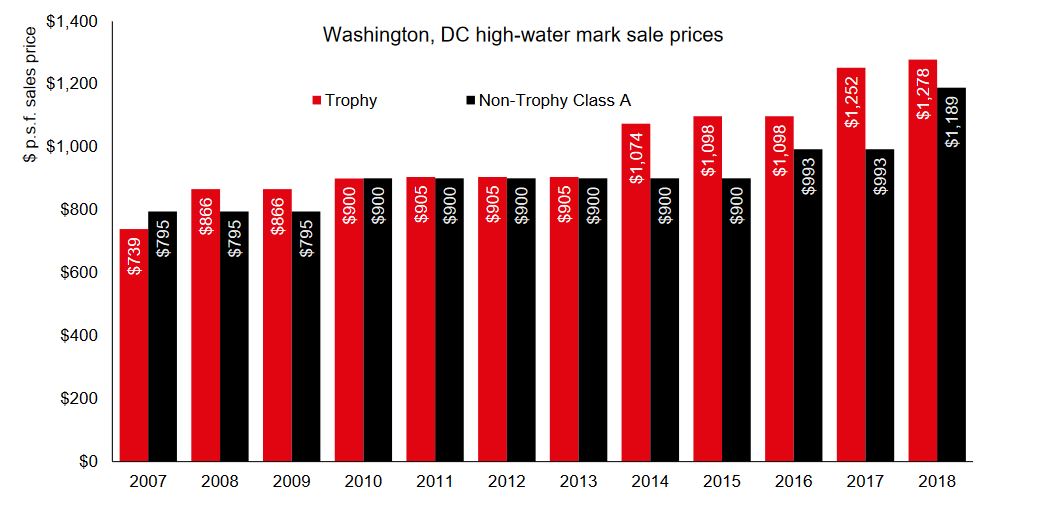

WASHINGTON, DC–Washington DC's Downtown market has been setting record pricing both in the trophy and non-trophy space, JLL notes in a new research report, and the reason is simple: scarce supply has met up with strong demand for DC product. This is not a new story, of course, but what is interesting is that this trend is spilling over into the commodity office space.

In the first quarter of 2018, 900 G Street NW sold for $144 million, or $1,278 per square foot, topping the $1,252 per square foot record set last year by the sale of 900 16th Street NW. Perhaps a more notable record, JLL says, was set in the non-trophy Class A segment: 1440 New York Ave., NW achieved a price per square foot of $1,189, surpassing the previous non-trophy high-water mark by nearly $200 per square foot.

Scarce supply is one factor. There are few trophy-quality buildings in the DC core available to investors — at the moment, just two are being actively marketed, JLL says. The second piece of the equation is the strong demand from foreign and institutional investors — demand that spilled over into both the non-trophy / Class A segment and the emerging submarkets outside the core.

JLL writes:

Foreign capital chased top-tier assets aggressively in the first quarter. Overseas buyers were involved in 96% of trophy and Class A investment volume inside the city, and were responsible for setting both of the aforementioned pricing records. The share of DC investment coming from overseas has increased steadily since the early 2000s, accounting for more than half of all sales volume since 2013 and comprising 66% in Q1.

Foreign demand will likely continue to drive investment activity and maintain pressure on pricing, despite the challenging leasing fundamentals in the market, JLL concludes. It notes that:

A mere five trophy and Class A buildings are for sale in the core, and of these, all are more than 75% leased and three have law firm anchors expiring in 2024 or later. Over the rest of the year, these assets will likely be joined by a handful of others that are currently burning off free rent periods, creating a small but highly desirable crop of investment opportunities.

Want to continue reading?

Become a Free ALM Digital Reader.

Once you are an ALM Digital Member, you’ll receive:

- Breaking commercial real estate news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical coverage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

*May exclude premium content© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.