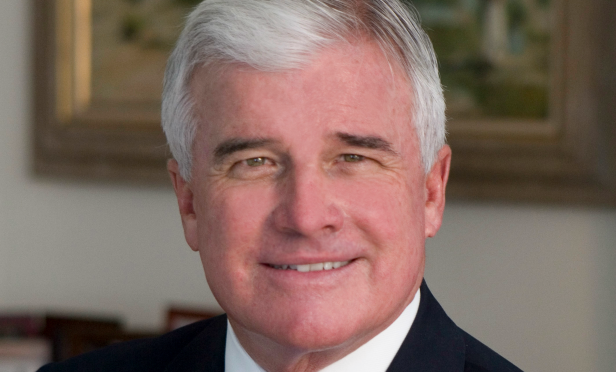

Industrial is quickly becoming a pillar asset class for institutional lenders, which are more and more frequently looking to diversify into the commercial real estate segment. MetroGroup, in fact, says that these lenders are interested in deals across the spectrum, including small box buildings and manufacturing spaces. The firm recently secured $21 million in acquisition funding for a 103,000-square-foot industrial property in Sorrento Mesa. While typically lenders are concerned about small-box or single-tenant properties, there was healthy lender interest in this deal. We sat down with Patrick Ward, founder and president of the MetroGroup, to talk about the lender appetite for these deals.

Industrial is quickly becoming a pillar asset class for institutional lenders, which are more and more frequently looking to diversify into the commercial real estate segment. MetroGroup, in fact, says that these lenders are interested in deals across the spectrum, including small box buildings and manufacturing spaces. The firm recently secured $21 million in acquisition funding for a 103,000-square-foot industrial property in Sorrento Mesa. While typically lenders are concerned about small-box or single-tenant properties, there was healthy lender interest in this deal. We sat down with Patrick Ward, founder and president of the MetroGroup, to talk about the lender appetite for these deals.

GlobeSt.com: Industrial, in general, has become a popular asset class for lenders in the last few years. What is lender demand like for small-box industrial properties?

Patrick Ward: Institutional lenders have always viewed industrial properties as security for mortgage loans as a preferred asset class. Several of the life insurance companies that we represent classify industrial property loans as their best performing assets. They prefer industrial over office and retail properties. Smaller industrial properties carry the same preferences. Multitenant industrial properties, in particular, are desirable due the staggered lease expirations of the tenants. Single tenant industrial buildings are also desirable, however, they tend to face a bit more scrutiny in concern to lease expiration, functionality, and suitability to quickly re-lease in the event the existing tenant does not renew the lease.

GlobeSt.com: How does lender demand for these small-box properties—which are presumably more manufacturing in nature—compare to demand for larger, ecommerce properties?

Ward: In looking at the industrial asset class, there is clearly a preference for distribution or warehouse buildings over manufacturing buildings of any size, large or small. This is simply due to their minimal improvement requirements. That said, manufacturing buildings remain a very attractive asset for lenders. The heavier the manufacturing use, the more closely the lender will underwrite cost to dismantle equipment, clean up and environmental concerns. Several large national banks, within their real estate departments, have an “owner user” division that solely concentrates on making loans to companies that own and occupy their buildings. Most of these banks will go down to loans in the $1M range. In addition, most of the banks consider these owner user loans safer and better performing, and in some cases, price them accordingly. Also, the federal government through the SBA program guarantees loans in this category to provide liquidity for smaller industrial properties.

GlobeSt.com: In San Diego, are there lending opportunities for small-box deals?

Ward: In San Diego, there is an abundance of opportunity for mortgage lending on smaller industrial properties. All of the different types of lending institutions, which I would broadly classify as Banks, Life Insurance companies and CMBS, all have a very heavy appetite and allocation to continue to seek smaller industrial properties as security for their mortgage loans.

GlobeSt.com: You recently secured a $21.9 million loan for a 103,000-square-foot property in Sorrento Mesa. What was lender interest like in this deal, and why was this a good opportunity?

Ward: Lender interest was very strong for this transaction. The basic fundamentals of the transaction were very compelling: Ten years remaining on a fifteen year lease; tenant manufactures industrial and scientific testing equipment worldwide and is a leader in their industry; tenant made substantial improvements to the building showing a commitment to the facility and the area; our client is very knowledgeable and has a portfolio of similar properties; as a result, we were able to provide very attractive financing that met our client's investment objectives in interest rate and leverage.

GlobeSt.com: In general, what is your outlook for lender activity in this space this year?

Ward: As mentioned earlier, industrial properties of any size have always been an attractive investment for mortgage lenders. In the three different economic downturns we experienced since starting our company in 1983, industrial property delinquencies outperformed retail and office properties. We see this as a trend that will continue in the future. Smaller industrial properties fit the need of a wide range of perspective users from inexpensive offices to warehouse, distribution, assembly and manufacturing. Big businesses had to start somewhere and the lending community will continue to provide liquidity to these size and type of properties.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.